Caution ahead

S&P 500 premarket spike had been sold into, and prices were taken down courtesy not just of NVDA. Rotations saved the 500-strong index, but another day (that seems to be followed by yet one more just ahead if you plot the QQQ:SPY ratio) more tech underperformance, is not what the bulls want to see.

The shape of the correction is being decided, and S&P 500 is less vulnerable to downside move than Nasdaq. MU earnings Wednesday after the close are keenly awaited, but the failure of NVDA to bounce yesterday and latest trends in AVGO, AMAT, KLAC and CLOU fail to inspire much enthusiams to step in on the bullish side in Nasdaq. The trappy session yesterday had a distinct bearish bias, and in my opinion is far from over – and the dubious XLF leader in S&P 500 is barely holding up there at the moment.

Plenty of question marks, negatively tinted upcoming data, and decreased corporate buybacks provide for less support to turn stocks around – the only question remains how shallow a correction would we get, and whether that plays out in time rather than in price. I favor one more Nasdaq led dip lower – and that‘s regardless of rate cut odds not taking a hit, and short end of the curve behaving well.

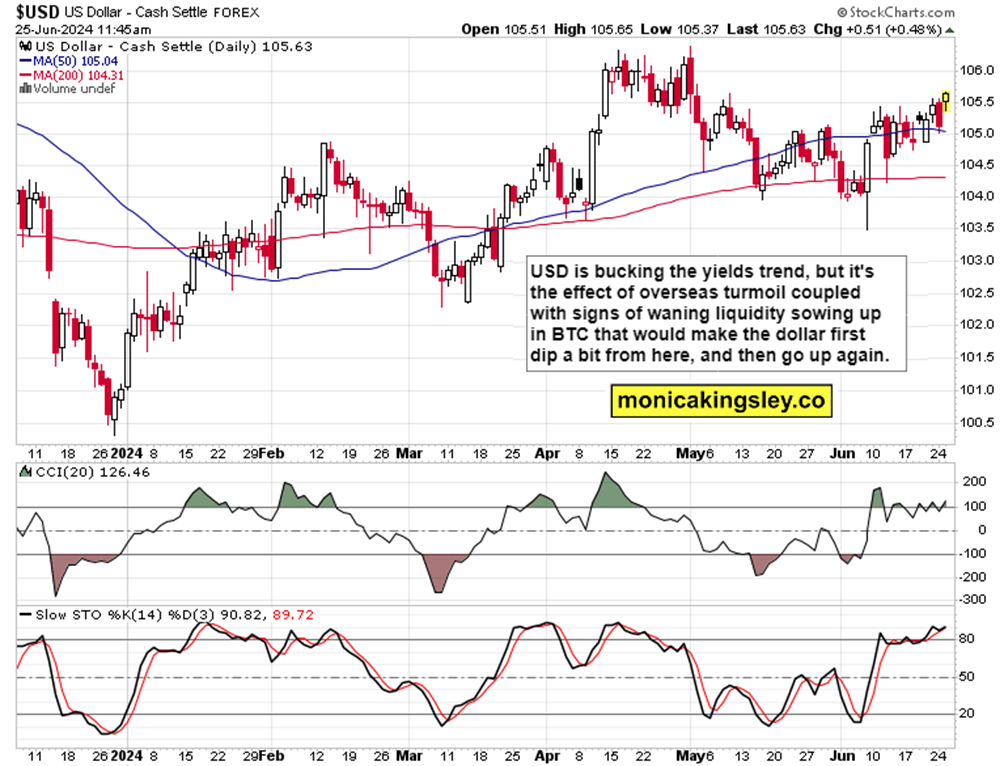

Way more detailed analysis as regards the stock market sectors, precious metals and oil, follow in the premium section together with most promising swing trades – for now, note how the USD move is failing to lift up certain asset classes.

Let‘s mve right into the charts – today‘s full scale article contains 3 more of them, with commentaries.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.