- Coronavirus cases are rising in Europe and the US.

- A probable Biden victory is unlikely to prioritize the cruise industry.

- The "herd immunity" theory has been shattered by a new study.

Cruising to nowhere – that seems to be the grim reality for Carnival Corp and also its peers. While the Miami-based firm may have an advantage over its peers, the whole sector is suffering from three adverse development that may cause NYSE: CCL to sink.

1) Covid concerns: Recent statistics from Europe and the US paint a grim picture. The seven-day rolling average of American infections has hit a new record near 70,000. Hospitalizations, cases, and also mortalities are on the rise in the old continent, with governments imposing new restrictions. While no authority has slapped a full lockdown, long nighttime curfews will probably are already in place in France. At the time of writing, the disease and restrictions are both trending higher.

2) No herd immunity: A new study by Imperial College London screened 365,000 people over three rounds of testing between June and September and it has shown that the level of antibodies in recovered COVID-19 patients fades within months. Supporters of allowing the disease to spread – many of them in US – may be disappointed.

For Carnival's audience, made mostly of elderly and more vulnerable clients, that is worrying. Many would-be customers would likely shy away from booking a cruise – even if a vaccination comes out.

3) Unfavorable elections: Congress is now adjourned until after the elections and has failed to pass a stimulus bill. President Donald Trump mentioned the cruise industry as a potential recipient of federal funds – but he may be on his way out. Opinion polls show a steady lead for former Vice-President Joe Biden.

The presidential debates have not moved the needle, and in the meantime, around 64 million Americans have already cast their ballots, narrowing the chances for the incumbent. The challenger is likely to pass a multi-trillion deal but may prioritize green causes over cruises.

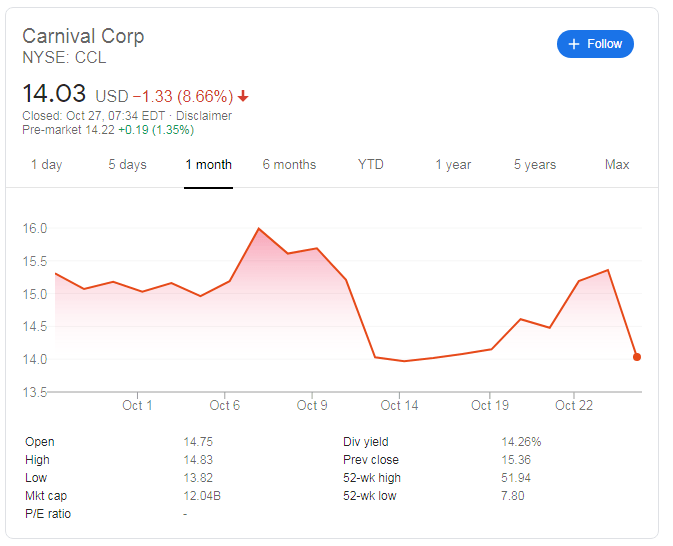

NYSE: CCL

Carnival Corp (NYSE: CCL) fell by 8.66% on Monday, more than the broader stock market. It is now near the October lows. Further down, the round $10 level is eyed. Resistance is at $15.25, a recent high, followed by $16.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD loses the grip and challenges 1.0400

A robust, tariff-driven upswing in the US Dollar is now driving EUR/USD to deepen its daily losses, closing in on the key support at 1.0400 the figure ahead of scheduled speeches from Federal Reserve officials and President Trump.

GBP/USD keeps its offered bias around 1.2630 on USD buying

Following the lead of other risk-sensitive currencies, GBP/USD is giving way to renewed buying pressure on the Greenback, keeping the trade around 1.2630 ahead of remarks from Fed policymakers and President Trump.

Gold flirts with two-week lows around $2,880

Gold prices resume their downtrend and revisit two-week lows in the sub-$2,880 zone per ounce troy following the improved tone in the US Dollar, higher yields and further tariff narrative.

Bitcoin recovers above $85,000 while institutional investors offload their holdings

Bitcoin (BTC) recovers slightly and trades around $86,000 at the time of writing on Thursday after falling nearly 15% at one point this week. US President Donald Trump’s ongoing tariff news and falling institutional demand fueled the BTC’s correction.

February inflation: Sharp drop expected in France, stability in the rest of the Eurozone

Inflation has probably eased in February, particularly in France due to the marked cut in the regulated electricity price. However, this overall movement masks divergent trends. Although disinflation is becoming more widespread, prices continue to rise rapidly in services, in France as well as elsewhere in the Eurozone.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.