Costco Stock News and Forecast: COST falls despite sales growth for September

- Costco stock falls despite sales growth data.

- COST released sales growth data for September showing a gain of 8%.

- COST stock fell over 1% on Wednesday as investors overlooked the news.

Costco (COST) stock continues to search for a definitive direction after it reported earnings a couple of weeks ago. COST stock gapped lower on the earnings but has since recovered and largely traded sideways since. Investors are grappling with some margin issues as well as the overall negative climate affecting equities. COST closed out Wednesday at $480.32 for a loss of just over 1%.

Costco stock news

Costco released sales data for September on Wednesday that showed sales growth of 8.5%. Costco reported earnings on September 22. Earnings per share (EPS) came in pretty much in line with consensus at $4.20, while revenue was slightly ahead at $72.1 billion versus expectations at $72. However COST stock dropped after earnings as there was some evidence of margin compression. COST closed over 4% lower after those earnings.

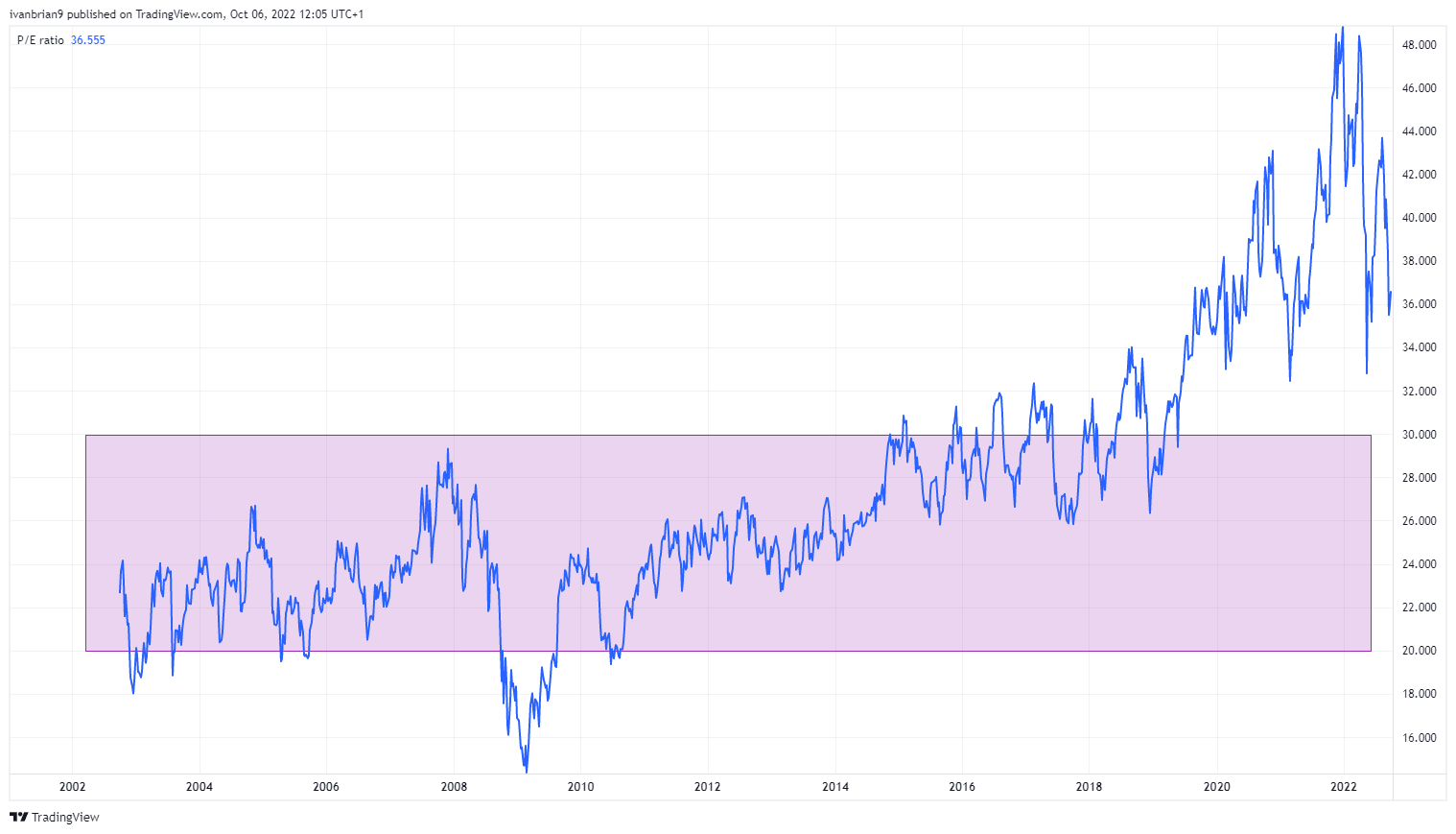

That margin pressure looks to be trending lower, which is likely to see further losses unless COST can arrest the slide. Margins have lost 100bps in the past two years. That has seen the P/E ratio decline, but historically it still looks too high. The current P/E for COST is 36, but it traded in a 20-30 range from 2002 until 2019, only breaking out in the post-pandemic era. This would indicate more losses to come unless the E in the equation can rise significantly.

COST stock P/E ratio

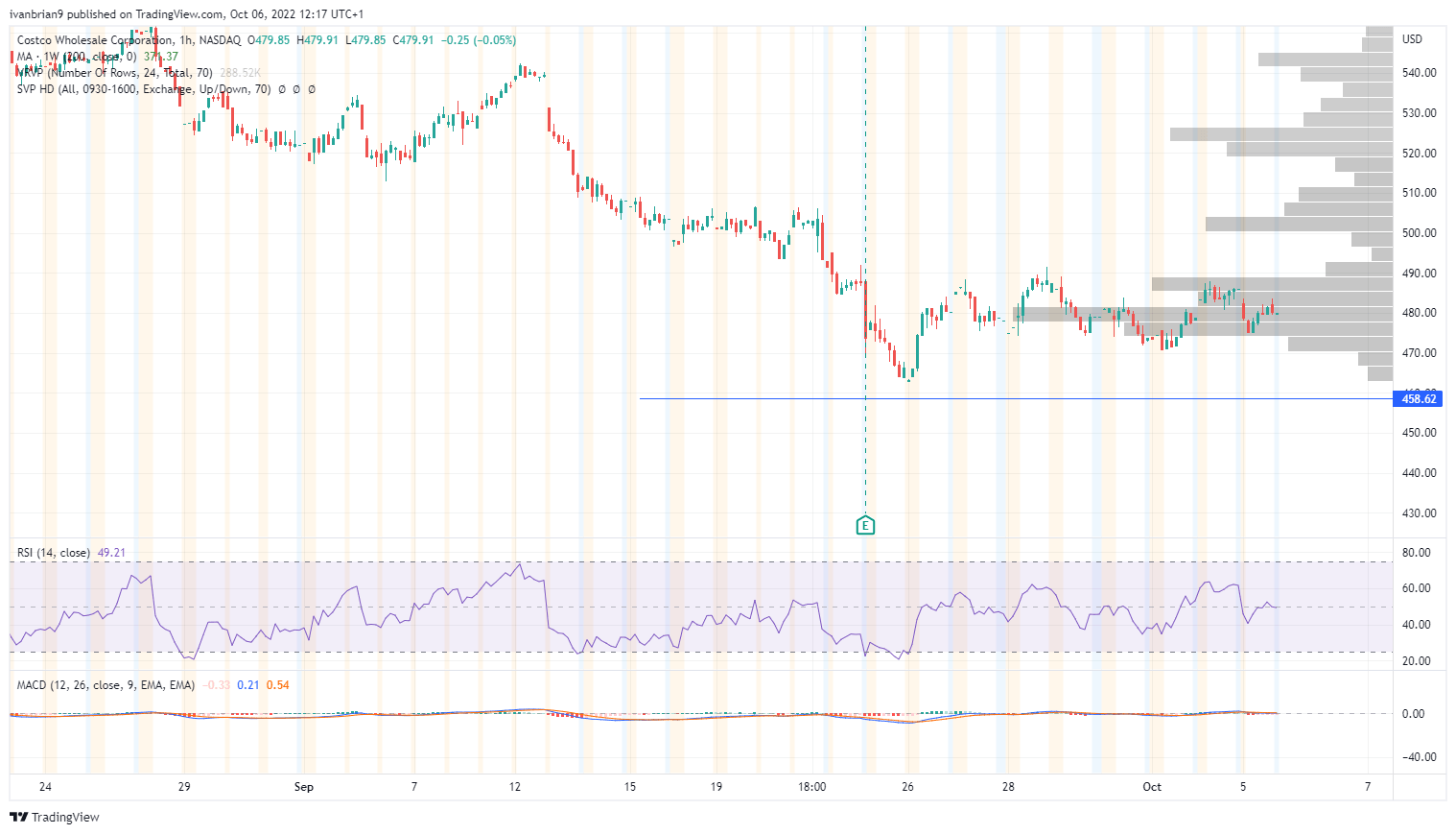

Costco (COST) stock forecast

While the stock looks expensive based on the long-term P/E, in the short term it is rangebound. A break of $490 brings it into a light volume zone, so a quick move to $505 cannot be ruled out.

COST hourly chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.