Canadian Dollar struggles to find footing at multi-year lows

- The Canadian Dollar took another hit on Tuesday, testing the 1.4200 handle.

- The Bank of Canada is poised to accelerate its pace of rate cuts.

- A widening differential and soggy data outlook keeps the Loonie pinned on the low end.

The Canadian Dollar (CAD) swooned on Tuesday, dipping closer toward the 1.4200 handle against the Greenback before meagerly recovering its stance on the day. Investors are broadly cashing out of the Loonie as the Bank of Canada (BoC) is poised to widen the CAD’s interest rate differential against the US Dollar even further.

The Canadian economy is in a sore spot right now, and the BoC is set to tip back into the pool and find another 50 bps rate cut this week. The Canadian Unemployment Rate hit multi-year highs recently, giving the Canadian central bank and BoC Governor Tiff Macklem all of the ammunition they need to case further rate cuts in order to bolster the Canadian housing market. As Canada’s largest industry, the selling and buying of residential property holds a death grip on Canadian policymaking as an outsized contributor to national growth figures.

Daily digest market movers: CAD suffers at the hands of widening rate differentials

- Canadian Dollar inches toward a tenth of a percent gain against the Greenback on Tuesday as Loonie flows battle back from a midday low near the 1.4200 handle.

- The Bank of Canada is broadly set to trim interest rates by another 50 bps on Wednesday.

- BoC main reference rate expected to decline to 3.25% from 3.75%.

- US Consumer Price Index (CPI) inflation also set to release on Wednesday, markets are hoping that inflation pressure continue to ease enough to keep the Federal Reserve (Fed) on-balance for a third straight rate cut on December 18.

- US headline CPI inflation set to tick upwards to 2.7% from 2.6% YoY.

Canadian Dollar price forecast

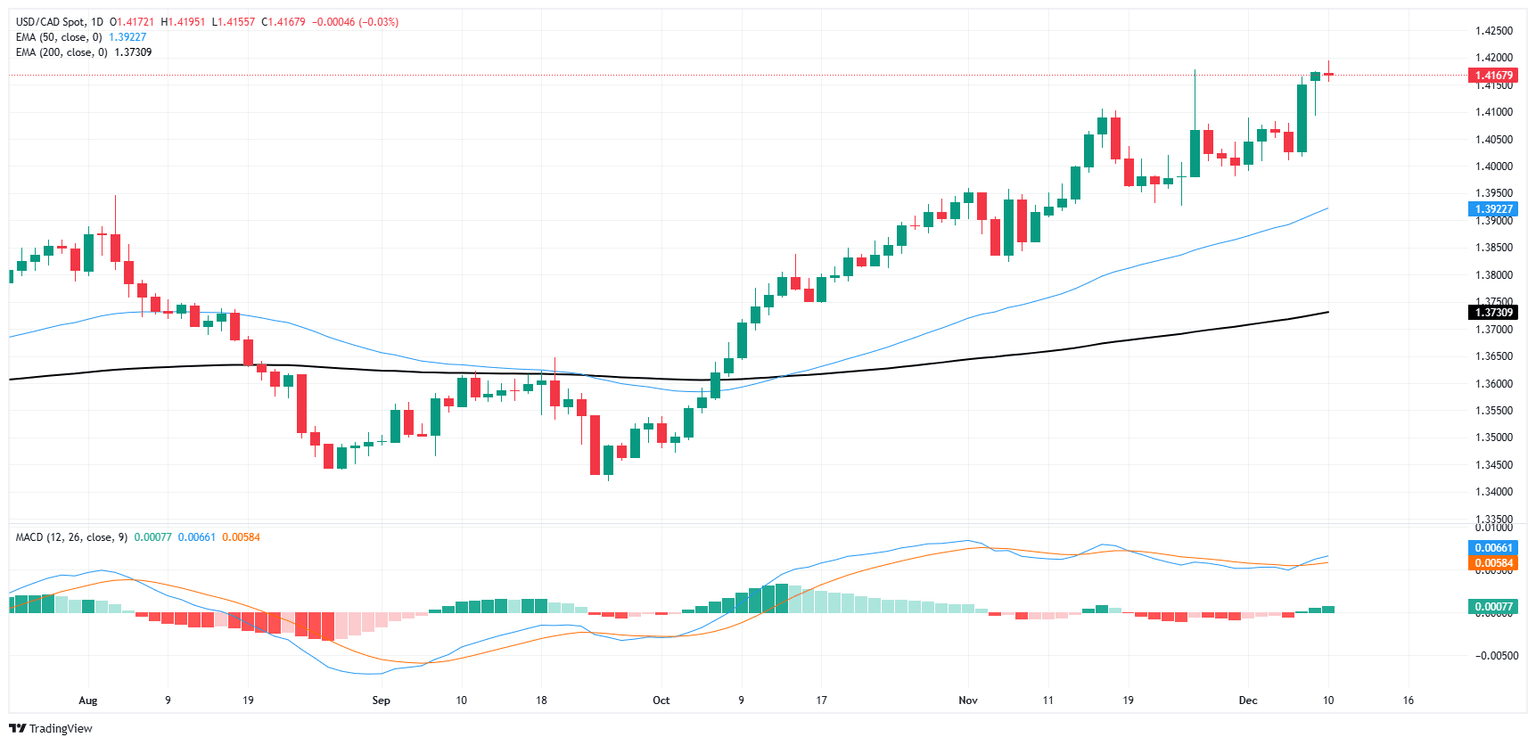

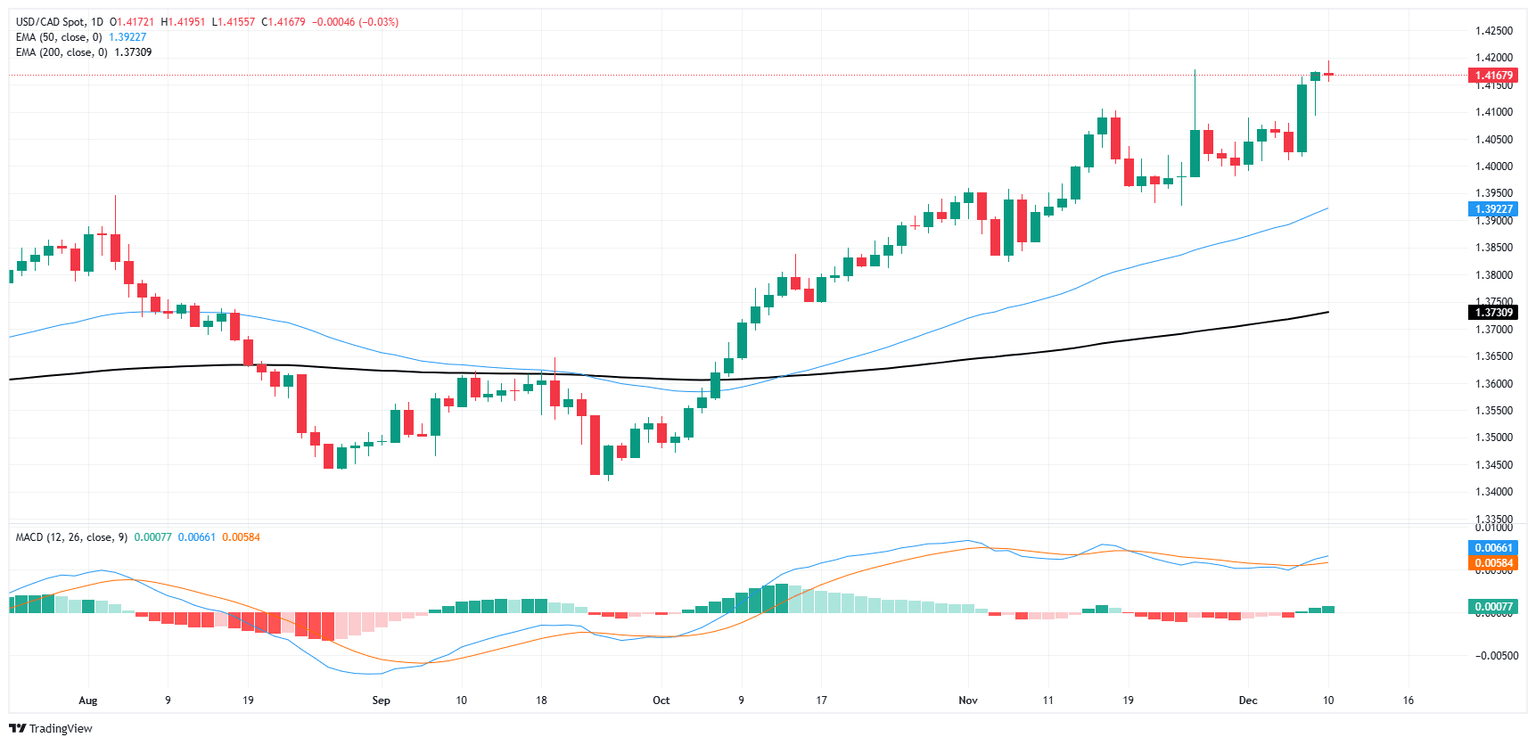

The Canadian Dollar (CAD) came within touch range of 1.4200 against the US Dollar, slumping to a 56-month low and bolstering the USD/CAD chart to its highest bids in nearly five years. Structural CAD weakness has pushed USD/CAD into the top end of a long-term sideways grind that has trapped the pair for nearly a decade. The pair is on pace to close in the green for a fourth consecutive month.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.