- NYSE:CCIV bounces from support as crypto weakness ongoing.

- Lucid Motors CCIV merger deal is not good news, but retail flow should help.

- Electric vehicle companies get hammered after Elon Musk’s latest Twitter outburst.

Update: CCIV shares recovered some ground on Friday as the stock failed to break key support at $17.62. Holding the line here may provide some succour for CCIV bulls. A delay in the merger date is not exactly good news for investors and neither is the continued wait for the first production vehicle.

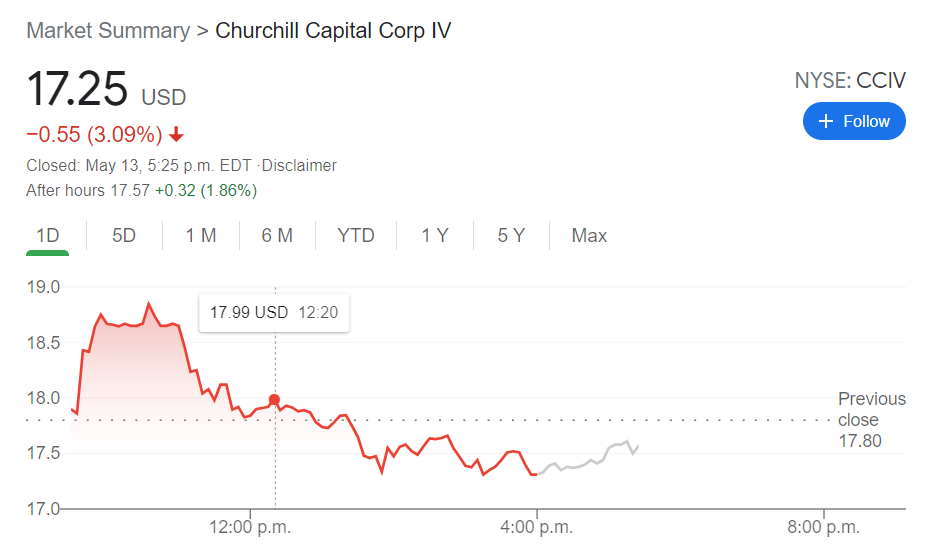

NYSE:CCIV is on a one-way road back down to its SPAC NAV price as investors are getting impatient with the once promising electric vehicle merger. That is not to say that Lucid Motors will not one day be a fine investment, but concerns over pre-merger valuations and management being noncommittal about future vehicle deliveries has taken most of the wind out of CCIV’s sails. On Thursday, CCIV fell a further 3.1% and broke a key support level that could see the stock plummet back to its $15 PIPE price. There seems to be some support in after hours trading though as the stock is back up 2% at the time of this writing.

Stay up to speed with hot stocks' news!

CCIV and Lucid made some announcements on Thursday that have given investors some clarity over the ambiguous merger. First, the merger date for the SPAC has been moved to the third quarter of 2021 to align with the launch of its Lucid Air sedan. The company has reported over 9,000 reservations and anticipates over $800 million in sales this year. Lucid will also be providing a digital user experience update on May 26th, which should provide further clarity over the state of the company.

CCIV stock news

Lucid rival Tesla (NASDAQ:TSLA) is back in the headlines as Elon Musk managed to tank the major cryptocurrency indices overnight with one tweet. Musk reiterated on Thursday that he is very much in favor of Bitcoin, but cannot support the current methods of Bitcoin mining which he deems are harmful to the environment. The entire EV sector sold off on Thursday, led by Tesla which fell 3.09%.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD: Next on the upside comes the 2025 peak

AUD/USD maintained its constructive outlook well and sound, advancing for the fourth day in a row and surpassing the key barrier at 0.6300 the figure with certain conviction.

EUR/USD: Further gains retarget 1.1470

EUR/USD alternated gains with losses around the 1.1350-1.1360 band in a context of further weakness in the US Dollar and a generalised improved mood in the risk-associated assets.

Gold trades with marked losses near $3,200

Gold seems to have met some daily contention around the $3,200 zone on Monday, coming under renewed downside pressure after hitting record highs near $3,250 earlier in the day, always amid alleviated trade concerns. Declining US yields, in the meantime, should keep the downside contained somehow.

Solana ETF to debut in Canada after approval from regulators

Solana ETF will go live in Canada this week after the Ontario Securities Commission greenlighted applications from Purpose, Evolve, CI and 3iQ. The products will allow staking, enabling investors to earn yield on their holdings.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.