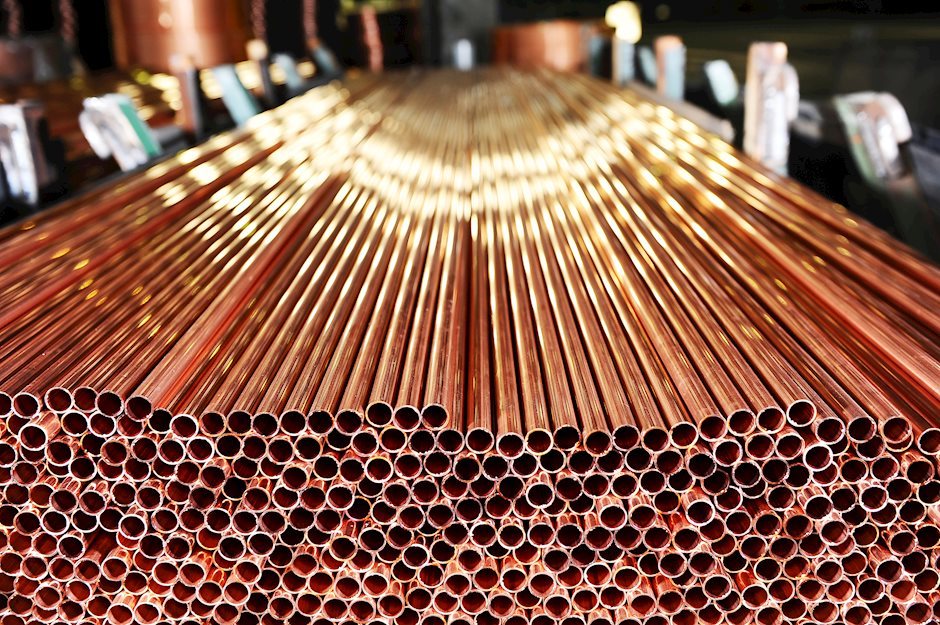

Copper price rebounds from three-week low on softer DXY, upbeat China data

- Copper price snaps three-day downtrend, picks up bids of late.

- Firmer prints of China PMI, fears of more supply outage favor intraday buyers of late.

- Fears surrounding Taiwan, coronavirus probe upside momentum.

- Hawkish Fedspeak, firmer US data also challenge metal buyers ahead of US ADP, NFP.

Copper price prints the first daily gains in four as buyers cheer softer US dollar and the firmer China activity numbers during early Wednesday morning in Europe. The red metal’s latest weakness could also be linked to the market’s cautious optimism, as well as fears of more supply outages due to the covid-led lockdowns.

That said, the US Dollar Index (DXY) fades the previous day’s corrective pullback as it drops to 108.60, down 0.20% by the press time.

The greenback gauge’s latest weakness could be considered as the preparations for today’s US ADP Employment Change for August, expected 200K versus 128K prior. Also keeping traders on their toes is Friday’s US Nonfarm Payrolls (NFP).

While portraying the metal’s moves, copper futures on COMEX rise 0.60% intraday to $3.58 by the press time. Elsewhere, three-month copper on the London Metal Exchange (LME) moved up 0.4% to $7,896 a tonne, after a decline from the previous session.

It should be noted that China’s NBS Manufacturing PMI improved to 49.4 in August versus 49.2 expected and 49.0 prior whereas the Non-Manufacturing PMI also grew to 52.6 during the stated month compared to 52.2 market forecasts and 53.8 previous readings.

On the other hand, hopes of more demand from manufacturing units and covid-led lockdowns that lead to a supply crunch may keep the copper buyers hopeful. “China's southwestern Sichuan province resumed its power supply to industrial and residential usage, and factories there have restarted their production after being ordered to shut down since August 15,” said Reuters.

It should be noted that a jump in the copper scrap transactions also appears to underpin the metal’s corrective pullback. From August 22 to August 28, the copper scrap throughput of East China Nonferrous Metals City was about 22,000 metric tonnes, a week-on-week increase of 29.15%, according to the SMM data shared by Reuters.

Looking forward, the US ADP Employment Change for August, the early signal for Friday’s US Nonfarm Payrolls (NFP), expected 200K versus 128K prior. headlines surrounding the Sino-American tussles, China’s covid conditions and global recession fears are also important for the near-term market directions.

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.