Crude Oil finds some piece of mind with traders looking for where to go next in Crude

- Crude Oil trades steady on Thursday after a two-day painful correction.

- Markets are looking for clues on the outcome of the Biden-Netanyahu phone call on Wednesday.

- The US Dollar Index halts rally after CPI numbers come in touch stronger than expected.

Crude Oil is keeping it together and seems to have found some support on Thursday after a two-day correction that erased nearly 5% of recent gains. Traders are left clueless, though, with no clear comments after US President Joe Biden had a phone call with Israel Prime Minister Benjamin Netanyahu on Wednesday. Meanwhile, Hurricane Milton hit the Florida peninsula and decreased power, though it is possible to see supply disruptions and extended delays until the oil production in the region could restart.

The US Dollar Index (DXY), which tracks the performance of the Greenback against six other currencies, is trading flat this Thursday after rallying earlier this week. The main driver is the US Treasury rates, which are moving higher ahead of the US September’s Consumer Price Index (CPI) release this Thursday. Markets are starting to doubt if the US Federal Reserve (Fed) is really in a rate-cutting cycle, with expectations of no more bigger rate cuts this year starting to grow.

At the time of writing, Crude Oil (WTI) trades at $73.70 and Brent Crude at $77.41

Oil news and market movers: Risk premium discounted for now

- Libya’s oil utility, National Oil Corporation (NOC), announced the start of 5 new wells to be exploited and be operational by early October. Around 12,000 barrels per day would be added, according to the Libya Observer and reported by Bloomberg.

- Investors remained wary of escalating tensions between Israel and Iran, providing further support to prices, Reuters reports.

- On Tuesday, the U. Energy Information Administration downgraded its demand forecast for 2025 on weakening economic activity in China and North America, according to Bloomberg.

- Kurdistan has cut its Oil Output by 50% in order to help Iraq meet its OPEC quota, Reuters reports.

Oil Technical Analysis: Who moves first?

Crude Oil is a clear reflection of when you leave markets behind without clues or comments. The fact that markets still need to second guess what Prime Minister Netanyahu will do next makes markets price out quite quickly escalation risk premiums. More downside could be seen as days go by, while Israel sticks to small ops and very limited military activity in Lebanon.

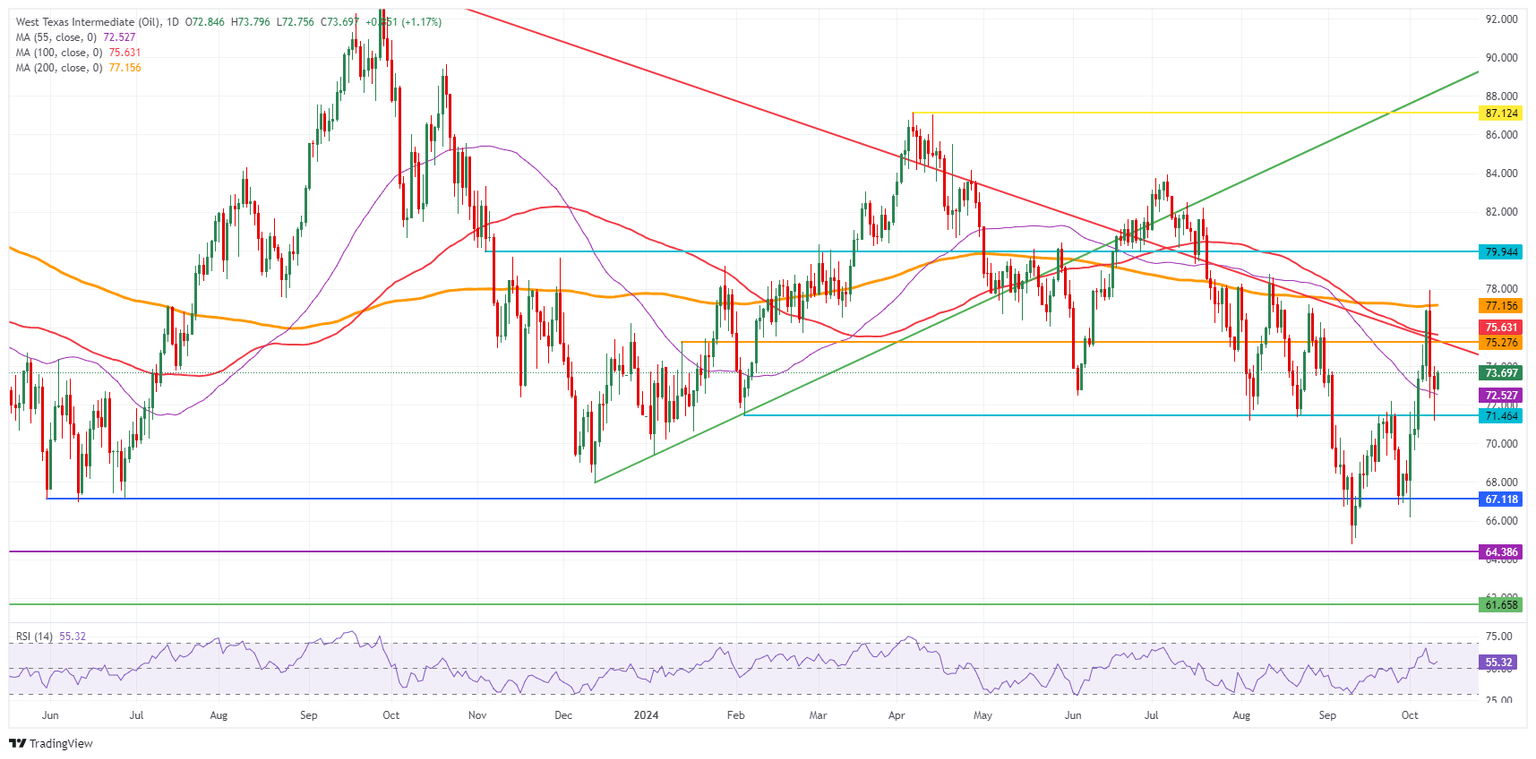

Monday’s false break is to be ignored, as the move was fully paired back on Tuesday. It means that current pivotal levels on the upside are still valid: the red descending trendline in the chart below, and the 100-day Simple Moving Average (SMA) at $75.63 just hovering above it, makes that region very difficult to surpass. Once holding above there, the 200-day SMA at $77.15 should refute any further upticks as it did in early trading on Tuesday.

On the downside, similar remark as for the upside with all these falls breaks. Rule of thumb is that if there has not been a daily close below the level, it still accounts for as a support. First is the 55-day SMA at $72.52, which acts as a potential first line of defence. A bit further down, $71.46 (the February 5 low) comes into play as second support before looking back to the $70.00 big figure and $67.11 as ultimate support for traders to buy the dip.

US WTI Crude Oil: Daily Chart

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 12 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.