Costco Wholesale Corp.(COST) Elliott Wave technical analysis [Video]

![Costco Wholesale Corp.(COST) Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/TechnicalAnalysis/ChartPatterns/PointFigure/hand-point-to-graph-on-financial-graphs-success-concept-73251403_XtraLarge.jpg)

COST Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Minor 5.

Direction: Upside in Minor 5.

Details: Trading Level 8 at 800$ will provide resistance, looking for a five wave move to unfold in wave 5.

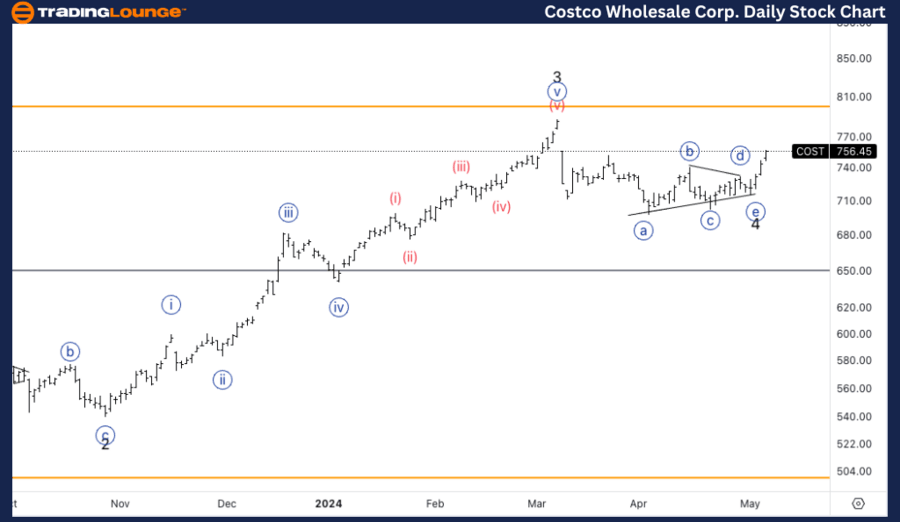

COST Elliott Wave technical analysis – Daily chart

The daily chart of Costco reveals that the stock is currently in an impulsive, motive wave structure, specifically identified as Minor wave 5. This indicates an upward trend with expectations of continuing momentum. The analysis points out that the $800 price level, referred to as TradingLevel8, is expected to act as a significant resistance. In this phase, a five-wave structure within wave 5 is anticipated to unfold, suggesting sustained upward movement.

COST Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave {i} of 5.

Direction: Pullback in wave {ii}.

Details: Looking for a pullback in wave {ii} to then continue higher and target longs. We seem to be finding support on 720$.

This comprehensive Elliott Wave analysis provides a current and future perspective on Costco Wholesale Corporation (COST), focusing on the potential price movements as indicated by the Elliott Wave theory on the daily and 4-hour charts as of May 7, 2024. Investors and traders can leverage this detailed insight to optimize their market positions.

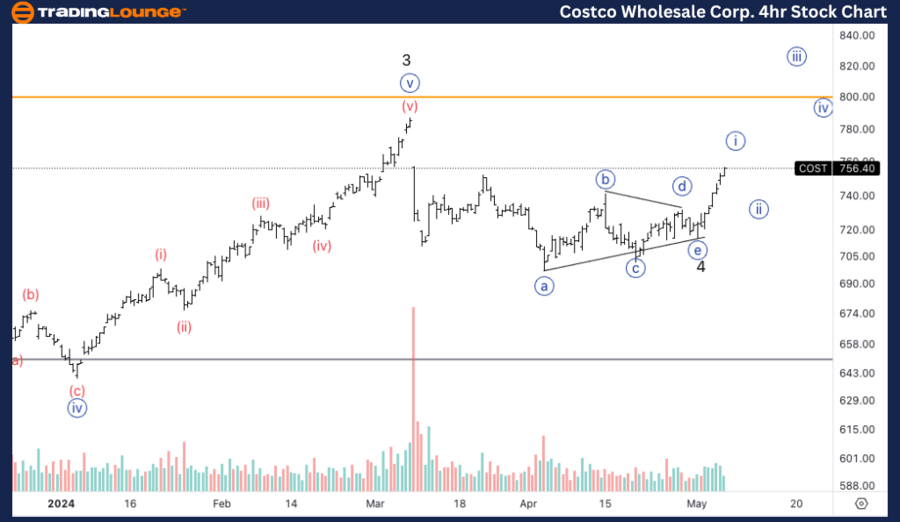

COST Elliott Wave technical analysis – Four-hour chart

Zooming into the 4-hour chart, Costco is currently positioned in Wave {i} of Minor 5, and a pullback in Wave {ii} is expected. This pullback presents a strategic entry point for traders, with the stock finding preliminary support at the $720 level. Following this correction, a continuation higher in Wave {iii} is likely.

Costco Wholesale Corp.(COST) Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.