China’s DeepSeek: Could this be a turning point for US tech?

Key points

-

China’s DeepSeek and US tech dominance: DeepSeek, a Chinese AI startup, has rapidly gained attention with its advanced models, potentially challenging the dominance of established U.S. tech giants like OpenAI and Nvidia.

-

Cost-effectiveness and open-source strategy: DeepSeek challenges the traditional, capital-intensive AI development approach by using less advanced hardware to create cost-efficient models. Their open-source strategy promotes faster innovation and wider adoption, potentially reducing the competitive edge of U.S. firms that rely on proprietary systems.

-

Investment implications: This development could raise concerns about the high valuations of the U.S. tech sector that has been the key driver of broader U.S. market gains.

DeepSeek, a Chinese artificial intelligence (AI) startup, has recently emerged as a significant player in the AI landscape, drawing considerable attention from global investors and industry leaders. Founded in 2023, DeepSeek has rapidly developed advanced AI models that rival those of established U.S. tech giants.

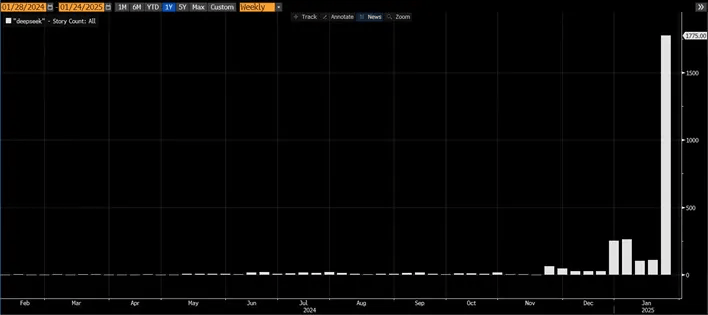

DeepSeek unveiled a free, open-source large-language model in late December that it says took only two months and less than $6 million to build, using reduced-capability chips from Nvidia called H800s. DeepSeek’s app is now one of the most downloaded app on Apple’s App Store, and Bloomberg searches for “DeepSeek” have surged, reflecting heightened global interest and investor focus.

Count of Bloomberg stories mentioning DeepSeek. Source: Bloomberg

This has raised a few pertinent questions, such as:

Sustainability of US tech dominance

DeepSeek’s AI models, like the DeepSeek-R1, have demonstrated superior performance compared to prominent U.S. models such as OpenAI’s GPT-4 and Meta’s LLaMA 3.1. These achievements span across various benchmarks, including complex problem-solving, mathematics, and coding, positioning DeepSeek as a key player in the global AI arena.

Even if DeepSeek does not maintain its current level of popularity, this development serves as a reminder that competition in the global AI arena is intensifying, and Nvidia may not be in the pole position forever.

The cost debate: Does more spending equal better AI?

By developing cutting-edge AI models with less advanced and more cost-efficient hardware, DeepSeek challenges the heavy investments U.S. tech companies are pouring into high-cost AI infrastructure.

Reports suggest that DeepSeek-R1’s API costs just $0.55 per million input tokens and $2.19 per million output tokens, compared to OpenAI’s API, which costs $15 and $60, respectively. This raises critical questions about whether the traditional capital-intensive approaches are sustainable in the long run.

Open source: The innovation multiplier

Taking a different path from many U.S. companies that tightly guard their AI models, DeepSeek has adopted an open-source strategy, openly sharing its code and training methodologies.

This approach could drive faster innovation and broader adoption globally, potentially diminishing the competitive advantage of U.S. firms reliant on proprietary systems such as OpenAI’s GPT-4 or Google’s Bard. Yann LeCun, Meta's chief AI scientist, remarked that DeepSeek's success underscores the potential of open-source models to surpass proprietary ones.

High valuations: The constant pain point for US big tech

U.S. tech companies are trading at premium valuations, with major AI players like Nvidia, Microsoft, and Alphabet commanding forward P/E multiples far above historical averages. With these stocks priced for perfection, even minor disruptions, such as DeepSeek proving advanced AI can be built without top-tier chips, could weigh heavily on share prices. For Nvidia, in particular, its role as a key supplier of AI chips makes it vulnerable if demand for its high-end products wanes.

In contrast, Chinese tech companies, including new entrants like DeepSeek, are trading at significant discounts due to geopolitical concerns and weaker global demand. DeepSeek's rise could spark renewed investor interest in undervalued Chinese AI companies, providing an alternative growth story.

Geopolitical chess: Beating chip restrictions

DeepSeek’s success raises another pressing question: how did they do it despite U.S. export controls? The Biden administration’s semiconductor restrictions were designed to limit China’s access to high-powered chips like Nvidia’s H100s. Yet DeepSeek has managed to thrive, suggesting either a workaround or that these controls aren’t as restrictive as intended.

This could have major implications for both U.S. policy and investor sentiment toward Chinese tech. If companies like DeepSeek can innovate despite sanctions, the narrative around China's technological dependence on the U.S. may shift dramatically.

What does this mean for investors?

-

Evaluate US AI capex and margins: High costs and stretched valuations could put U.S. AI leaders under pressure, especially if DeepSeek’s cost-efficient model gains traction. Watch for commentary during the Q4 earnings season that kicks into high gear this week with Meta, Microsoft, Tesla and Apple reporting.

-

Watch for value in Chinese tech: DeepSeek’s success could spark renewed interest in China’s AI sector, which remains undervalued relative to U.S. peers.

-

Diversify within and beyond AI: While AI remains a critical growth driver, investors should consider broader diversification across sectors like renewable energy, semiconductors, and healthcare—industries where innovation is also creating opportunities for outsized returns.

-

Spread across regions: DeepSeek’s rise underscores the importance of geographic diversification. Allocating capital to Europe and Asia, for instance, could help balance portfolios over the long term, especially as non-U.S. markets build competitive tech ecosystems.

-

Brace for policy shifts: If U.S. export controls fail to restrict Chinese innovation, expect policymakers to explore new tactics—potentially creating volatility in the semiconductor space.

Read the original analysis: China’s DeepSeek: Could this be a turning point for US tech?

Author

Saxo Research Team

Saxo Bank

Saxo is an award-winning investment firm trusted by 1,200,000+ clients worldwide. Saxo provides the leading online trading platform connecting investors and traders to global financial markets.