Cipla Indian Elliott Wave technical analysis [Video]

![Cipla Indian Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Equities/Industries/Media/music-board_XtraLarge.jpg)

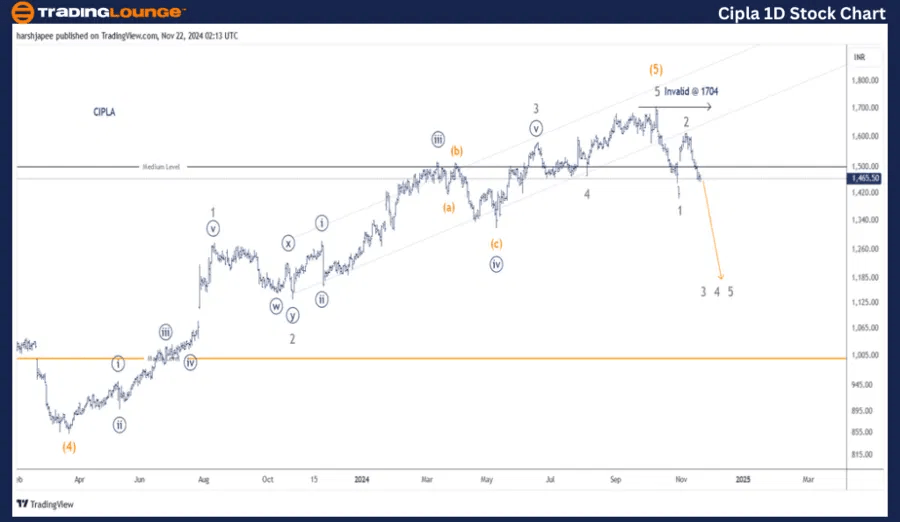

Cipla Elliott Wave technical analysis

Function: Counter Trend (Minor Degree Grey).

Mode: Corrective.

Structure: Impulse within larger degree Corrective Structure.

Position: Minor Wave 1 Grey.

Details: A larger degree correction might be underway as Minor Wave 1 is complete around 1400 mark. Minor Wave 2 is also complete around 1620-30, and Wave 3 could be now underway.

Invalidation point: 1705.

Cipla daily chart technical analysis and potential Elliott Wave counts

CIPLA daily chart indicates potential termination of its larger degree uptrend around 1705 mark as prices have reversed lower breaking below 1470, the previous Wave 4 of one lesser degree. Also note that Wave 2 rallied through 1615 and looks complete as bears are now dragging prices lower.

The stock earlier terminated Intermediate Wave (4) around 850 in March 2023. An impulse rally through 1705 thereafter, indicates the trend is complete and bears are now in control. Alternatively, the recent drop to 1400 lows could be Minor Wave 4, with bulls working on a Wave 5 rally.

Cipla Elliott Wave technical analysis

Function: Counter Trend (Minor Degree Grey).

Mode: Corrective.

Structure: Impulse within larger degree Corrective Structure.

Position: Minor Wave 1 Grey.

Details: A larger degree correction might be underway as Minor Wave 1 is complete around 1400 mark. Minor Wave 2 is also complete around 1620-30, and Wave 3 could be now underway.

Invalidation point: 1705.

Cipla four-hour chart technical analysis and potential Elliott Wave counts

CIPLA 4H chart is highlighting the potential wave counts since Minor Wave 4 terminated around 1470 in August 2024. Minor Wave 5 as an impulse, which looks complete at 1704 mark. The stock has sharply reversed thereafter breaking below 1470 low.

Minor Wave 1 terminated around 1400 mark followed by Wave 2 rally through 1615. Minor Wave 3 is now underway with potential target seen towards 1250 at least.

Conclusion

CIPLA is progressing lower within Minor Wave 3 against 1705 high.

Cipla Indian Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.