- NYSE:CCIV dropped by 0.2% on Tuesday amidst another mixed day for the broader markets.

- CCIV CEO remains noncommittal on vehicle delivery estimates for 2022.

- American automakers fall after Tesla’s mediocre China delivery report.

Update May 13: CCIV shares resumed the downtrend and fell 4.5% on Wednesday, having witnessed a dead cat bounce a day before. The renewed downside momentum drove the stock closer towards the four-month troughs of $17.42. CCIV shared settled Wednesday near the lows of the day around $17.80. The stock tumbled after the Thornton Law Firm alerted investors that a class action lawsuit has been filed on behalf of investors of the company. Additionally, the broader market sell-off on concerns over rising inflation also exacerbated the pain for the CCIV investors. A retest of the multi-month lows remains on the cards.

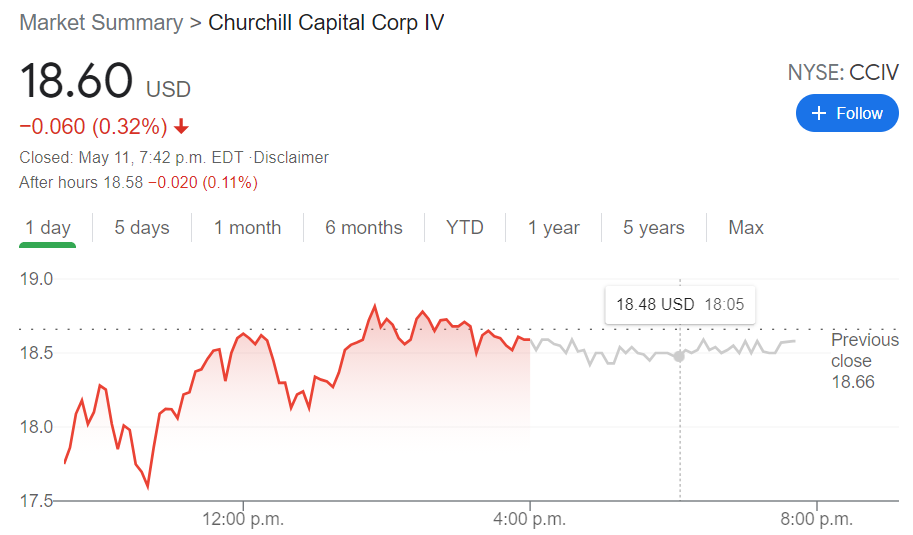

NYSE:CCIV has been a hot topic among SPAC investors, even as the SEC seeks to institute more regulations around the popular merger vehicle. On Tuesday, CCIV continued its downward descent as the stock fell 0.2% to close the trading day at $18.60. CCIV’s march back to its $10 NAV price has been steady since the stock skyrocketed on the news of its merger with Lucid Motors back in February. Along with other SPAC stocks, CCIV has fallen out of favor with investors as several prominent companies that came public via the SPAC merger have since fallen well below the $10 share price.

Stay up to speed with hot stocks' news!

Lucid Motors CEO Peter Rawlinson remained noncommittal about the amount of vehicles the company is aiming to deliver in 2022. After revealing that Lucid is targeting the delivery of more than 577 vehicles for 2021, Rawlinson only vaguely submitted that 2022 would see ‘significant growth’ but failed to provide an estimate when further pressed. A number of vehicles delivered would be able to provide analysts with forward looking sales and revenue estimates, which helps to provide a proper valuation for the share price once the merger is completed.

CCIV stock news

Industry leader Tesla (NASDAQ:TSLA) reported its delivery numbers for the China market on Tuesday, and while many outlets are reporting a drop in sales, the true number remains to be seen. The figure reported was 25,845 vehicles delivered in China in April compared to 35,478 delivered in March, good for a 27% decline. It should be noted that Tesla has said that it focussed on exporting more vehicles that were built at its Shanghai Gigafactory in April than in previous months, so the actual vehicle delivery figures may be skewed.

Previous updates

Update May 12: Churchill Capital Corp IV (NYSE: CCIV) is set to extend its decline, falling below the all-important $18.45 trough recorded on April 20 and tumble close to $18. That would put shares of the SPAC merging with Lucid Motors at levels recorded before the move was announced. Will bargain-seekers jump in? Investors remain concerned about inflation and the potential for rate hikes.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD faces potential extra gains near term

AUD/USD faced renewed upward pressure following the US Dollar’s sell-off, successfully reclaiming the key 0.6300 mark and beyond, supported by persistent optimism in the risk complex.

EUR/USD now looks to challenge 1.0500

EUR/USD gained ground for the third consecutive day on Thursday, trading within close reach of the 1.0450 level, or three-week highs, driven by a strong selling bias in the Greenback.

Gold comfortable around $2,910

Gold prices now extend the recent breakout of the key $2,900 mark per ounce troy on the back of persistent weakness in the US Dollar and diminishing US yields across the curve.

Three reasons why PancakeSwap CAKE is rallying 96% in seven days

PancakeSwap’s native token CAKE extended gains by 8% on Thursday, inching closer to the $3 level. The DEX token hit several key milestones in the last 30 days, according to an official update shared on X.

Tariffs likely to impart a modest stagflationary hit to the economy this year

The economic policies of the Trump administration are starting to take shape. President Trump has already announced the imposition of tariffs on some of America's trading partners, and we assume there will be more levies, which will be matched by foreign retaliation, in the coming quarters.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.