CBA Elliott Wave technical forecast [Video]

![CBA Elliott Wave technical forecast [Video]](https://editorial.fxstreet.com/images/TechnicalAnalysis/ChartPatterns/Candlesticks/digital-tablet-with-stock-charts-30304744_XtraLarge.jpg)

Greetings, Our Elliott Wave analysis today updates the Australian Stock Exchange (ASX) with COMMONWEALTH BANK OF AUSTRALIA. - CBA. In our Top 50 ASX Stocks service, we accurately forecasted the ongoing 2-red wave, pushing lower, This helps investors avoid risks when holding long positions in trading/investment. Currently, our forecast suggests that the 2-red wave will continue for some time, followed by the 3-red wave returning to push much higher.

ASX: Commonwealth Bank of Australia – CBA Elliott Wave technical analysis

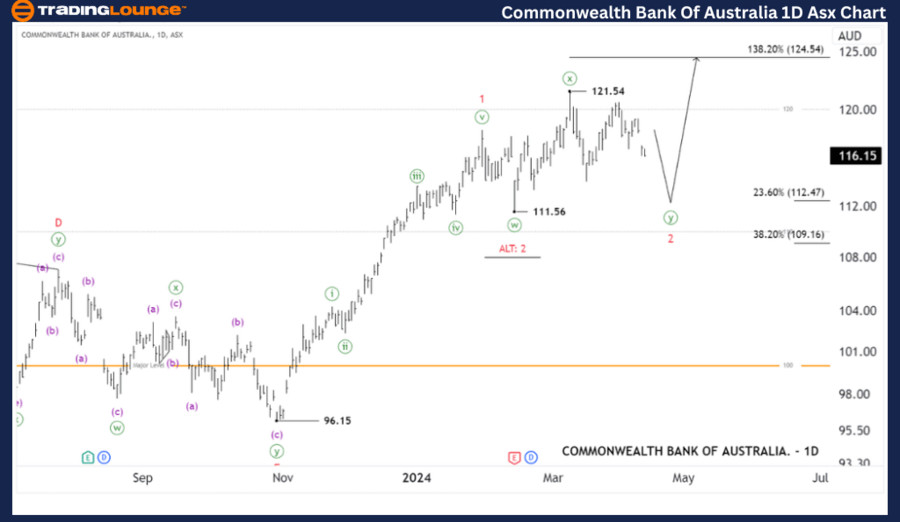

ASX: COMMONWEALTH BANK OF AUSTRALIA. - CBA 1D Chart (Semilog Scale) Analysis.

Function: Major trend (Minor degree, red).

Mode: Motive.

Structure: Impulse.

Position: Wave ((y))-green of Wave 2-red.

Latest forecast: Accurate forecast.

Details: The short-term outlook describes that the 1-red wave has peaked, and the following 2-red wave is likely to unfold as a Combination pattern to continue pushing lower. A rise above 124.54 would indicate that the 2-red wave has ended earlier than expected, and the 3-red wave is returning to push higher.

This wave count is conducted because the price action from the low of 111.56 rising to the high of 121.54 occurred in Three-waves, suggesting to me that the 2-red wave still appears to be developing into a more complex pattern with a WXY or ABC structure with (3-3-3).

Invalidation point: 96.15

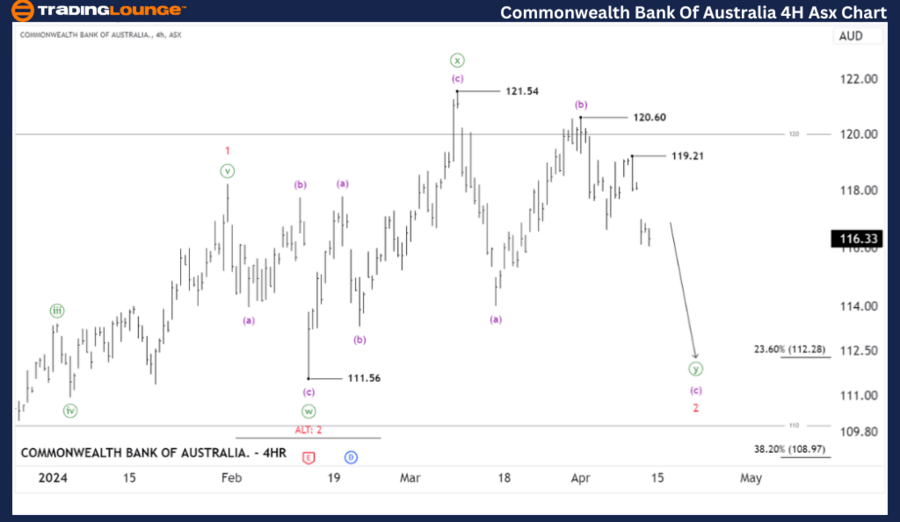

ASX: COMMONWEALTH BANK OF AUSTRALIA. – CBA Elliott Wave Technical Analysis TradingLounge (4-Hour Chart)

ASX: COMMONWEALTH BANK OF AUSTRALIA. – CBA Elliott Wave Technical Analysis

ASX: Commonwealth Bank of Australia – CBA Elliott Wave technical analysis

Function: Counter trend (Minute degree, green).

Mode: Corrective.

Structure: Combination, Double Three.

Position: Wave (c)-purple of Wave ((y))-green.

Details: The shorter-term outlook indicates that the 2-red wave is unfolding as a Combination pattern, with ((w))-green being a zigzag and ((y))-green appearing to be a Flat Correction. It will continue to push slightly lower before completing the entire 2-red wave, with its target aiming around ~112.28 - 110.00. Maintaining a price below 119.21 will be advantageous and serve as strong resistance for this bearish view. After the completion of wave 2-red, we will have a long-term trading opportunity with wave 3-red.

Invalidation point: 120.60.

Conclusion

Our analysis, forecast of contextual trends, and short-term outlook for ASX: COMMONWEALTH BANK OF AUSTRALIA. - CBA aim to provide readers with insights into the current market trends and how to capitalize on them effectively. We offer specific price points that act as validation or invalidation signals for our wave count, enhancing the confidence in our perspective. By combining these factors, we strive to offer readers the most objective and professional perspective on market trends.

CBA Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.