- NYSE:CCIV sheds 1.8% in first hour of tuesday's trade.

- CCIV has lost momentum since annoucning th Lucid merger.

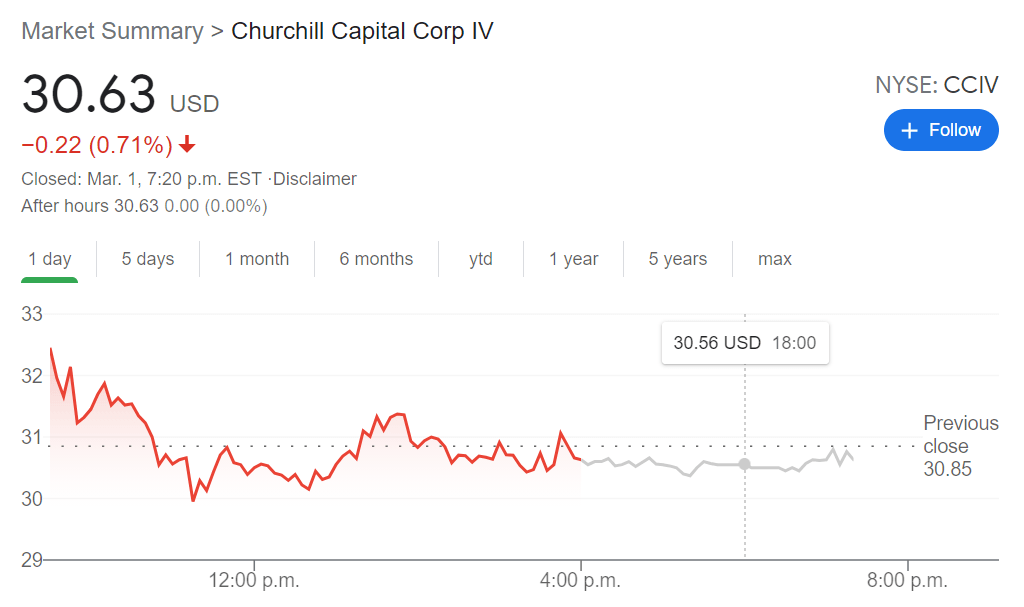

- CCIV shares moved from $60 to $30 and have stabilised there.

Update Tuesday, March 2: Shares in CCIV continue to stabilize around $30 after the long-awaited merger was announced with Lucid Motors. Shares suffered as the PIPE transaction details were announced. Recent news from established auto manufactures that they would move solely to Electric Vehicle (EV) production have also hurt the EV sector. Volvo said on Tuesday it is to go fully electric by 2030 for its entire vehicle range. Ford had said in February it was to be fully electric in Europe by 2030.

NYSE:CCIV was the hottest stock on the market a couple of weeks ago, but since it officially announced its reverse merger with Lucid Motors, investors have slammed on the brakes. On Monday, despite a broader market rally that saw the S&P 500 jump 2.4%, CCIV traded sideways trimming 0.39% to close the trading session at $30.63. Shares are now trading 52% lower than the 52-week high price of $64.86 that it saw in mid-February.

Stay up to speed with hot stocks' news!

The broader electric vehicle sector rallied on Monday as tech stocks and the NASDAQ rebounded by 3.01%. Industry leader Tesla (NASDAQ:TSLA) jumped by 6.36% after lagging for most of the year so far, and Chinese electric vehicle maker NIO (NYSE:NIO) surged by 8.96% ahead of its fourth quarter earnings report after the closing bell. CCIV recorded a lower than average daily trading volume, as the recently quoted valuation of $68 billion seems to have scared some investors off of its sky-high stock price.

CCIV Stock Price

As CCIV and Lucid Motors head towards their impending merger, the stock still represents an opportunity to get into a company with a strong management team and a manufacturing plant that is nearly completed. Lucid definitely targets a high-end demographic as its Lucid Air sedan is priced at $96,000, $139,000, and $169,000, depending on which model you prefer. While expected vehicle deliveries certainly will not be as high as companies with entry level models, with time Lucid could see some impressive margin growth as production ramps up.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to recovery gains below 1.0800, US data awaited

EUR/USD is trading under 1.0800, holding the recovery from three-week lows in European trading on Thursday. The pair defends gains amid sustained US Dollar softness as traders digest latest tariff threats from US President Trump. Traders also resort to repositioning ahead of Friday's US PCE inflation data.

Gold just a sigh away from fresh all-time high on Thursday

Gold price sprints higher on Thursday, gaining around 0.70% gains, trading at $3,040 at the time of writing. The pop in the precious metal was infused by U.S. President Donald Trump, who issued fresh new tariffs. Trump signed a proclamation for a 25% tariff on auto imports on Wednesday.

GBP/USD holds gains above 1.2900 on US Dollar weakness

GBP/USD trades with positive bias above 1.2900 in Thursday’s European session. The pair holds the uptick amid persistent US Dollar weakness as fresh Trump tariff threats rekindle US economic slowdown concerns. Focus remains on tariff updates and mid-tier US data.

Curve DAO rallies as developer activity hits new ATH

Curve DAO (CRV) price extends its gains by 8% and trades above $0.58 at the time of writing on Thursday, rallying over 15% so far this week.

Auto tariffs dominate, can European stocks maintain their lead over the US?

Tariffs are yet again dominating market sentiment. European stocks have opened sharply lower after President Trump announced a 25% levy on imports of cars and car parts coming into the US.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.