- COIN follows Bitcoin lower as things turn ugly.

- Bitcoin is down 7%, breaking $50,000 in the process.

- COIN is sharply lower again in Friday's pre-market.

Update April 27: Contrary to premarket trading, Coinbase Inc (NASDAQ: COIN) shares have been on the back foot in Tuesday's trading session. The stock of the cryptocurrency exchange company is changing hands at around $303.58. Nevertheless, the increase in Bitcoin's price may eventually push it higher. BTC/USD is hovering around $54,000, well above the lows.

Coinbase launched on Wednesday on the Nasdaq to much investor anticipation. The crypto sector has been one of the most revolutionary developments to financial markets this century as Bitcoin steadily inserts itself into the mainstream. Companies are increasingly making Bitcoin part of their future plans with Goldman Sachs, VISA, Tesla and others all getting on board. Coinbase is akin to an exchange, allowing users to buy and sell cryptocurrency. Soon after opening, its value exceeded that of some of the largest stock exchanges in the world, most notably the NYSE and Nasdaq.

Coinbase was founded in 2012 and has a near 12% share of the crypto market, according to regulatory filings, with 56 million users.

Stay up to speed with hot stocks' news!

COIN stock forecast

The latest results from Coinbase show just how tied the company's revenues are to the underlying crypto leader Bitcoin. As BTC doubled in price in the first quarter of 2021 so Coinbase's revenue has surged. COIN said revenue for Q1 2021 will likely be $1.8 billion versus $1.3 billion for the full year 2020.

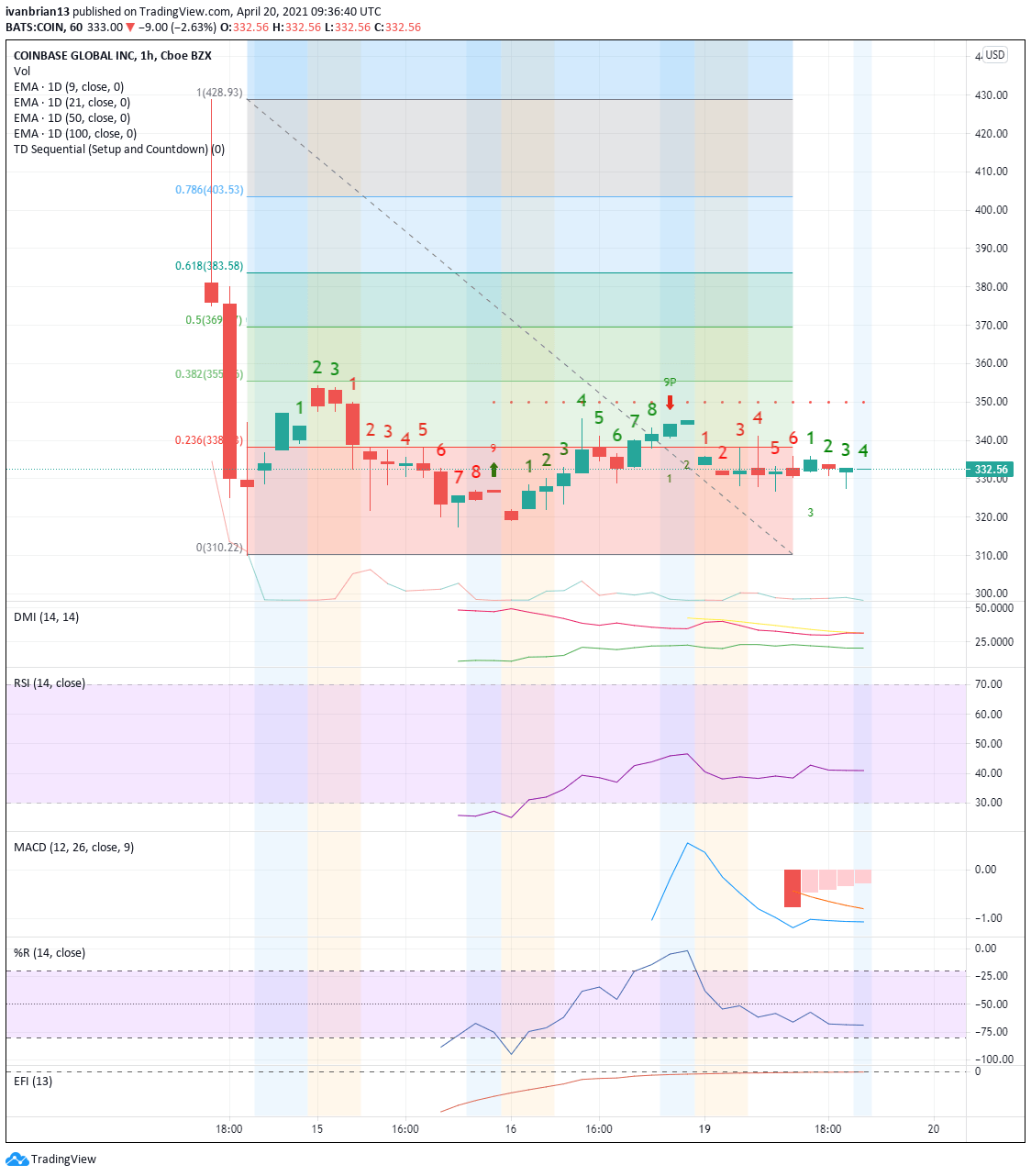

As demonstrated in our last look at the technical chart picture, COIN has flagged up the dreaded DeMark 9 sell on the hourly charts. Given COIN is a new listing, we cannot use daily data as there just is not enough of it yet. Other indicators are neutral. The Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Williams indicators are all in neutral territory. Volume and volatility are low.

COIN opened with a gap lower on Monday based on Bitcoin's weekend fall. In doing so, COIN breached the Fibonacci 23.6% retracement from the opening day high to low. This is the first resistance should COIN turn bullish, $338.24.

Support comes at $310.22, the opening day low. This is the current target from the DeMark sell signal. Technical analysis is never an exact science, but particularly in a new listing with limited data, so caution and solid risk management should be the order of the day.

Previous updates

Update April 27: Coinbase Global Inc (NASDAQ: COIN) shares have recaptured the $300 line and closed at $304.54 on Monday, an increase of 4.4%. According to Tuesday's premarket data, shares are expected to extend their gains with another 1.5% to the upside. The biggest boost came from Tesla. Elon Musk's electric vehicle company said it made $100 million on its Bitcoin investment and sees more potential there. As a cryptocurrency exchange, Coinbase benefits from such a highly visible endorsement.

Update April 23: COIN shares continue to collapse as Bitcoin suffers sharp declines. Bitcoin is down 7% at the time of writing on Friday, trading at $48,166. COIN is as a result suffering further and is currently down 4% in the premarket at $282. The Moving Average Convergence Divergence (MACD) and Directional Moving Index (DMI) remain in bearish territory.

Update April 22: Coinbase Global Inc (NASDAQ: COIN) opened lower for the fourth straight day on Thursday and continues to have a difficult time staging a meaningful rebound. As of writing, COIN was trading at $304.90, losing 2.3% on a daily basis. Earlier in the day, Deutsche Boerse announced that it would delist COIN from the Xetra trading system and the Frankfurt Stock Exchange due to an error identified in the reference code. Although Deutsche Boerse later noted that COIN will remain listed as Coinbase has provided the correct information, this development failed to trigger a recovery. Meanwhile, Bitcoin is up more than 2% following Wednesday's sharp drop, possibly helping COIN limit its losses for the time being.

Update April 22: Etehreum (ETH/USD) has hit new highs above $2,550 and Bitcoin is recovering – yet the publically traded cryptocurrency exchange fails to benefit. Coinbase Global Inc (NASDAQ: COIN) has dropped to below $310 at the time of writing, extending its declines. One week after directly listing on the stock market, some hot air seems to come out of shares.

Update April 22: Coinbase Global Inc (NASDAQ: COIN) has been on the back foot, falling nearly 2.8% to close at $311.92 on Wednesday. After-hours data is pointing to a minor extension of that drop to $308.95 on Thursday. While Ethereum is trading higher – flirting with $2,500 – Bitcoin, the granddaddy of cryptocurrencies, remains on the back foot below $55,000. The cryptocurrency exchange's value is becoming more and more correlated with BTC. An uptick over the weekend may boost its shares.

Update April 21: COIN shares are under the microscope as investors take a closer look at the valuation metric. COIN was worth more than the NYSE and Nasdaq shortly after launch and more notably was close to the lead bank involved in its listing, Goldman Sachs. GS has a market cap of $113 billion and COIN was approaching this shortly after listing as the shares roared ahead. Investors have started to focus on how sustainable the COIN business model is given it is highly dependant on stable commission rates. Commission rates on trading shares have been falling for decades as have trading fees for commodities, futures, and bonds. Crypto is a market in its infancy by comparison but if the trend spreads across, COIN will not be able to maintain current margin and commission levels.

Update: COIN struggles for gains on Tuesday as the Bitcoin hangover continues. COIN shares are lower by nearly 1% early on in the session. Technically the chart still remains bearish with the DeMark sell signal still in place. COIN also broke support at $338.32, a Fibonacci retracement level.

At the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.