- The Canadian Dollar backslid on Friday as CAD traders retreat for the weekend.

- Canada revealed another sharp contraction in new building permits.

- US PPI wholesale inflation accelerated, but markets are trying to shrug it off.

The Canadian Dollar (CAD) shed weight on Friday, falling to the bottom as one of the poorest-performing major currencies for the last session of the trading week. Broader markets are shaking off an unexpected acceleration of US Producer Price Index (PPI) wholesale inflation, instead focusing on cooling Consumer Price Index (CPI) inflation from earlier in the week.

Canada posted 2024’s second-steepest contraction in Building Permits in May, hobbling the CAD further and setting the Canadian Dollar up to churn on the low side as traders await next Tuesday’s Canadian CPI inflation print.

Daily digest market movers: Canadian Dollar stumbles on bad housing data

- Canadian Building Permits contracted 12.2% in May, the second-steepest decline in 2024.

- US core PPI wholesale inflation accelerated notably in June, rising to 3.0% YoY compared to the expected 2.5%.

- The previous period’s print was also revised higher to 2.6% from the initial 2.3%.

- MoM core US PPI rose 0.4% MoM, double the forecast 0.2% while the previous month’s print was likewise revised upwards to 0.3% from the initial 0.0%.

- The University of Michigan Consumer Sentiment Index for July declined to a seven-month low of 66.0 from the previous 68.2, reversing the forecast uptick to 68.5.

- Despite the upswing in producer-level inflation, markets are broadly leaning into the bullish side, focusing on Thursday’s cooler-than-expected CPI inflation print.

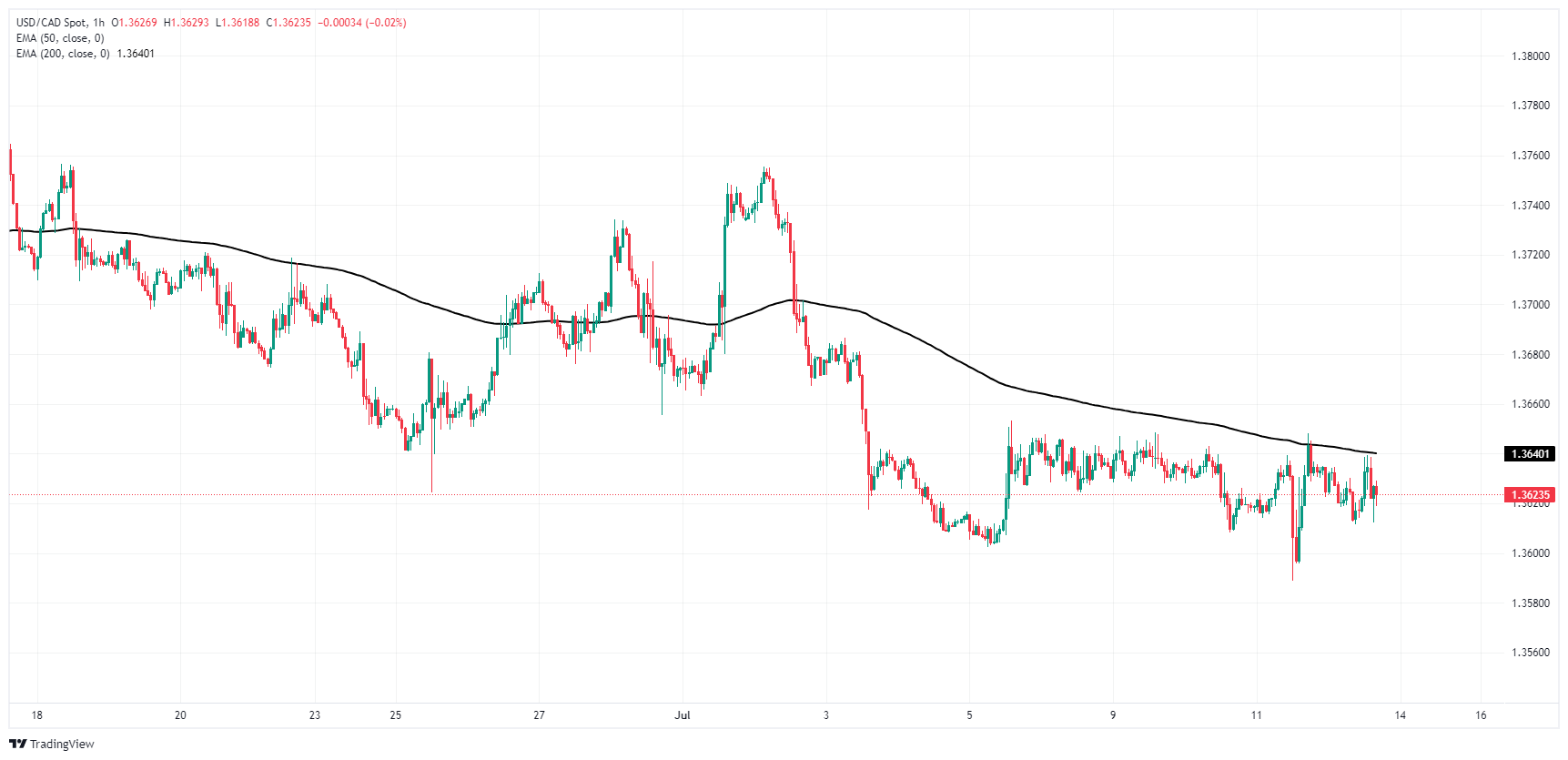

Technical analysis: USD/CAD swamped out in near-term midrange

The Canadian Dollar (CAD) is one of the poorest-performing currencies on Friday, shedding weight across the board and struggling to develop any meaningful momentum against the US Dollar. USD/CAD is stuck in a lurch just above the 1.3600 handle, and threatening to spiral out into a longer-running consolidation phase as the pair finds little reason to push too far in either direction.

Intraday bidding remains capped below the 200-hour Exponential Moving Average (EMA) at 1.3640, and tests to the low side are unable to find a foothold below 1.3600. Daily candlesticks are bolstered by the 200-day EMA at 1.2594, keeping a lid on downside pressure while a supply zone priced in above 1.3750 caps off any bullish attempts.

USD/CAD hourly chart

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stays near 1.0400 in thin holiday trading

EUR/USD trades with mild losses near 1.0400 on Tuesday. The expectation that the US Federal Reserve will deliver fewer rate cuts in 2025 provides some support for the US Dollar. Trading volumes are likely to remain low heading into the Christmas break.

GBP/USD struggles to find direction, holds steady near 1.2550

GBP/USD consolidates in a range at around 1.2550 on Tuesday after closing in negative territory on Monday. The US Dollar preserves its strength and makes it difficult for the pair to gain traction as trading conditions thin out on Christmas Eve.

Gold holds above $2,600, bulls non-committed on hawkish Fed outlook

Gold trades in a narrow channel above $2,600 on Tuesday, albeit lacking strong follow-through buying. Geopolitical tensions and trade war fears lend support to the safe-haven XAU/USD, while the Fed’s hawkish shift acts as a tailwind for the USD and caps the precious metal.

IRS says crypto staking should be taxed in response to lawsuit

In a filing on Monday, the US International Revenue Service stated that the rewards gotten from staking cryptocurrencies should be taxed, responding to a lawsuit from couple Joshua and Jessica Jarrett.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.