Caterpillar Inc. Elliott Wave technical analysis [Video]

![Caterpillar Inc. Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Equities/Industries/Media/AMC/AMC_stock_teather_people_XtraLarge.jpg)

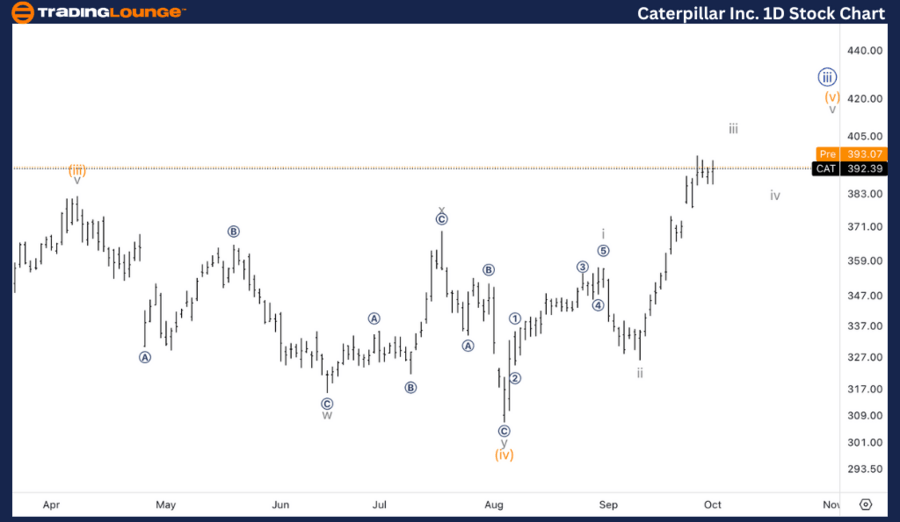

CAT Elliott Wave Analysis Trading Lounge Daily Chart,

Caterpillar Inc., (CAT) Daily Chart.

CAT Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Minute {iii}.

Direction: Upside into wave (v) of {iii}.

Details: Looking for continuation higher within wave {iii}, which could eventually reach 500$.

CAT Elliott Wave Analysis Trading Lounge 1H Chart,

Caterpillar Inc., (CAT) 1H Chart.

CAT Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave iii.

Direction: Micro wave 5 of iii.

Details: Looking for at least one more leg higher within wave iii as we seem to have been correcting in micro wave 4 and are now resume higher towards 400$.

This analysis focuses on the current trend structure of Caterpillar Inc. (CAT), utilizing the Elliott Wave Theory on both the daily and 1-hour charts. Below is a breakdown of the stock's position and potential future movements.

CAT Elliott Wave technical analysis – Daily chart

On the daily chart, Caterpillar Inc. is advancing in an impulsive motive structure within Minute Wave {iii}. The stock is progressing higher and currently in Wave (v) of {iii}. This suggests that there is further upside potential, with $500being the projected target for the completion of Wave {iii}.

The stock continues to exhibit strong bullish momentum, and traders should look for continuation higher, particularly as the move approaches critical resistance levels.

CAT Elliott Wave technical analysis – One-hour chart

On the 1-hour chart, Caterpillar appears to be progressing within Wave iii, and specifically within Micro Wave 5 of iii. After completing a corrective phase in Micro Wave 4, the stock is now resuming its upward movement, with the next upside target likely around $400.

This final leg within Wave iii suggests at least one more push higher before a potential corrective phase begins. Traders should watch for any resistance near $400, which could trigger some short-term consolidation before further upside.

Technical analyst: Alessio Barretta.

CAT Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.