Crude Oil keeps positive spirit despite bearish outlooks

- Israel has agreed in principle to the ceasefire proposal from the US, with the document now under consideration for Hezbollah to sign.

- OPEC+ countries Russia, Iraq and Saudi Arabia are discussing measures before Sunday's official OPEC+ supply meeting.

- The US Dollar Index trades flight with the Index participants off set each other.

Crude Oil is giving up its earlier gains ahead of weekly Crude Oil stockpile change numbers from the American Petroleum Institute (API). The uptick earlier came after the President-elect has confirmed to be hitting Mexico and Canada with 25% tariffs on imported goods, fading during the trading day. Meanwhile, in the Middle East, Israel’s Prime Minister Benjamin Netanyahu is said to agree to the ceasefire proposal from the US, which is now up to Hezbollah to sign before taking effect.

The US Dollar Index (DXY), which measures the Greenback’s performance against a basket of currencies, is struggling only because the Canadian dollar (CAD) is part of the DXY basket. A weaker CAD is being offset with a stronger Euro (EUR) and Swedish Krona (SEK) against the US Dollar. Later this Tuesday, traders will focus on the release of the Federal Reserve (Fed) Minutes for the November meeting for fresh clues on the possibility of a December interest rate cut.

At the time of writing, Crude Oil (WTI) trades at $69.43 and Brent Crude at $73.08

Oil news and market movers: Another API build would mean more issues for OPEC+

- There is a strong case for the Organization of the Petroleum Exporting Countries and its allies (OPEC+) to extend its production normalization timing to as late as the second quarter of 2025 to get a clearer picture of the market, RBC head of commodity strategy Helima Croft says in a note, reported by Bloomberg.

- Russia sees its seaborne crude exports undergo its biggest drop since July, with shipments sliding to a two-month low. Flows towards key buyer India fell sharply in relationship with that, Reuters reports.

- Oil traders are pointing out that a risk premium over the situation in the Middle East still has some room to get priced out now that a ceasefire deal is just around the corner between Israel and Hezbollah, Bloomberg reports.

- Officials from Iraq, Russia and Saudi Arabia (three of the biggest nations in OPEC+) are meeting in Baghdad to discuss energy markets just a few days before OPEC+ holds its year-end gathering on Sunday, Bloomberg reports.

- At 21:30 GMT, the American Petroleum Institute (API) will release its weekly Crude stockpile change numbers. No expectations with previously a build of 4.753 million barrels.

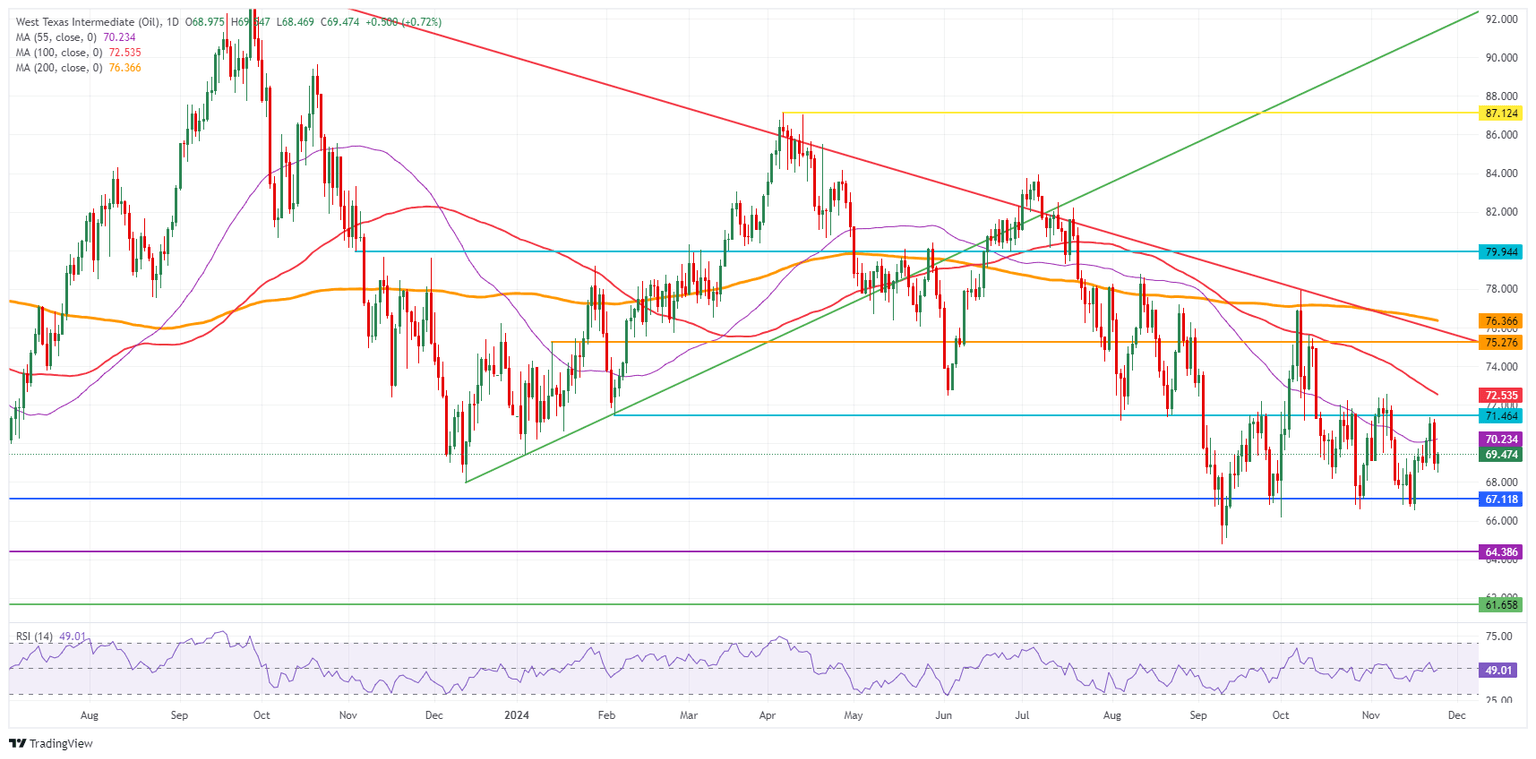

Oil Technical Analysis: OPEC+ is the only body that can change things around for Crude

Crude Oil price might enjoy a surge in volatility to enjoy some recovery. However, in the end, it looks like another delay in production normalization will be rescheduled yet again by the OPEC+ in its upcoming meeting. With the Trump administration set to drill and pump up more US Oil, the question could arise of whether there will ever be a production normalization from OPEC+ in 2025.

On the upside, the 100-day Simple Moving Average (SMA) at $72.53 and the pivotal level at $71.46 just below are the two main resistances. The 200-day SMA at $76.36 is still far off, although it could be tested if tensions intensify further. In its rally towards that 200-day SMA, the pivotal level at $75.27 could still slow down any upticks.

On the other side, traders need to look towards $67.12 – a level that held the price in May and June 2023 – to find the first support. In case that breaks, the 2024 year-to-date low emerges at $64.75, followed by $64.38, the low from 2023.

US WTI Crude Oil: Daily Chart

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 12 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.