CHF/JPY Price Analysis: Bears have this pair highup on their watchlist

- CHF/JPY bulls are tiring out on the weekly chart in the form of a bearish rising wedge.

- The hourly daily and hourly charts offer a prospect to the downside.

Bears are engaging the charts for this pair with CHF/JPY a high priority on the watchlist. There is confluence across the time frames that makes for a compelling bearish case for the cross.

The following is a top-down analysis that illustrates where the next opportunity for the bears could emerge from a break of support on the hourly charts.

Monthly chart

Monthly resistance is being tested and while there are still prospects of an extension of the monthly impulse, the lower time frames could offer a meanwhile downside opportunity.

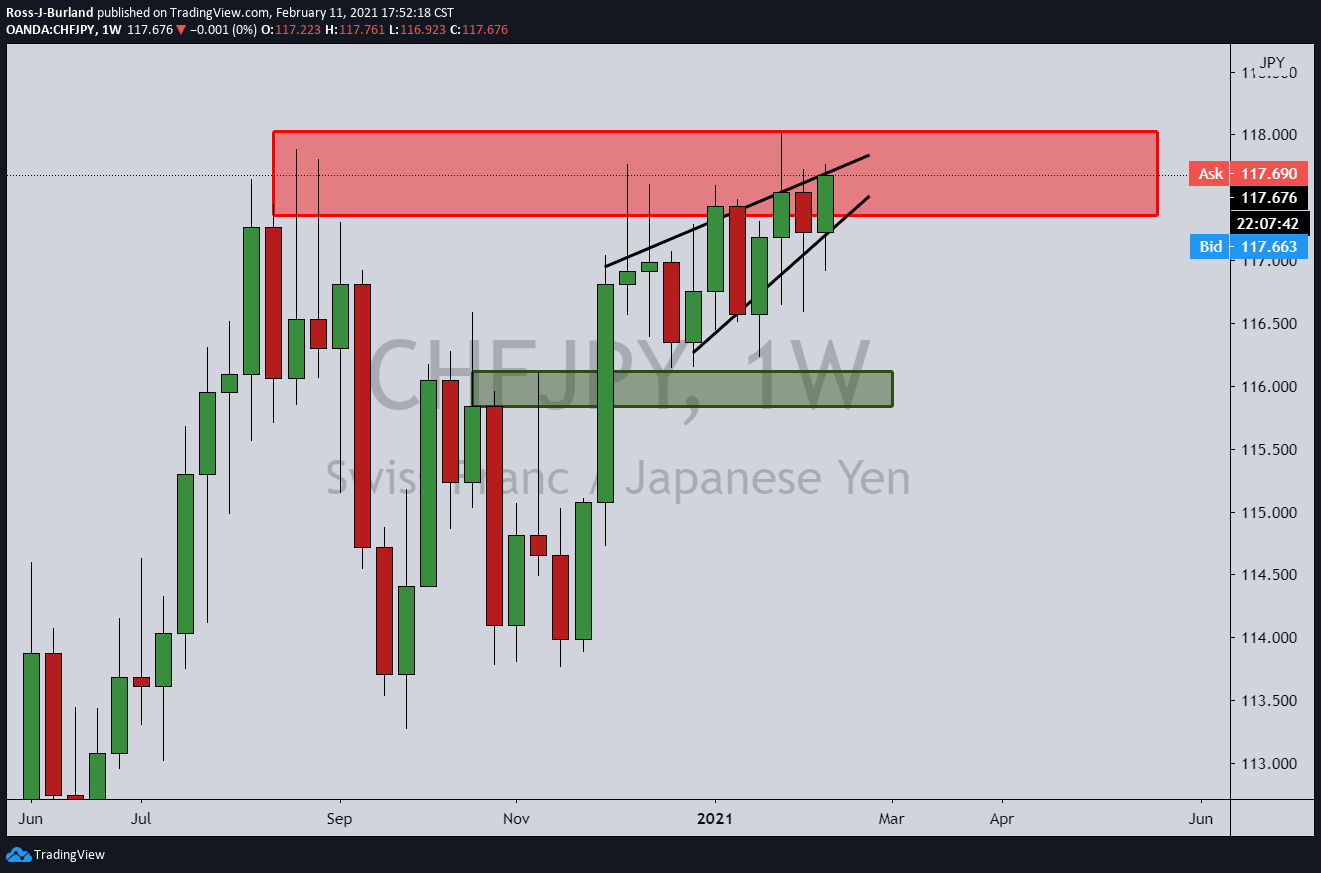

Weekly chart

The rising wedge formation is regarded as a bearish chart pattern that begins wide at the bottom and contracts as prices move higher and the trading range narrows.

The fact that price is testing strong monthly resistance is an extra conviction of the downside bias.

Daily chart

The daily chart has painted a W-formation from which bears would expect the price to retest the neckline of the formation.

This could be worked upon from an hourly perspective as follows:

1-hour

The 1-hour time frame has the price still in bullish territory, so there is no action to take at this juncture other than to monitor for bearish developments and structure.

MACD is bullish while above the zero line and the price is still above the 20-EMA

However, bears can expect a break below support which would send the price below the EMA and MACD below zero.

Bears would then anticipate the old support structure to act as resistance on a restest from which an optimal entry point targetting the W-formation's neckline.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.