- COIN follows Bitcoin lower as crypto leader struggles.

- Bitcoin is down 2% at $55,500 as risk off dominates.

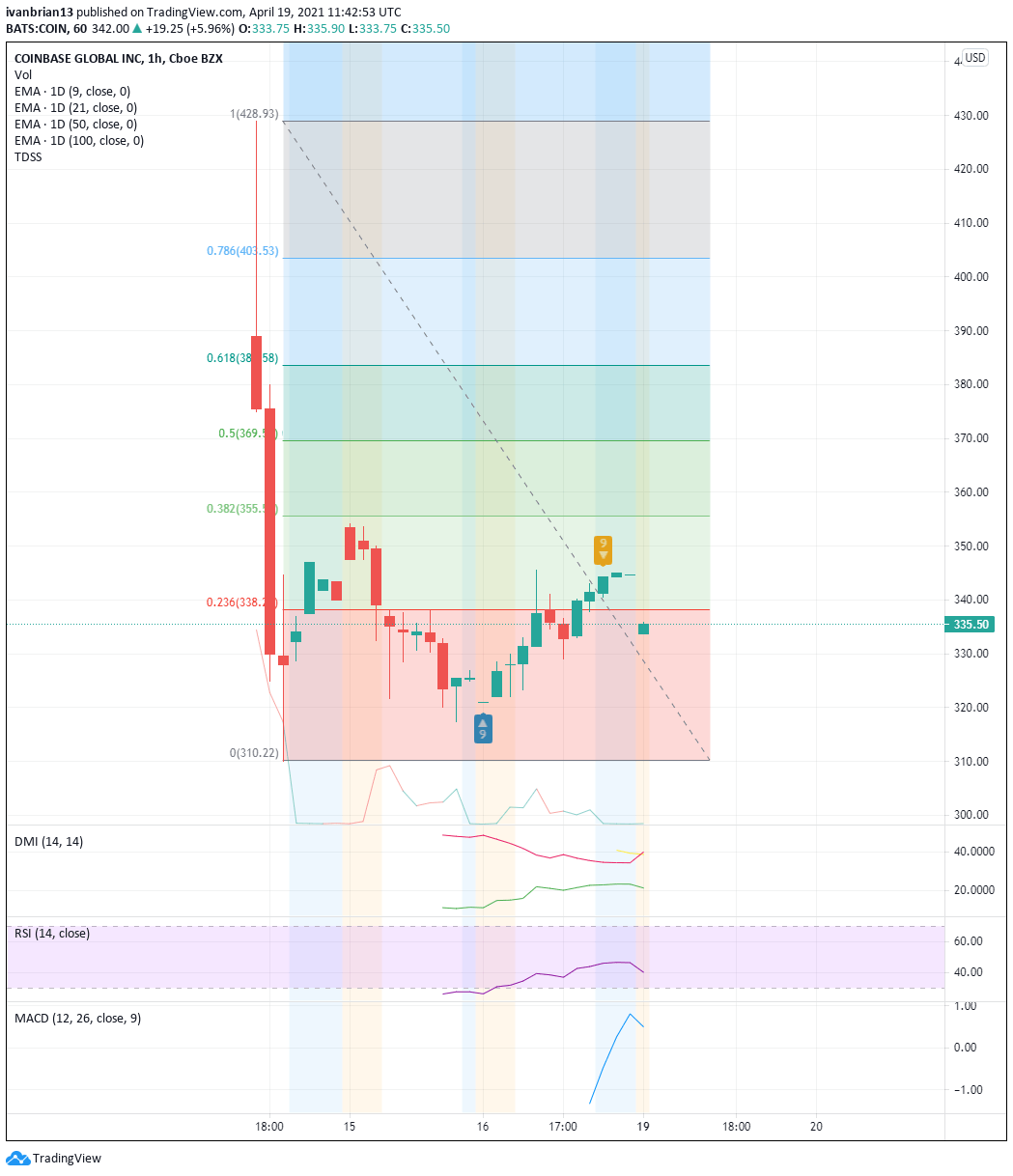

- COIN trending lower, tests support from opening day low at $310.

Update April 21: COIN shares are under the microscope as investors take a closer look at the valuation metric. COIN was worth more than the NYSE and Nasdaq shortly after launch and more notably was close to the lead bank involved in its listing, Goldman Sachs. GS has a market cap of $113 billion and COIN was approaching this shortly after listing as the shares roared ahead. Investors have started to focus on how sustainable the COIN business model is given it is highly dependant on stable commission rates. Commission rates on trading shares have been falling for decades as have trading fees for commodities, futures, and bonds. Crypto is a market in its infancy by comparison but if the trend spreads across, COIN will not be able to maintain current margin and commission levels.

Update: COIN struggles for gains on Tuesday as the Bitcoin hangover continues. COIN shares are lower by nearly 1% early on in the session. Technically the chart still remains bearish with the DeMark sell signal still in place. COIN also broke support at $338.32, a Fibonacci retracement level.

Coinbase launched on Wednesday on the Nasdaq to much investor anticipation. The crypto sector has been one of the most revolutionary developments to financial markets this century as Bitcoin steadily inserts itself into the mainstream. Companies are increasingly making Bitcoin part of their future plans with Goldman Sachs, VISA, Tesla and others all getting on board.

Stay up to speed with hot stocks' news!

Coinbase (COIN) stock forecast

Coinbase has seen recent large purchases by Cathie Wood's ARK funds, but all that pales in insignificance as the Bitcoin effect ripples through crypto-related stocks.

Bitcoin tumbled from $59,000 to $52,000 this weekend as rumours swirled that US authorities were set to clamp down on cryptocurrency use in illicit transactions. Turkey also banned the use of Bitcoin last week. All of this is likely to see some pressure on COIN when it opens for trade on Monday. Losses in the pre-market remain relatively modest as Bitcoin has recovered to trade back to $57,000.

On the technical level, we have some bearish signals with a DeMark '9' sell signal on the hourly chart in COIN. The premarket price for COIN is also just breaching the 23.6% Fibonacci retracement of the move from the high to low set on COIN's opening day. A break of this level of $338 brings the ultimate low as the next target of $310.22.

At the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

GBP/USD holds gains near 1.2700 after UK inflation data

GBP/USD holds the latest uptick near 1.2700 in the European session on Wednesday. The data from the UK showed that the annual inflation, as measured by the change in the CPI, rose to 2.3% in October from 1.7% in September, supporting Pound Sterling.

EUR/USD stays pressured below 1.0600, ECB/ Fedspeak eyed

EUR/USD remains depressed below 1.0600 in European trading on Wednesday. The US Dollar advances, tracking US Treasury bond yields higher even though risk appetite returns on fading Russia-Ukraine geopolitical tensions. Central banks' speeches are eyed for fresh impetus.

Gold price moves away from one-week top on rising US bond yields, modest USD strength

Gold price retreats after touching a one-and-half-week top earlier this Wednesday and drops to a fresh daily low, below the $2,630 level heading into the European session. A goodish pickup in the US Treasury bond yields, bolstered by bets for a less aggressive policy easing by the Fed, revives the USD demand and undermines demand for the non-yielding yellow metal.

Why is Bitcoin performing better than Ethereum? ETH lags as BTC smashes new all-time high records

Bitcoin has outperformed Ethereum in the past two years, setting new highs while the top altcoin struggles to catch up with speed. Several experts exclusively revealed to FXStreet that Ethereum needs global recognition, a stronger narrative and increased on-chain activity for the tide to shift in its favor.

How could Trump’s Treasury Secretary selection influence Bitcoin?

Bitcoin remained upbeat above $91,000 on Tuesday, with Trump’s cabinet appointments in focus and after MicroStrategy purchases being more tokens.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.