Watch the free-preview video below extracted from the WLGC session before the market opens on 3 Jul 2024 to find out the following:

-

The significance of shallow consolidations in the S&P 500 and what it indicates about market direction.

-

How to read volume trends and identify selling into strength, and their implications for future market moves.

-

Key support levels for the S&P 500 and how they serve as indicators for potential bullish or bearish market behavior.

-

The signals indicate whether the market is likely to break out or pull back in the near future.

-

And a lot more…

Market environment

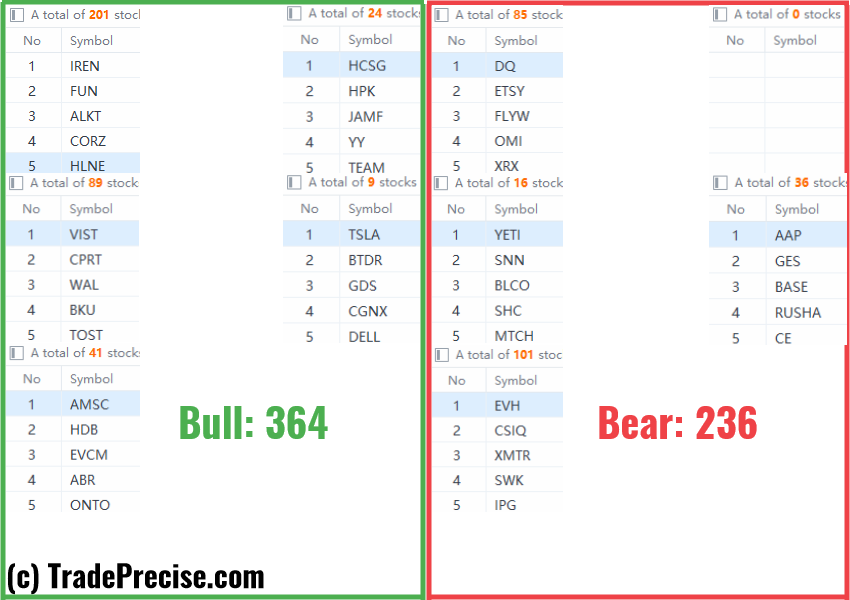

The bullish vs. bearish setup is 364 to 236 from the screenshot of my stock screener below.

Although the short-term market breadth is still negative, there are still no shortage of the bullish setups.

The analogue comparison discussed last week is still unfolding and will likely take time and effort to stop the prior strong bullish momentum.

Three stocks ready to soar

14 “low-hanging fruits” ARM, CORZ trade entries setups + 20 actionable setups CRWD were discussed during the live session before the market open (BMO).

ARM

CORZ

CRWD

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD stabilizes around 1.2550 after hitting two-year lows

EUR/USD plunged to 1.0223, its lowest in over two years, as risk aversion fueled demand for the US Dollar. Thin post-holiday trading exacerbated the movements, with financial markets slowly returning to normal.

USD/JPY flirts with multi-month highs in the 158.00 region

The USD/JPY pair traded as high as 157.84 on Thursday, nearing the December multi-month high of 158.07. Additional gains are on the docket amid prevalent risk aversion.

Gold retains the $2,650 level as Asian traders reach their desks

Gold gathered recovery momentum and hit a two-week-high at $2,660 in the American session on Thursday. The precious metal benefits from the sour market mood and looks poised to extend its advance ahead of the weekly close.

These 5 altcoins are rallying ahead of $16 billion FTX creditor payout

FTX begins creditor payouts on January 3, in agreement with BitGo and Kraken, per an official announcement. Bonk, Fantom, Jupiter, Raydium and Solana are rallying on Thursday, before FTX repayment begins.

Three Fundamentals: Year-end flows, Jobless Claims and ISM Manufacturing PMI stand out Premium

Money managers may adjust their portfolios ahead of the year-end. Weekly US Jobless Claims serve as the first meaningful release in 2025. The ISM Manufacturing PMI provides an initial indication ahead of Nonfarm Payrolls.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.