CCIV Stock Forecast: Churchill Capital Corp IV: Jim Cramer boosts shares with Lucid Motors interview

- NYSE: CCIV has closed Tuesday's session with a leap of over 8%.

- CNBC's Jim Cramer endorsed Lucid Motors in an interview with its CEO.

- Competition with Tesla and a rumored Apple car are in focus.

"I welcome the competition" – the headline from the interview that Lucid Motors CEO Peter Rawlinson gave to CNBC's Jim Cramer has been rattling investors. The colorful TV host has endorsed the upstart electric vehicle company that recently announced its SPAC merger with Churchill Capital Corp IV (NYSE: CCIV) and that has certainly helped shares. Cramer also called it "the next Tesla."

Lucid's luxury cars have been critically acclaimed by automotive experts, which compare it favorably to Elon Musk's firm, the industry leader. Rawlinson held a senior position at Tesla before starting his own firm.

On the other hand, some doubt that the small company from Arizona can compete with Musk's celebrity status and with Tesla's now stable production and improving prospects.

Even if Lucid Motors (under the CCIV ticker) has a chance against highly valued TSLA, can both put up a fight against Apple? The maker of iPhones and Mac computers is reportedly venturing into cars, with a valuation of over $2.1 trillion. Speculation suggests that Tim Cook's Apple is working with Korean carmakers such as Hyundai and Kia to roll out an Apple Car on the road.

CCIV Price Prediction

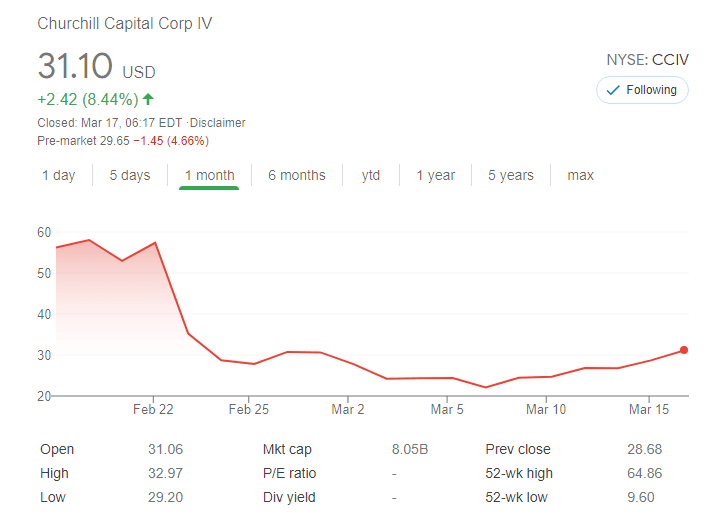

NYSE: CCIV has closed Tuesday's session at $31.10, an increase of 8.44% – the highest closing level since February 23. Can it continue higher from this three-week peak? It is essential to remember that Churchill's stock suffered a "buy the rumor, sell the fact" response after the SPAC move. with the peak level of $64.86 looking elusive.

The $30 level provides psychological support, with further cushions awaiting $26.84 and $24.46. Looking up, $34.85, a high point from before the soar and collapse is a critical level to watch.

Every effort has been made to accurately report the appropriate dollar currency US$ or CAD$. But readers must exercise caution as Sundial is a Canadian company reporting in CAD, listed in the US Nasdaq exchange, but news providers typically convert into $US for earnings comparisons. In some cases, it is not clear in reports from news providers and Sundial which dollar CAD or US is being reported as just the $ symbol is used. For the most part, Sundial does specify CAD$ in press releases unless otherwise stated and this assumption is used in statements above re cash reserves.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.