Crude Oil sees second day of losses after IEA and OPEC point to oversupply

- Crude Oil sees sharp correction halt after firm talks from Israel's Galant.

- Markets see IEA reporting oversupply still continues for at least until New Year.

- The US Dollar Index orbits around 103.00, though it faces resistance on the upside after two false breaks.

Crude Oil is on the backfoot for a second day in a row on Tuesday after the release of the monthly report from the International Energy Agency (IEA), and, at the time of writing, it loses almost 7% in the week. A piece from the Washington Post on Monday suggested that Israel would limit its targets to only military positions, refraining from targeting Iranian oil facilities. Though firm words from Israel's Minister of Defence Yoav Gallant who said Israel would respond deadly and precise against Iran, is the headline which is halting the steep decline in Crude Oil for now.

In the end, the IEA report adds to more losses after the monthly report from the Organization of the Petroleum Exporting Countries (OPEC) on Monday showed OPEC revising down its demand growth forecast for a third time in a row. With a persistent oversupply and tuned-down geopolitical tensions, a heavy correction is unfolding in Oil’s prices.

The US Dollar Index (DXY), which tracks the performance of the Greenback against six other currencies, orbits around 103.00 and tries to advance. However, red flags have risen, with the DXY unable to move beyond the resistance level at 103.18 for a second day. Another close below that level and easing geopolitical tensions in the Middle East could lead to a sharp correction in the DXY.

At the time of writing, Crude Oil (WTI) trades at $69.70 and Brent Crude at $73.67

Oil news and market movers: Markets still flooded with Oil

- Israel's Minister of Defense Yoav Gallant comment that Israel will soon respond to Iran, and the response will be deadly and precise, Reuters reports.

- It has been a while, but for the first time, the IEA and OPEC are aligned and are seeing an oversupply in markets, Bloomberg reports.

- OPEC’s crude output in September dropped 650k barrels per day (bpd) from a month earlier to 26.72m bpd, reflecting lower volumes from Libya, the IEA said in its monthly market report, Reuters reported.

- Geopolitical risks to oil output in the Middle East and elsewhere are being offset by global oversupplies, the IEA reports. The sizable surplus is expected to remain under these current conditions in the new year if there isn’t any significant disruption, Reuters reports.

- Due to Columbus Day festivity on Monday, the weekly numbers from the American Petroleum Institute (API) are moved to Wednesday.

Oil Technical Analysis: More downside to come

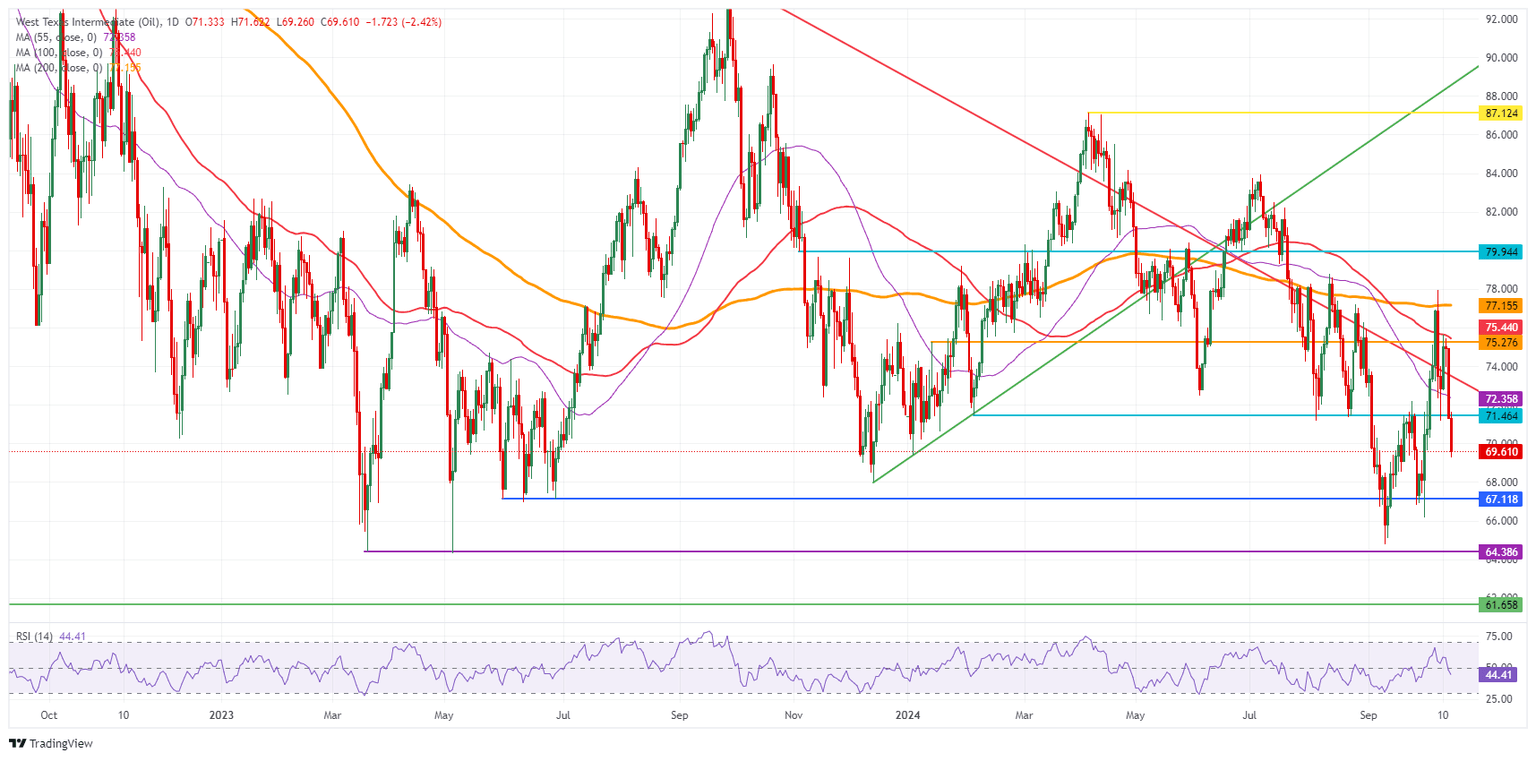

Crude Oil is receiving a second big blow, this time from the IEA. Again, the main takeaway is oversupply, which is still more than enough to fill any gaps that might have occurred in production from, for example, Libya. With the IEA report even pointing to more downsides in demand until the New Year, at the least, more downside moves in Oil’s price could materialize.

There is a challenging path to recovery if Crude Oil wants to get back to $75.00. First, the pivotal level at $71.46, which was strong enough to catch the falling knife on Monday, must be regained again with a daily close above it. Once from there, the hefty technical level at $75.30, with the 100-day Simple Moving Average (SMA) and a few pivotal lines, is possibly the first big hurdle ahead.

On the downside, that previously mentioned $71.46 pivotal level has now turned into resistance and no longer has any value as support. Instead, traders need to look much lower, at $67.11, that supported the price in May-June 2023. In case that level breaks, the year-to-date low will be under pressure near $64.75, followed by $64.38, the low of 2023.

US WTI Crude Oil: Daily Chart

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 12 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.