- Crude oil WTI prints a new yearly high of $69.56 a barrel but closed lower on Thursday.

- The US dollar rebound weighed on crude in the late European session.

Crude oil WTI continued its advance on Thursday’s trading and printed a new 2018 high of $69.56 a barrel only at a shouting distance from the 70.00 handle.

The West Texas Intermediate benchmark is trading at $68.21 down 0.80% on the day but still at levels not seen since late 2014. In late European session, the greenback staged a come back across the board and the US Dollar Index is now trading in the 89.90 region.

The concerns over Russian sanctions and that Trump might not renew the Iranian deal are bullish for oil as both countries are big oil producers. Diplomatic tensions can create supply disruptions.

Crude oil prices are being underpinned by oil-producing countries including OPEC (Organization of the Petroleum Exporting Countries) and Russia with an agreement to cut production in order to create a supply squeeze. The supply-cut agreement is in effect since January 2017 and has been extended until the end of 2018. In June the members will meet and discuss any adjustments that need to be made.

Oil is rising because of the geopolitical risks in the Middle-East and uncertainties with Russia and Iran, while supply is getting tighter because of the output cut agreement and the global economy is in a relatively good shape which keeps the demand up for the black gold. Also worth mentioning is the decreasing Venezuelan production.

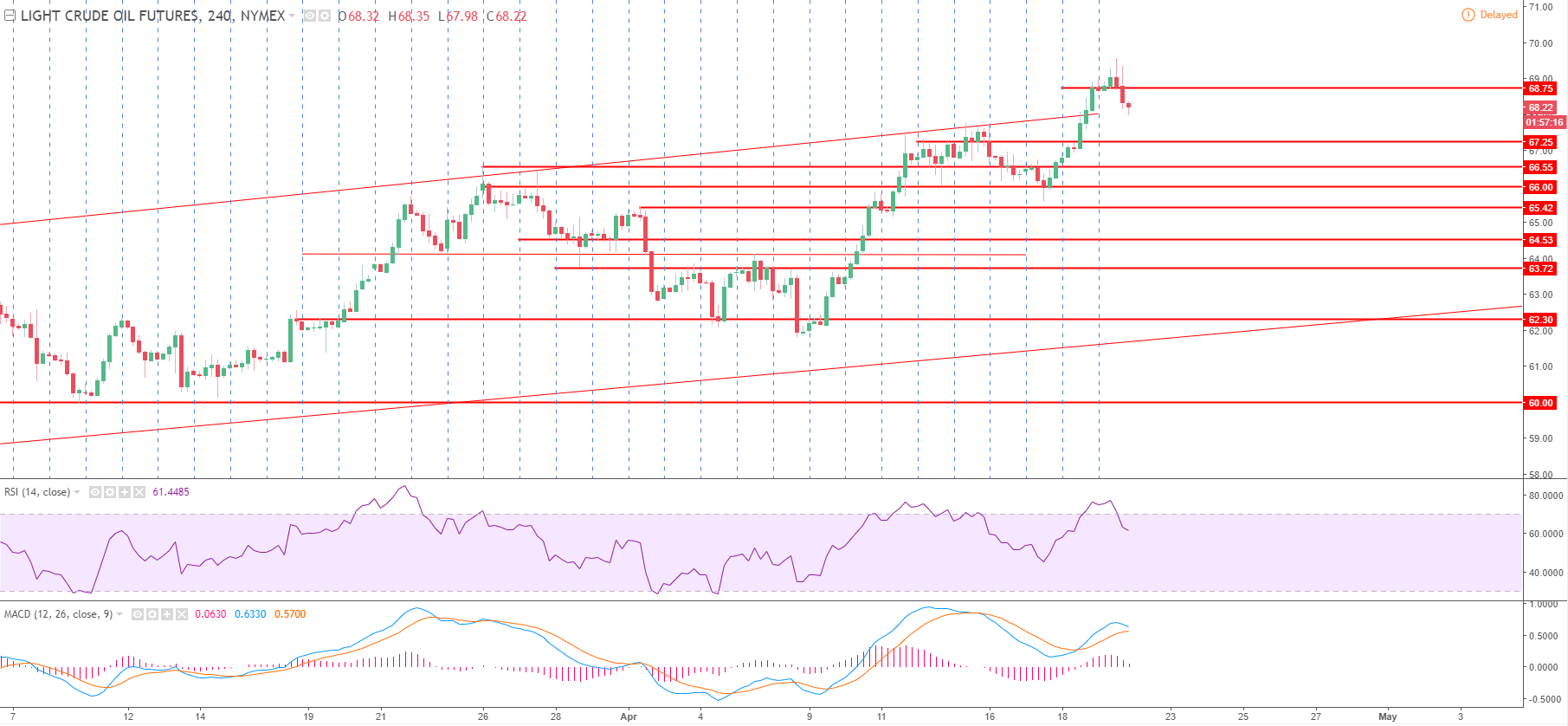

WTI crude oil 4-hour chart

The trend is bullish. Resistance is priced in at 68.75 supply level and the 70.00 figure. Supports are seen at the 68.00 figure and at the 67.25 demand level.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD treads water just above 1.0400 post-US data

Another sign of the good health of the US economy came in response to firm flash US Manufacturing and Services PMIs, which in turn reinforced further the already strong performance of the US Dollar, relegating EUR/USD to the 1.0400 neighbourhood on Friday.

GBP/USD remains depressed near 1.2520 on stronger Dollar

Poor results from the UK docket kept the British pound on the back foot on Thursday, hovering around the low-1.2500s in a context of generalized weakness in the risk-linked galaxy vs. another outstanding day in the Greenback.

Gold keeps the bid bias unchanged near $2,700

Persistent safe haven demand continues to prop up the march north in Gold prices so far on Friday, hitting new two-week tops past the key $2,700 mark per troy ounce despite extra strength in the Greenback and mixed US yields.

Geopolitics back on the radar

Rising tensions between Russia and Ukraine caused renewed unease in the markets this week. Putin signed an amendment to Russian nuclear doctrine, which allows Russia to use nuclear weapons for retaliating against strikes carried out with conventional weapons.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.