CSL Limited Elliott Wave technical forecast [Video]

![CSL Limited Elliott Wave technical forecast [Video]](https://editorial.fxstreet.com/images/TechnicalAnalysis/ChartPatterns/Chartism/stock-market-ticker-board-black-17803444_XtraLarge.jpg)

ASX: CSL Elliott Wave technical analysis (one-day chart)

Function: Major trend (Minute degree, navy).

Mode: Motive.

Structure: Impulse.

Position: Wave (3) - orange of Wave ((3)) - navy of Wave iii - gray of Wave ((iii)) - navy.

Details: Wave (3) - orange is advancing, targeting 325.26, with the requirement that the price stays above 294.81. This view holds as long as the price does not dip below this level. The Long Trade position in CSL has been profitable and is expected to continue growing.

Invalidation point: 294.81.

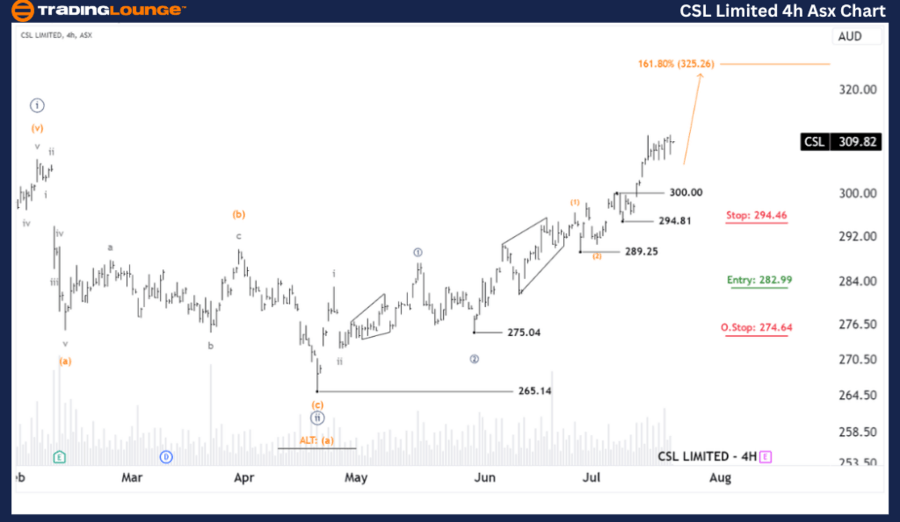

ASX: CSL Elliott Wave technical analysis (four-hour chart)

Function: Major trend (Minuette degree, orange).

Mode: Motive.

Structure: Impulse.

Position: Wave (3) - orange of Wave ((3)) - navy of Wave iii - gray of Wave ((iii)) - navy.

Details: Wave (3) - orange is still in an upward trajectory, aiming for 325.26, with the price needing to stay above 300.00 to maintain this outlook. The Long Trade position in CSL remains profitable and is poised for further gains.

Invalidation point: 300.00.

Conclusion

Our analysis provides a comprehensive forecast of CSL LIMITED – CSL’s market trends and short-term outlook. We highlight specific price points that act as validation or invalidation signals, bolstering confidence in our wave count. By integrating these elements, we offer an objective and professional perspective on market trends.

CSL Limited Elliott Wave technical forecast [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.