- NYSE: CCIV shares continue higher, up 16% on Friday.

- Lucid Motors CEO Peter Rawlinson spoke earlier on CNBC.

- Investors looking for news of a merger between CCIV and Lucid.

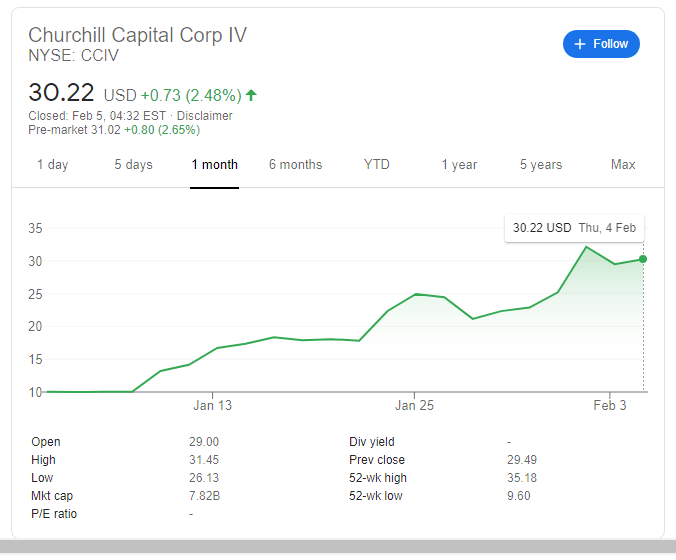

Update February 9: CCIV shares have been trending lower on Tuesday, slipping below $31 – a drop of around 6% at the time of writing. The Special Purpose Acquisition Company (SPAC) is still expected to merge with Lucid Motors, the luxury electric vehicle maker founded Tesla alumni. However, that has yet to materialize. Some investors probably prefer to "buy the rumor, sell the fact" even before anything happens, or in fear that the deal does not come through. Nevertheless, it is essential to note that Churchill Capital Corp IV is already worth more than double its price early in the year.

Update: February 8: Churchill Capital Corp IV (NYSE: CCIV) has been edging lower at the beginning of a new trading week, moving down below $34, but holding most of its gains. Is there a buy opportunity on shares of the blank check company? While the merger with Lucid Motors remains elusive, it remains on the cards. President Joe Biden is set to pass a large stimulus plan supporting the economy. If it includes any provisions for green technologies – or opens the door to such initiatives – electric vehicle firms could benefit.

Update 2 Friday, February 5: Shares in CCIV continued to rally as Friday progressed. CCIV shares are trading above $35 at the time of writing, a gain of 16% for the day. Volume remains high in CCIV. Investors hoped that the rumoured merger between Lucid Motors and CCIV may be back on the cards.

Update Friday, February 5: CCIV powered higher in early trading on Friday as investors pondered over the rumoured Lucid Motors merger. Lucid CEO Peter Rawlinson speaking to CNBC says he "cannot confirm nor deny" if the merger is going ahead. Investors took that as a positive after the Wall Street Journal had reported on Wednesday that the merger "isn't imminent". CCIV shares are up 8% at the time of writing at $32.75.

Update: Churchill Capital Corp IV (NYSE: CCIV) has been changing hands at around $31 early on Friday, indicating another gain of 2.58% on the last day of a bullish week. That would follow up on Friday's increase of 2.48% that allowed shares of the blank-check company to top $30. Investors are still awaiting news about a potential SPAC merger with Lucid Motors. Some are awaiting news to come out early next week, perhaps on "Merger Monday" as some Wall Street insiders call such events. At current levels, CCIV shares are worth more than triple their value early in 2021.More: Best Stocks to Buy Forecast 2021: Vaccines and zero rates to broaden recovery

Update February 4, GMT 19:30: While investors await an announcement on an illusive merger deal, CCIV bulls had taken the price to fresh highs on Wall Street.

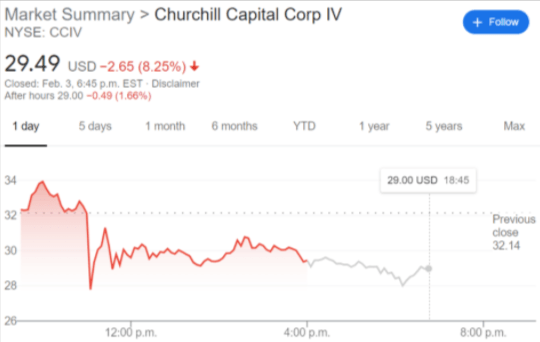

The price was recovering to a 61.8% Fibonacci retracement of the prior day's sell-off from $34.50 to today's low of $26.13.

Trading at $29.79 at the time of writing, the stock is over 1% higher having found demand in the vicinity of the 25th Jan highs.

Meanwhile, for the day traders, the price is now breaking a key support in the 15 min chart, below $30, testing $29.40 support with eyes on a break to $28.76 structure which meets a 61.8% Fibonacci confluence of the latest bullish impulse.

Update February 4: Shares in CCIV continue to suffer in early trade on Thursday. Shares are currently trading at $27.87 down nearly 6%. CCIV investors were left disappointed on Wednesday as the Wall Street Journal had dashed hopes of a quick merger with Lucid Motors.

NYSE:CCIV has finally slowed down after being one of the most popular SPAC targets for investors looking to get in on the ground floor of the up and coming Lucid Motors. That momentum came to a screeching halt on Wednesday as the stock dropped by 8.25% to close the trading session at $29.49. Shares made a slight recovery near the closing bell after dropping to $27.58 before some investors jumped in at the discounted price.

The catalyst for the drop in price was a Wall Street Journal report that the highly anticipated merger between Churchill Capital and upstart electric vehicle maker Lucid Motors is not at all imminent. Investors have been piling into the SPAC stock since early January, where the initial rumors of a merger with Lucid were reported. Lucid is widely viewed as a luxury electric vehicle brand that has a chance to disrupt industry leader Tesla’s (NASDAQ:TSLA) stranglehold on the market. With a manufacturing plant in Arizona nearly ready to start production of its Lucid Air sedan, many investors believed that CCIV would be a chance to get the next parabolic electric vehicle stock at a discount.

CCIV stock forecast

But is CCIV trading at a discount? It is currently one of the highest price SPAC stocks on the market – higher even than Chamath Palihapitiya’s IPOD, IPOE, and IPOF companies. The proposed Lucid merger has already been baked into the high price, so investors who want to get in may want to wait, as the stock should continue to decline the longer it goes without an announcement for a merger.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD remains offered and challenges 1.0800

The intense recovery in the US Dollar keeps the price action in the risk complex depressed, forcing EUR/USD to recede further and put the key support at 1.0800 to the test on Friday.

GBP/USD breaks below 1.2900 on stronger Dollar

Persistent buying pressure on the Greenback has pushed GBP/USD to multi-day lows below the 1.2900 level, as investors continue to digest the recent interest rate decisions from both the Fed and the BoE.

Gold meets support around the $3,000 mark

The combined impact of a stronger US Dollar, continued profit taking, and the effects of Quadruple Witching weighed on Gold, pulling its troy ounce price down to around the pivotal $3,000 level on Friday.

US SEC Crypto Task Force to host the first-ever roundtable on crypto asset regulation

The US Securities and Exchange Commission (SEC) Crypto Task Force will host a series of roundtables to discuss key areas of interest in regulating crypto assets. The “Spring Sprint Toward Crypto Clarity” series’ first-ever roundtable begins on Friday.

Week ahead – Flash PMIs, US and UK inflation eyed as tariff war rumbles on

US PCE inflation up next, but will consumption data matter more? UK budget and CPI in focus after hawkish BoE decision. Euro turns to flash PMIs for bounce as rally runs out of steam. Inflation numbers out of Tokyo and Australia also on the agenda.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.