China doctors have made a stark warning to Pres. Xi

China’s doctors have warned that the nation is not to relax lockdown measures, in an article by the Financial Times: China’s doctors warn ‘we’re not ready’ as threat of covid ‘exit wave’ stymies reopening ambitions.

The article starts:

China’s doctors have a blunt message for Xi Jinping: the country’s healthcare system is not prepared to deal with a huge nationwide coronavirus outbreak that will inevitably follow any easing of strict measures to contain Covid-19. The warning for China’s leader was delivered by a dozen health professionals — including frontline doctors and nurses and local government health officials — interviewed by the Financial Times this month, and echoed by international experts. “The medical system will probably be paralysed when faced with mass cases,” said one doctor in a public hospital in Wuhan, central China, where the pandemic started nearly three years ago.

Meanwhile, China’s official case counts are at their highest in six months, including a record number of infections in the capital Beijing and the southern manufacturing hub of Guangzhou where crowds of residents recently scaped a compulsory lockdown and clashed with police, as anger at strict coronavirus curbs boiled over. Guangzhou has reported more than 33,000 cases since October. Daily cases hit a record 8,761 on Wednesday, more than double the rate at the peak of a crippling two-month lockdown in Shanghai this year.

Today, China's Zhengzhou, another area that has seen cases spike this month, reported107 new local symptomatic coronavirus cases and 1,556 asymptomatic cases for November 17.

Markets could respond in a risk-off fashion to this as the story gains traction at the end of the week, serving as a reality check for the optimists hoping that Xi will end his hallmark zero-Covid policy.

''Experts said the policy meant China had failed to prioritize building robust defenses for a mass outbreak, instead focusing its resources on containment. At the heart of the problem that Beijing has created for itself is what many see as an inevitable “exit wave”, a rapid surge in infections as the country unwinds its heavy-handed pandemic restrictions,'' the article wrote.

“The big threat in an exit wave is just the sheer number of cases in a short space of time,” said Ben Cowling, a professor of epidemiology at the University of Hong Kong. “I would be reluctant to say there is a scenario in which an exit wave doesn’t cause problems for the healthcare system. That is difficult to imagine.”

Market implications

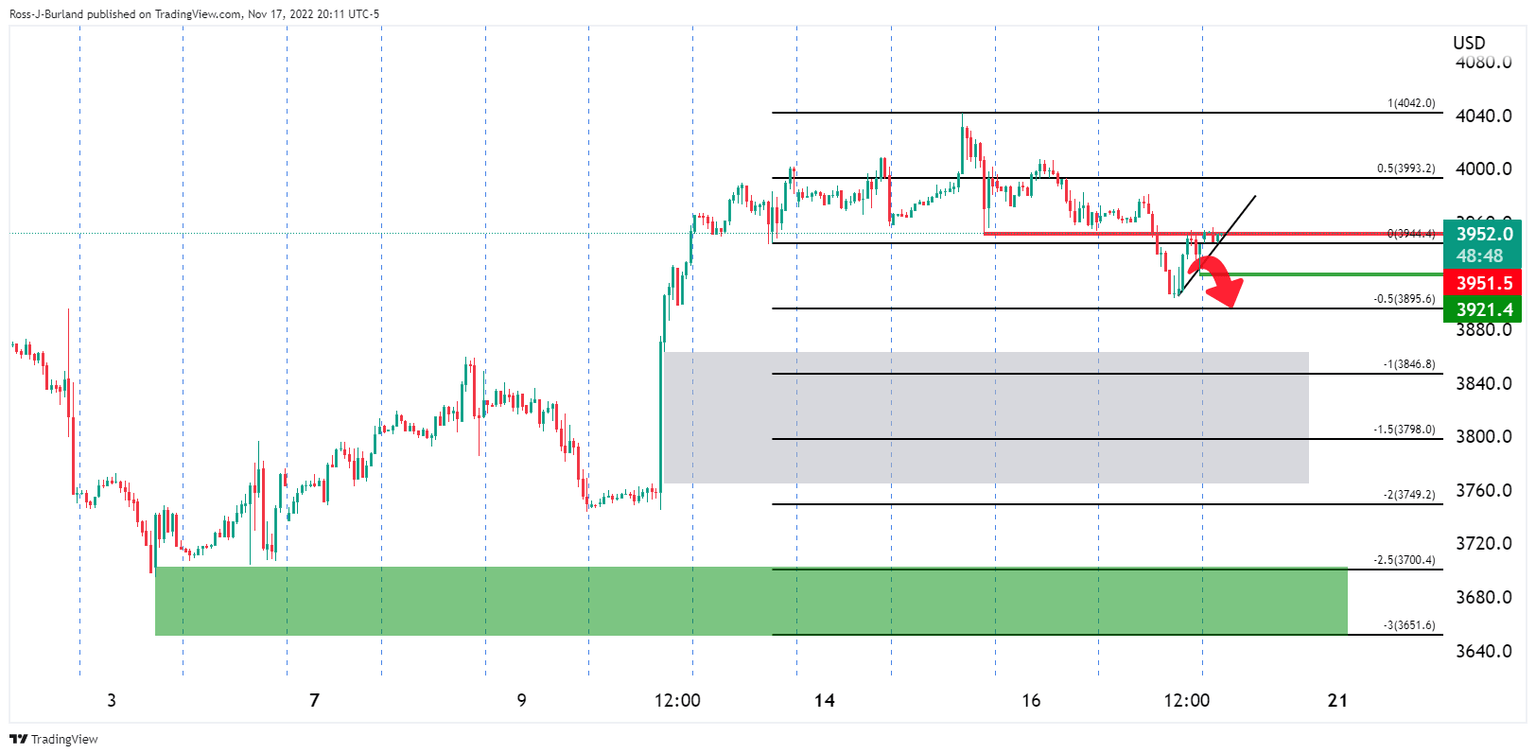

The worrisome outlook comes at the same time that the SP 500 is hovering over the abyss:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.