- Canopy Growth Corporation is enjoying broad momentum after appointing a new CEO.

- CGC's new line of Cannabis 2.0 products is inspiring investors.

- The weed firm's entry into the vast US CBD market is also an encouraging move.

Canopy Growth Corporation (CGC) is one of the prominent marijuana stocks. While rivals such as Aurora struggle with financial acrobatics, the Smiths Falls-based firm has its books more in order.

Yet the main drivers of the recent rise in its stock price stem from three reasons.

1) New boss: David Klein, formerly the CFO of Constellation Brands, has assumed his role as the new CEO of Canopy on January 14. The parachuting of a seasoned corporate manager into the driver's seat provides confidence for investors. Moreover, Klein is familiar with the firm as he already served on Canopy's board. CNBC's Jim Cramer has also weighed in, praising the new CEO and saying he has got "horse sense."

2) Cannabis 2.0: Chocolates, vapes, and also distilled cannabis offering form part of GCC's new line of products dubbed "Cannabis 2.0." The recently secured license to operate its large new beverage facility in Smiths Falls will enable it to develop and market THC and CBD-infused beverages. These include the Houseplant Grapefruit and Houseplant Lemon, both standard 355ml beverages containing 2.5mg of THC. Canopy will use the Quatreau brand name to market CBD-based wellness drinks.

3) US CBD Market: Perhaps most importantly for the Canadian company is its entry to the vast American market. Late in 2019, CGC launched its First and Free brand in 31 US states where CBD is legal. Apart from the vape products, the firm offers softness, oils, and creams. It has also begun sourcing hemp from American farmers based in New York state, among other places.

All in all, these three drivers are pushing the firm forward.

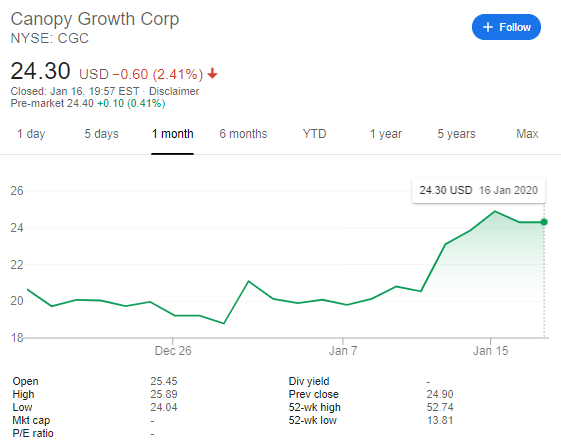

Canopy Growth Corporation Stock price today

CGC, traded in the New York Stock Exchange, has risen by over 25% from the lows under $20 in late December to $24.30 at the time of writing. On Thursday, shares corrected some of their gains and dropped by 2.4% or $0.60.

Nevertheless, CGC's reasons to rise and the general upbeat market mood – following the signing of the Sino-American trade deal – may help Canopy resume its rises.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to daily gains near 1.0300 after US PMI data

EUR/USD trades in positive territory at around 1.0300 on Friday. The pair breathes a sigh of relief as the US Dollar rally stalls, even as markets stay cautious amid geopolitical risks and Trump's tariff plans. US ISM PMI improved to 49.3 in December, beating expectations.

GBP/USD holds around 1.2400 as the mood improves

GBP/USD preserves its recovery momentum and trades around 1.2400 in the American session on Friday. A broad pullback in the US Dollar allows the pair to find some respite after losing over 1% on Thursday. A better mood limits US Dollar gains.

Gold retreats below $2,650 in quiet end to the week

Gold shed some ground on Friday after rising more than 1% on Thursday. The benchmark 10-year US Treasury bond yield trimmed pre-opening losses and stands at around 4.57%, undermining demand for the bright metal. Market players await next week's first-tier data.

Stellar bulls aim for double-digit rally ahead

Stellar extends its gains, trading above $0.45 on Friday after rallying more than 32% this week. On-chain data indicates further rally as XLM’s Open Interest and Total Value Locked rise. Additionally, the technical outlook suggests a rally continuation projection of further 40% gains.

Week ahead – US NFP to test the markets, Eurozone CPI data also in focus

King Dollar flexes its muscles ahead of Friday’s NFP. Eurozone flash CPI numbers awaited as euro bleeds. Canada’s jobs data to impact bets of a January BoC cut. Australia’s CPI and Japan’s wages also on tap.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.