“Fertilizer prices were already high before the war. They have now reached record levels amid a precipitous drop in Russian supply… The result is that fertilizer is about three to four times costlier now than in 2020” – Jon Emont and Silvina Frydlewsky, Wall Street Journal writers

Sanctions against Russia following its invasion on Ukraine have further intensified commodity and food shortages. Among them, a prohibition on Russia’s natural gas export does not solely hurt the oil market, but there is also a ripple effect towards the agricultural sector. This is because natural gas is a key input in the production of fertilizer, which is used by farmers to boost crop production.

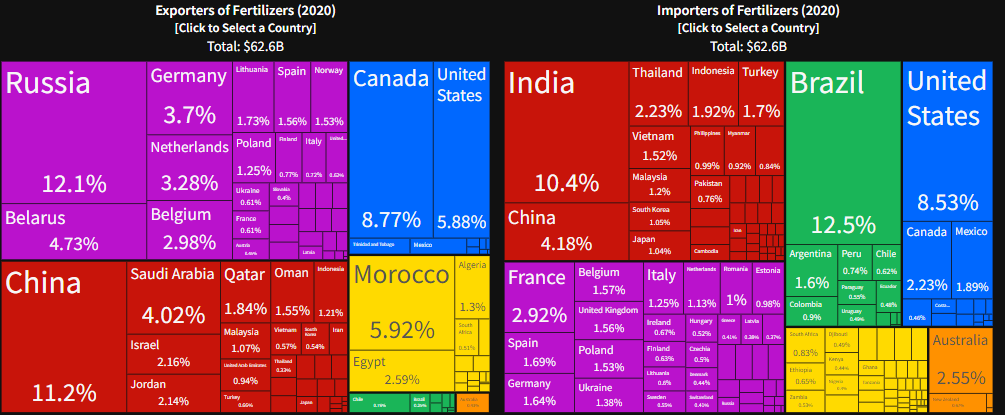

Figure 1: Exporters vs Importers of Fertilizers, in 2020. Source: OEC.World.

According to financial research firm CFRA, more than 1/3 of the world’s potash production, a key ingredient in fertilizer, is controlled by Russia and its ally Belarus, while the former alone controls 14% of nitrogen-based plant food production. Although the US is less dependent on Russia’s fertilizer, which accounts for only 9% of imports, as it has its own robust domestic production, prices going higher is unpreventable because price increases in the world market are likely to translate into similar price increases in the US market.

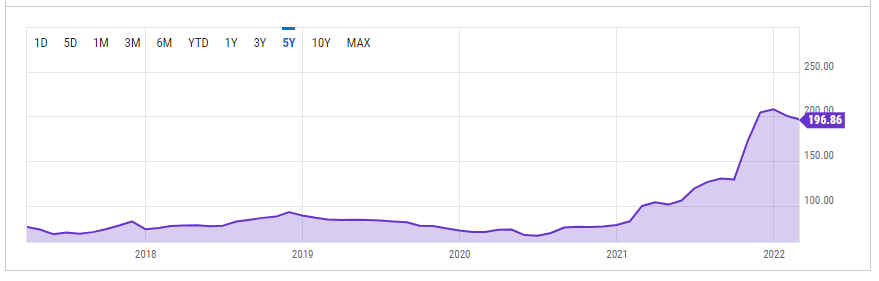

Fig.2: Fertilizers Price Index. Source: YCharts.

Based on the latest reported data, the fertilizers price index, which takes into account the weighted average of natural phosphate rock, phosphate, potassium and nitrogenous prices, stands at 196.86, up more than 96% from a year ago. It has even exceeded prices seen during the food and energy crisis in 2008.

A robust global demand and skyrocketing prices of crop nutrients may continue to benefit manufacturers and distributors of agricultural fertilizers such as CF Industries. The company mainly makes nitrogen, which has the biggest volume and nutrient volume out of the NPK (nitrogen, phosphorous, potassium). Recent news shows that CF Industries is currently increasing fertilizer shipments amid prolonged supply disruptions. Plant maintenance work of the company has had to be postponed until the second half of the year to meet growing demand. As the production rate may be less effective then, it will take some time to alleviate the supply shortages; consequently input prices remain at high levels, as do the company’s share values.

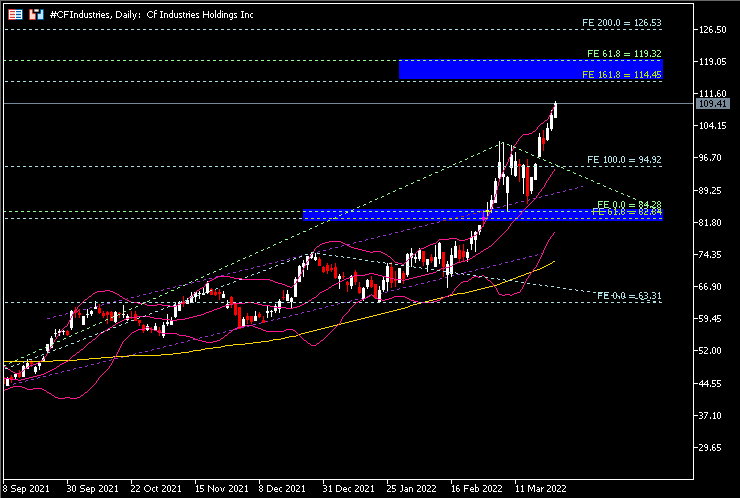

Technical analysis

Technically, #CFIndustries remains traded on a strong bullish trend since its rebound from the lows at $19.68 seen on 15th March 2020. After two years, as of its close on last Friday, total accumulated gains have exceeded 450%. Candlestick remains attached to the upper line of Bollinger band, indicating trend continuation. In the near term, resistance to watch lies in the $114.45-$119.30 range, followed by $126.50. On the contrary, the middle line of Bollinger band at $94.90 serves as the nearest support. Breaking below the support may extend the bearish momentum towards the upper line of ascending channel, and confluence zone $82.60-$84.30.

Recommended content

Editors’ Picks

Gold holds the record run to near $3,500

Gold price retreats slightly from near $3,500, or a fresh all-time highs in the early European session on Tuesday as bulls pause for a breather amid overbought conditions on short-term charts. Any meaningful corrective downfall, however, still seems elusive on sustained US Dollar weakness.

EUR/USD stays firm near 1.1550 as US Dollar wilts again

EUR/USD extends its gains for the third successive session, holding higher ground near 1.1550 in ealy Europe on Tuesday. The pair catches a fresh bid as the US Dollar comes under fresh selling pressure as investors remain wary of the US financial stability amid Trump's attacks on Fed Chair Powell.

GBP/USD recaptures 1.3400 on renewed US Dollar weakness

GBP/USD is back above the 1.3400 mark in the European trading hours on Tuesday, drawing support from a renewed bout of US Dollar selling across the board. Fears of a US economic slowdown and concerns about the Fed's independence remain a weight on the US Dollar, serving as a tailwind for the major.

3% of Bitcoin supply in control of firms with BTC on balance sheets: The good, bad and ugly

Bitcoin disappointed traders with lackluster performance in 2025, hitting the $100,000 milestone and consolidating under the milestone thereafter. Bitcoin rallied past $88,000 early on Monday, the dominant token eyes the $90,000 level.

Five fundamentals for the week: Traders confront the trade war, important surveys, key Fed speech Premium

Will the US strike a trade deal with Japan? That would be positive progress. However, recent developments are not that positive, and there's only one certainty: headlines will dominate markets. Fresh US economic data is also of interest.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.