Chevron (CVX) looking to do a double correction

Chevron Corporation (CVX) is a global leader in the energy sector. It engages in the exploration, production, and refining of crude oil and natural gas. They operate worldwide, with significant activities in North America, South America, Europe, Africa, the Middle East, and Asia-Pacific. Chevron also manufactures and markets petrochemicals through its affiliate, Chevron Phillips Chemical Company LLC. Below we update the long term technical Elliott Wave outlook for the company.

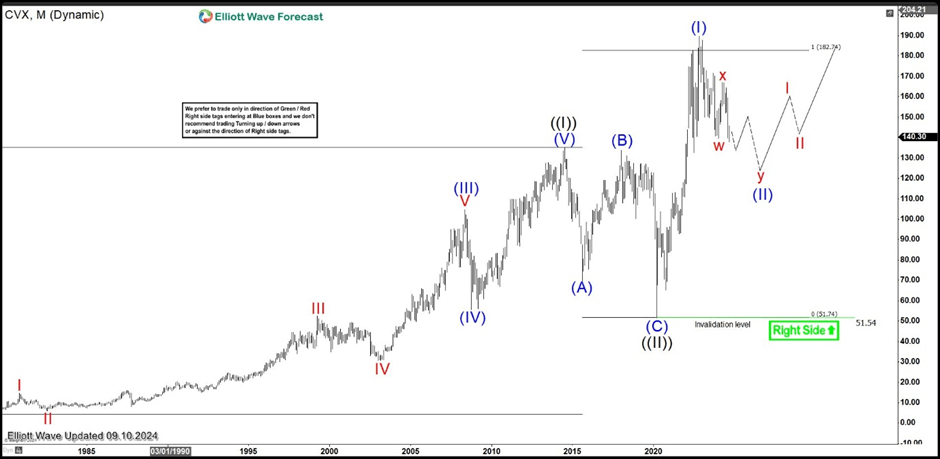

Chevron monthly Elliott Wave chart

Monthly Elliott Wave Chart of Chevron (CVX) above shows that the stock has ended wave ((II)) Grand Super Cycle degree at 51.5 on March 2020. From there, it has started a new impulsive wave ((III)). Up from wave ((II)), wave (I) ended at 189.68 and wave (II) pullback is currently in progress. Near term, while pullback stays above 51.54, the stock should see further upside.

Chevron daily Elliott Wave chart

Daily Elliott Wave Chart for Chevron above shows that wave (II) pullback is in progress to correct cycle from March 2020 low. Internal subdivision of the wave (II) pullback is unfolding as a double three Elliott Wave structure. Down from wave (I), wave w ended at 139.62 and wave x rally ended at 167.11. Wave y lower is currently in progress with internal subdivision as a zigzag structure. Potential target lower for the wave (II) is 100% – 161.8% Fibonacci extension of wave w which comes at 84.7 – 116.1 area.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com