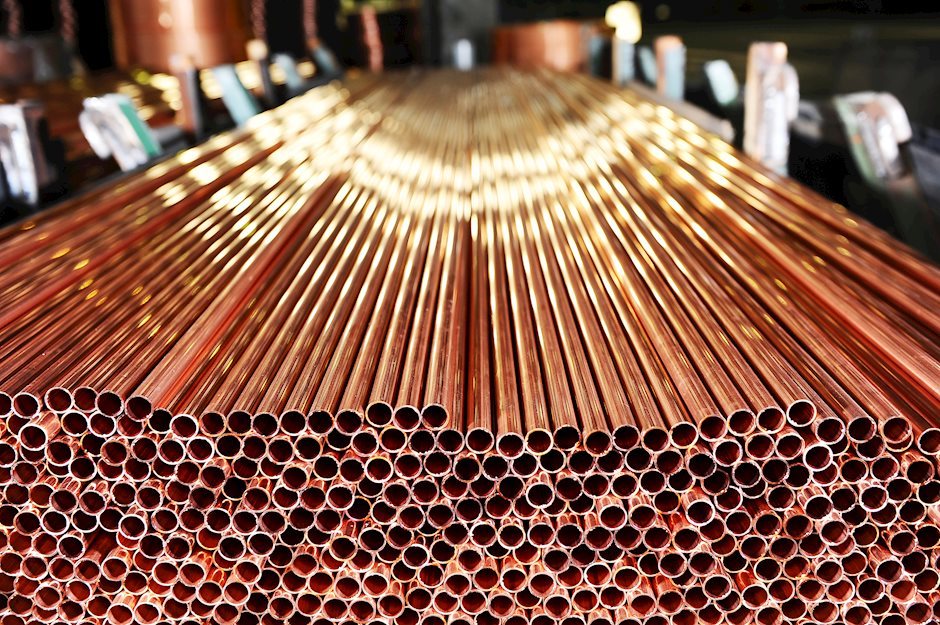

Copper bulls are puking – TDS

Copper prices are breaking down as headlines from the Third Plenum fail to halt the sharp slide in our real-time gauge of commodity demand expectations, TDS senior commodity strategist Daniel Ghali note.

Commodity demand expectations decline

“A continued surge in China's Copper exports corroborates our view of the striking weakness in domestic demand. A press conference will still discuss key points raised at the Plenum, but the Politburo meeting at the end of the month is another venue where policymakers may announce specific economic policies to boost domestic demand.”

“However, Commodity Trading Advisors (CTAs) still hold a decent margin of safety before additional selling activity is catalyzed, necessitating a break below the $9000/t range on a third-Wed futures basis before the first large-scale selling program is sparked. Barring a surprise from Chinese policy announcements, the fast decline in commodity demand expectations suggest downside convexity is still rising.”

“Aluminium remains vulnerable to significant CTA selling activity, as a big downtape could force trend following algos to abandon their longs and build a notable short position over the coming week.”

Author

FXStreet Insights Team

FXStreet

The FXStreet Insights Team is a group of journalists that handpicks selected market observations published by renowned experts. The content includes notes by commercial as well as additional insights by internal and external analysts.