Covid updates for New Zealand/Australia, lockdowns continue

In recent trade, we have news that that COVID-19 lockdown restrictions in Melbourne will not be eased until the state's 70% adult population gets at least one vaccine dose, which is expected around Sept. 23, Victoria state Premier Daniel Andrews said on Wednesday, reported by Reuters.

"This is very, very tough. But it is simply not possible to make wholesale changes, to have our freedom day if you like, or an opening up day in metropolitan Melbourne in the next few weeks," Andrews told reporters in Melbourne, the state capital. The current lockdown was due to end on Thursday, Reuters reported.

Meanwhile, NSW has recorded 1288 new local COVID-19 cases, seven deaths as state hits 7 million vaccination target; Victoria records 176 new cases.

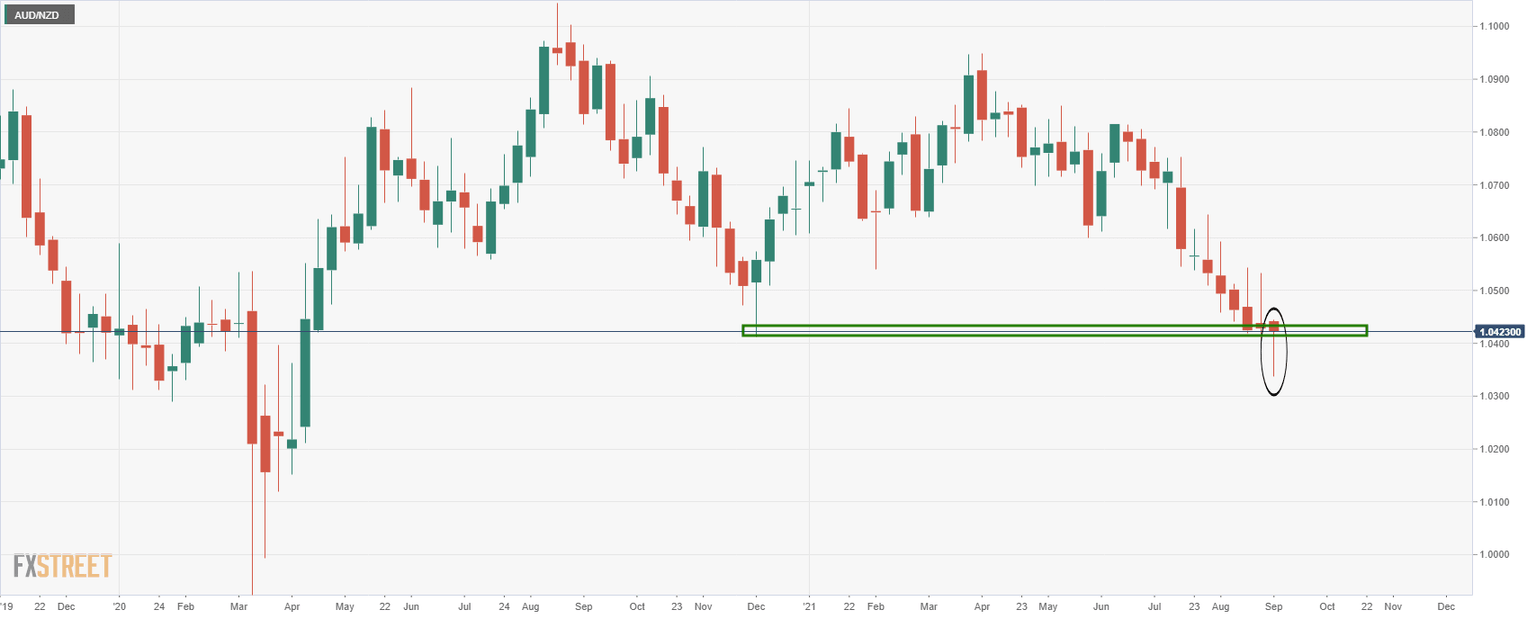

In terms of FX, AUD/NZD is being watched for further downside, as follows: AUD/NZD bulls capped on central bank divergence sentiment

Weekly chart

''Meanwhile, the weekly outlook is compelling.

If this week manages to close as is, then the hanging man could equate to a subsequent bullish structure over time, putting in a floor in this current downtrend from prior weekly support from April.''

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.