Churchill Capital Corp (CCIV) Stock Price and News: Finally the merger news but shares suffer

- Churchill Lucid merger confirmed by multiple news sources.

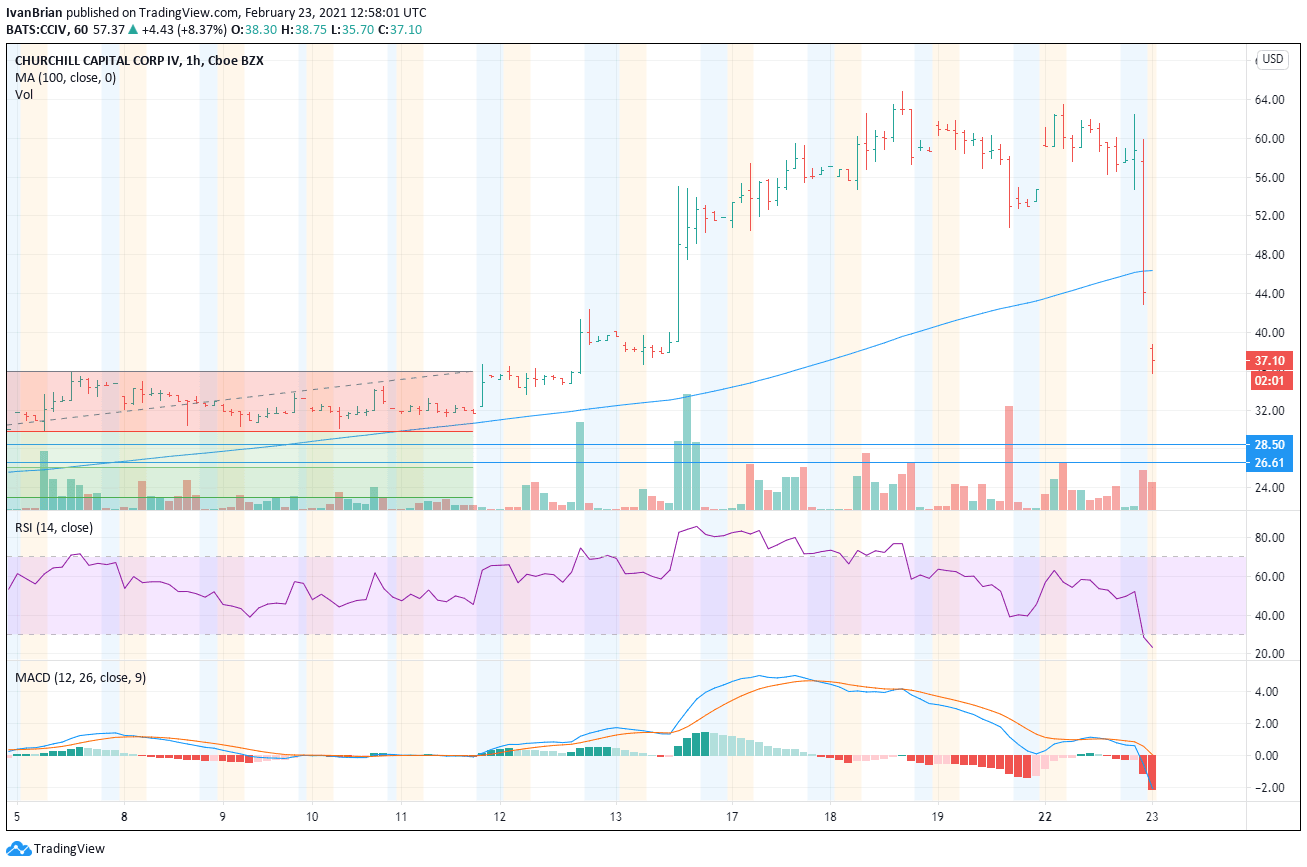

- Churchill (CCIV) shares down 32% in the first hour of Tuesday.

- Churchill had been trading sharply down during the pre-market on Tuesday.

Update: Well it isn't getting any better on Tuesday as CCIV shares suffer from post-merger fatigue and a general market sell-off. Any stocks with an outperformance for 2021 are being hit in a broad risk-off sell-off. Investors are growing increasingly worried about inflation as Federal Reserve Chair Jerome Powel speaks in Washington. At the time of writing shares in CCIV are trading at $38.55, a loss of 32%.

The news investors have long awaited has finally hit the tape with Reuters and other outlets confirming the merger between Lucid Motors and Churchill has been agreed. Probably one of the most speculated SPAC stories in recent years the anticipation over the CCIV Lucid merger had reached fever pitch amongst retail investors. The merger was heavily discussed on Twitter and other social media sites and was akin to the Gamestop frenzy of January.

See the latest news as Lucid CEO Peter Rawlinson outlines plans

Churchill Lucid Merger News

So the deal is reportedly a $24 billion pro-forma deal but with the CCIV share price at $40 Reuters estimates that gives the merged company "a market capitalization of about $64 billion. By comparison, General Motors Co is worth about $76 billion". This sounds very like the Tesla argument, ie Tesla is worth more than most car makers despite making a fraction of the sales but that has not deterred Tesla share price ascent so investors will be hoping for the same results for Lucid Motors.

Peter Rawlinson, CEO and CTO of Lucid, said, “Lucid is proud to be leading a new era of high-technology, high efficiency zero-emission transportation. Through a ground-up rethinking of how EVs are designed, our in-house-developed, race-proven technology and meticulous engineering have enabled industry-leading powertrain efficiency and new levels of performance. Lucid is going public to accelerate into the next phase of our growth as we work towards the launch of our new pure-electric luxury sedan, Lucid Air, in 2021 followed by our Gravity performance luxury SUV in 2023."

Michael Klein, Chairman and CEO of CCIV, said, “CCIV believes that Lucid’s superior and proven technology backed by clear demand for a sustainable EV make Lucid a highly attractive investment for Churchill Capital Corp IV shareholders, many of whom have an increased focus on sustainability. We are pleased to partner with Peter and the rest of Lucid’s leadership team as it delivers the highly anticipated Lucid Air to market later this year, promising significant disruption to the EV market and creating thousands of jobs across the U.S.”

Churchill Lucid Share Price

At the time of writing shares in Churchill Capital IV are at $38.03 from a close on Monday of $57.37. This decline likely has to do with the announcement of the PIPE investment being done at $15 a share.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.