- Carnival Corp is set to extend its gains on Tuesday as it ramps up preparations.

- Investors are shrugging off a lawsuit related to a coronavirus death on the Grand Princess.

- Closing above $17.24 is critical to moving even higher for CCL.

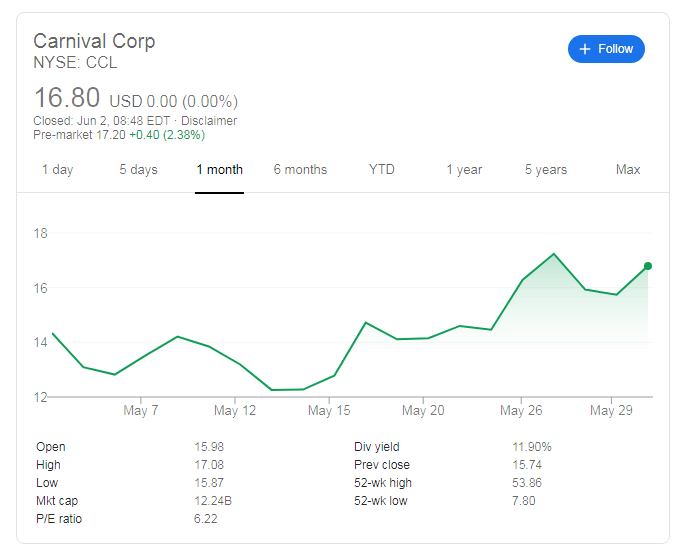

Carnival Corp's shares closed at $16.80 on Monday – only marginally higher – yet this trend is set to extend. Pre-market indicators are showing a rise of over 2%. Investors are cheering the cruise company's preparations to welcome holidaymakers in the summer.

The firm is the cleaning and disinfecting its large ships to protect its clientele, which tends to be elderly and vulnerable to the disease. Another measure that the company is set to deploy is thermal scanners. CCL is working with Infrared Cameras Inc to add such systems that measure temperature. The idea is to quickly isolate crew members and guests for fever, one of the symptoms of COVID-19.

Coronavirus cases and deaths continue falling in Asia, Europe, and also North America, to a lesser extent. Investors seem to shrug off previous concerns of cruisers turning into "floating Petri dishes." However, Carnival still has to encounter a lawsuit by a family member of a person that died from the disease on the Grand Princess. The person died at a California hospital and was 64 years old.

Legal action may result in high compensation, but perhaps investors see it as the cost of doing business. It is essential to note that Carnival raised a substantial amount of cash, and may weather a protracted battle in and outside courts.

CCL Stock Dividend

At the time of writing, NYSE: CCL is changing hands at around the previous peak of $1.7.24 recorded late last week. That level is critical to unleashing further gains for the stock. The 52-week high is $53.86 and at current levels, Carnival is already more than 100% off the 52-week trough of $7.80.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD loses the grip and challenges 1.0400

A robust, tariff-driven upswing in the US Dollar is now driving EUR/USD to deepen its daily losses, closing in on the key support at 1.0400 the figure ahead of scheduled speeches from Federal Reserve officials and President Trump.

GBP/USD keeps its offered bias around 1.2630 on USD buying

Following the lead of other risk-sensitive currencies, GBP/USD is giving way to renewed buying pressure on the Greenback, keeping the trade around 1.2630 ahead of remarks from Fed policymakers and President Trump.

Gold flirts with two-week lows around $2,880

Gold prices resume their downtrend and revisit two-week lows in the sub-$2,880 zone per ounce troy following the improved tone in the US Dollar, higher yields and further tariff narrative.

Bitcoin recovers above $85,000 while institutional investors offload their holdings

Bitcoin (BTC) recovers slightly and trades around $86,000 at the time of writing on Thursday after falling nearly 15% at one point this week. US President Donald Trump’s ongoing tariff news and falling institutional demand fueled the BTC’s correction.

February inflation: Sharp drop expected in France, stability in the rest of the Eurozone

Inflation has probably eased in February, particularly in France due to the marked cut in the regulated electricity price. However, this overall movement masks divergent trends. Although disinflation is becoming more widespread, prices continue to rise rapidly in services, in France as well as elsewhere in the Eurozone.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.