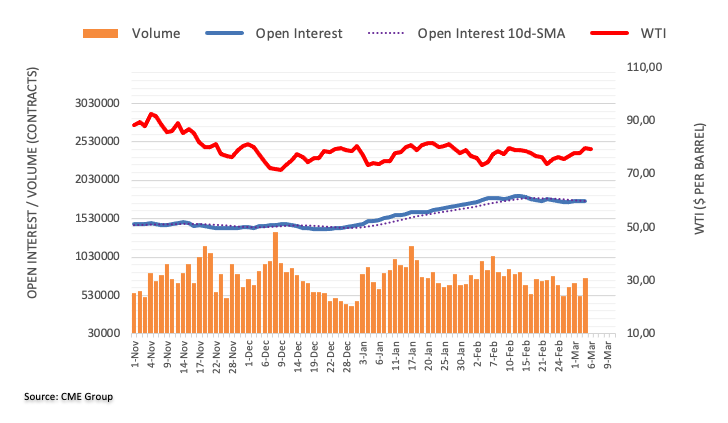

CME Group’s flash data for crude oil futures markets noted traders added nearly 5K contracts to their open interest positions at the end of last week, keeping the erratic performance unchanged for the time being. Volume, in the same direction, resumed the uptrend and rose by around 241.7K contracts.

WTI keeps targeting $80.00 and above

Prices of the WTI extended the weekly rebound on Friday. The move was in tandem with rising open interest and volume and suggests that further gains look likely in the very near term. The surpass of the key $80.00 mark per barrel should pave the way for a test of the February high at $80.57 (February 13) ahead of the so far 2023 peak at $82.60 (January 23).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD keeps range below 1.0900 ahead of US Retail Sales data

EUR/USD is keeping its range below 1.0900 in the European session on Monday. The US Dollar steadies as traders exercise caution before US Retail Sales data due later in the day. Meanwhile, the Euro stays defensive ahead of Tuesday's German vote on fiscal reforms and US-Russia talks.

GBP/USD retakes 1.2950, with Fed-BoE meetings on tap

GBP/USD retakes 1.2950 in European trading on Monday. The pair advances amid a subdued US Dollar. The risk mood stays cautious amid looming concerns over a trade war and Middle East conflict, capping the pair's upside. The focus shifts to the US Retail Sales data ahead of this week's BoE and Fed event risks.

Gold price holds gains just below $3,000, US data eyed

Gold price holds gains below $3,000 in the European session on Monday, staying close to all-time peak as rising trade tensions underpin safe-haven demand. Bets that the Fed will cut rates several times in 2025 lend additional support to the XAU/USD.

Five Fundamentals for the week: Fed leads central bank parade as uncertainty remains extreme Premium

Central bank bonanza – perhaps its is not as exciting as comments from the White House, but central banks still have sway. They have a chance to share insights about the impact of tariffs, especially when they come from the world's most powerful central bank, the Federal Reserve.

The week ahead: Central banks give their verdict on Trump

Rarely is one man dominant for financial markets and for central banks, however, Donald Trump’s new economic policy means that he is centre stage as we wait to hear from a multitude of central bankers this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.