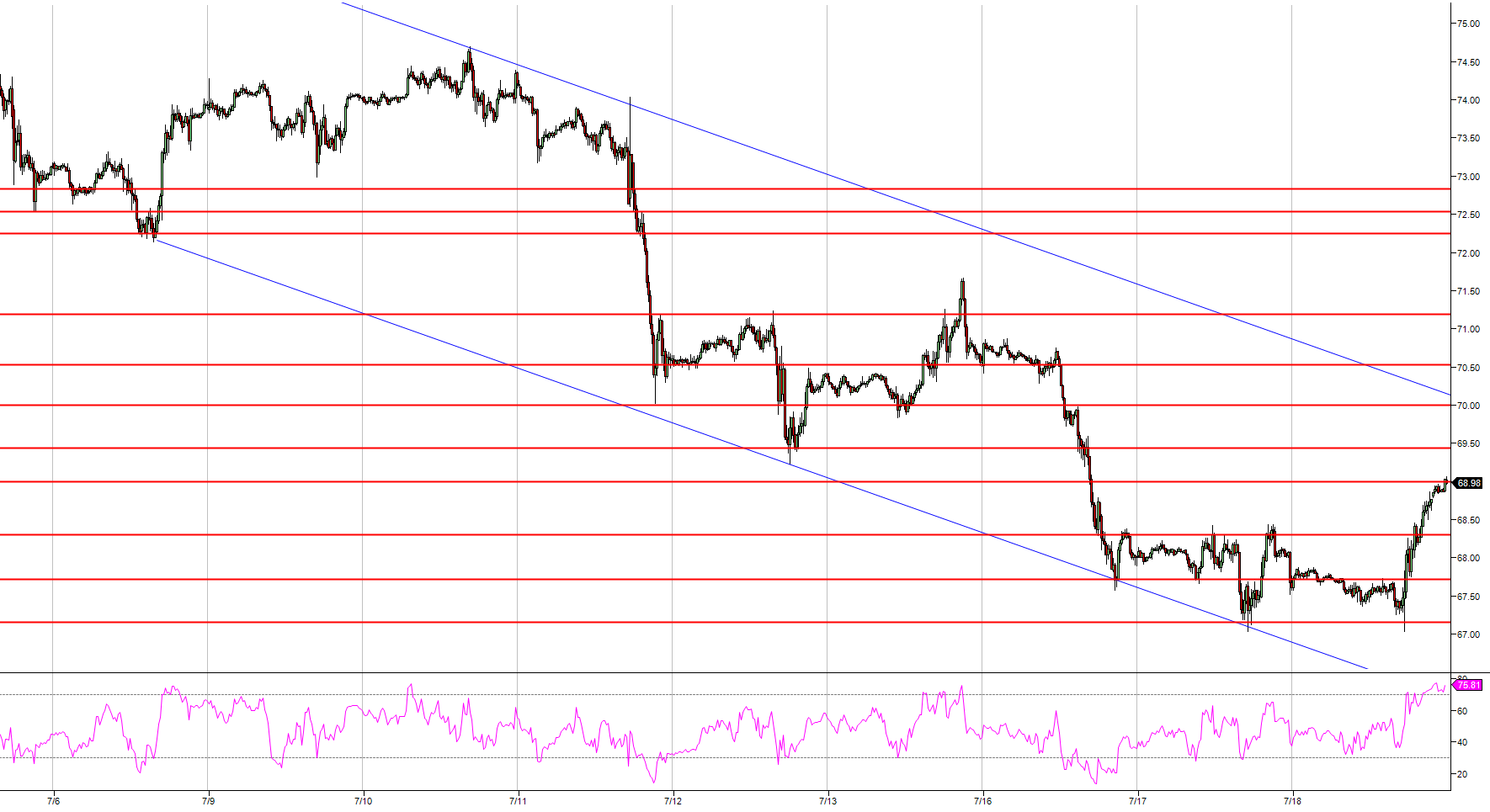

- Despite the huge build with the EIA Crude Oil Stocks change report to July 13, crude oil bulls managed to stage a rally. EIA: Commercial crude oil inventories increased by 5.8 million barrels from previous week.

- While bulls are not totally out of the woods just yet, today is the best daily close seen in about a month. Oil also rejected the daily 100-period simple moving average.

- Bulls have displayed some strength and a breakout above $70.00 should clear any doubts that bulls are in full control. Supports are seen near 68.30 and 67.72.

Spot rate: 68.96

Relative change: 1.79%

High: 69.03

Low: 67.03

Trend: Neutral to bullish

Resistance 1: 69.00 figure

Resistance 2: 69.44 June 25 high

Resistance 3: 70.00 figure

Resistance 4: 70.53 May 24 low

Support 1: 68.30 supply/demand level

Support 2: 67.72 June 26 low

Support 3: 67.16 June 14 high

Support 4: 66.53 June 20 high

Support 5: 65.71, June 22 low

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD clings to recovery gains near 1.0850 ahead of Fedspeak

EUR/USD trades in positive territory near 1.0850 on Friday following a four-day slide. China's stimulus optimism and a broad US Dollar correction help the pair retrace the dovish ECB decision-induced decline. All eyes remain on the Fedspeak.

GBP/USD pares UK data-led gains at around 1.3050

GBP/USD is trading at around 1.3050 in the second half of the day on Friday, supported by upbeat UK Retail Sales data and a pullback seen in the US Dollar. Later in the day, comments from Federal Reserve officials will be scrutinized by market participants.

Gold at new record peaks above $2,700 on increased prospects of global easing

Gold (XAU/USD) establishes a foothold above the $2,700 psychological level on Friday after piercing through above this level on the previous day, setting yet another fresh all-time high. Growing prospects of a globally low interest rate environment boost the yellow metal.

Crypto ETF adoption should pick up pace despite slow start, analysts say

Big institutional investors are still wary of allocating funds in Bitcoin spot ETFs, delaying adoption by traditional investors. Demand is expected to increase in the mid-term once institutions open the gates to the crypto asset class.

Canada debates whether to supersize rate cuts

A fourth consecutive Bank of Canada rate cut is expected, but the market senses it will accelerate the move towards neutral policy rates with a 50bp step change. Inflation is finally below target and unemployment is trending higher, but the economy is still growing.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.