Canadian Dollar flattens on Friday, softer overall on the week

- Canadian Dollar (USD) sees slight gains against US Dollar following US PPI miss.

- Canada economic calendar empty of meaningful data until next Tuesday’s CPI.

- Crude Oil up again on supply chain fears.

The Canadian Dollar is a mixed bag in Friday trading, seeing moderate gains against the US Dollar (USD) after a downside print in the US Producer Price Index forced the Greenback lower across the board. With a mixed performance on the day for the CAD, the Loonie is in the red against most of its major currency peers for the week, save for a slight uptick against the USD from Monday’s opening bids.

Loonie traders will have to wait until next Tuesday for the next print of Canada’s Consumer Price Index (CPI) inflation. However, Monday sees low-impact Manufacturing Sales from November as well as the Bank of Canada’s (BoC) latest Business Outlook Survey.

Crude Oil markets remain tense about Middle East conflicts potentially impacting the global barrel trade. As the ongoing spat with Houthi rebels continues, more firms continue to divert tankers and cargo ships from the Red Sea and the Suez Canal in order to take a longer trip around the continent of Africa.

Daily digest market movers: Canadian Dollar gets a slight leg up on lower than expected US PPI

- The Canadian Dollar is up a tenth of a percent against the Greenback on Friday as the US Dollar gets sold off amidst markets increasing their rate-cut bets from the Federal Reserve (Fed).

- US PPI figures missed the mark on Friday.

- December’s US PPI declined by 0.1% versus the forecasted 0.1% increase, adding to November’s print which saw a downside revision from 0.0% to -0.1% as well.

- US Core annualized PPI through December came in at 1.8%, down from the previous period’s and below the median market forecast of 1.9%.

- With inflation easing back faster than expected at the producer level, markets are once again ramping up bets of a faster, deeper pace of rate cuts from the Fed.

- Fed swaps are pricing in additional monetary easing through 2024, with short-term interest-rate futures on the rise and markets betting on 160 basis points of cuts from the Fed for the year, up from 154 bps.

- Crude Oil market tensions over Middle East turmoil are on the rise once again as US and UK naval forces launch strikes against Houthi targets, a move that is sure to draw ire from Iran, which openly backs Houthi activities in and around Yemen.

Canadian Dollar price this week

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies this week. Canadian Dollar was the strongest against the Australian Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.10% | -0.23% | 0.33% | 0.47% | 0.11% | 0.08% | 0.19% | |

| EUR | 0.10% | -0.11% | 0.44% | 0.58% | 0.22% | 0.19% | 0.28% | |

| GBP | 0.22% | 0.11% | 0.55% | 0.69% | 0.33% | 0.30% | 0.40% | |

| CAD | -0.33% | -0.43% | -0.56% | 0.14% | -0.20% | -0.25% | -0.15% | |

| AUD | -0.47% | -0.57% | -0.69% | -0.14% | -0.34% | -0.39% | -0.30% | |

| JPY | -0.15% | -0.21% | -0.36% | 0.23% | 0.36% | -0.03% | 0.06% | |

| NZD | -0.09% | -0.19% | -0.31% | 0.25% | 0.39% | 0.03% | 0.09% | |

| CHF | -0.19% | -0.28% | -0.40% | 0.16% | 0.30% | -0.06% | -0.09% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

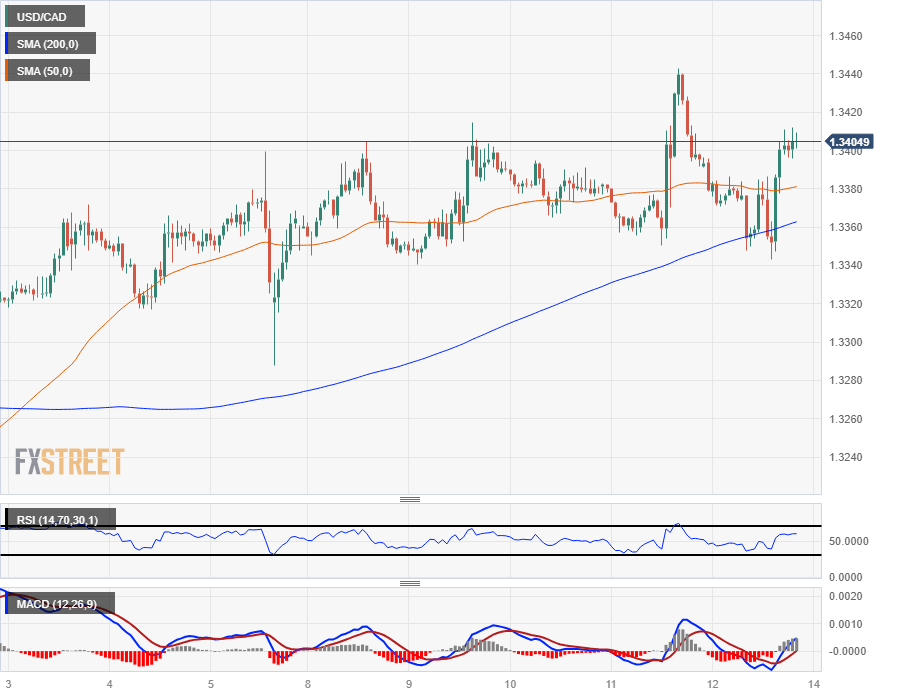

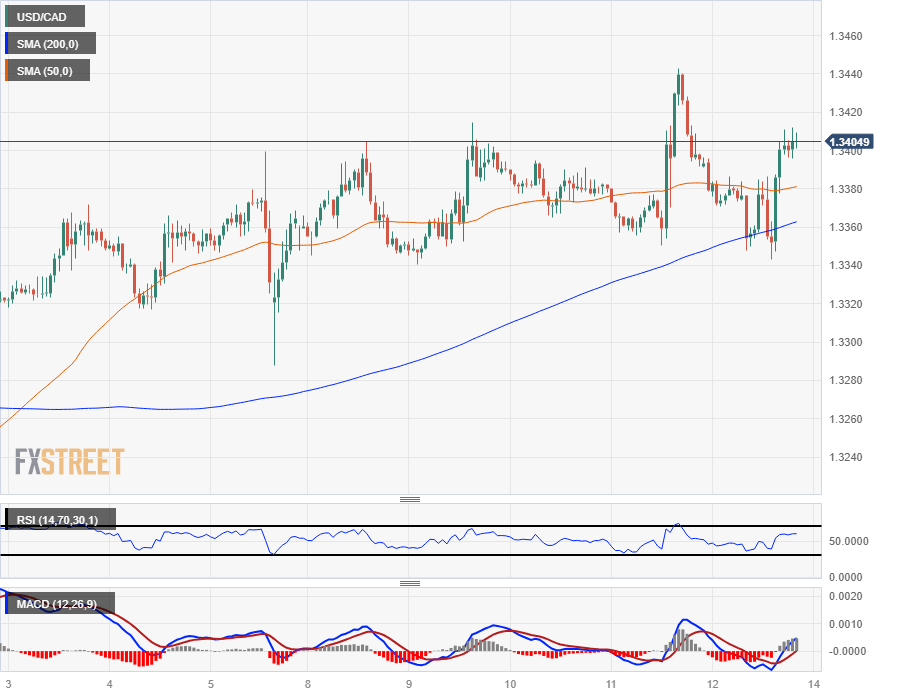

Technical Analysis: Canadian Dollar goes flat against US Dollar on Friday

The Canadian Dollar (CAD) is slightly up against the Greenback heading into the end of the trading week, pushing the USD/CAD pair down into the 1.3350 neighborhood.

The pair rose to a new 2024 high of 1.3443 on Thursday, but price action is drifting back into the midrange with intraday chart action knocking against the 200-hour Simple Moving Average (SMA) near 1.3360. A near-term pattern of higher lows is set to break down as the USD/CAD drifts sideways heading into next week.

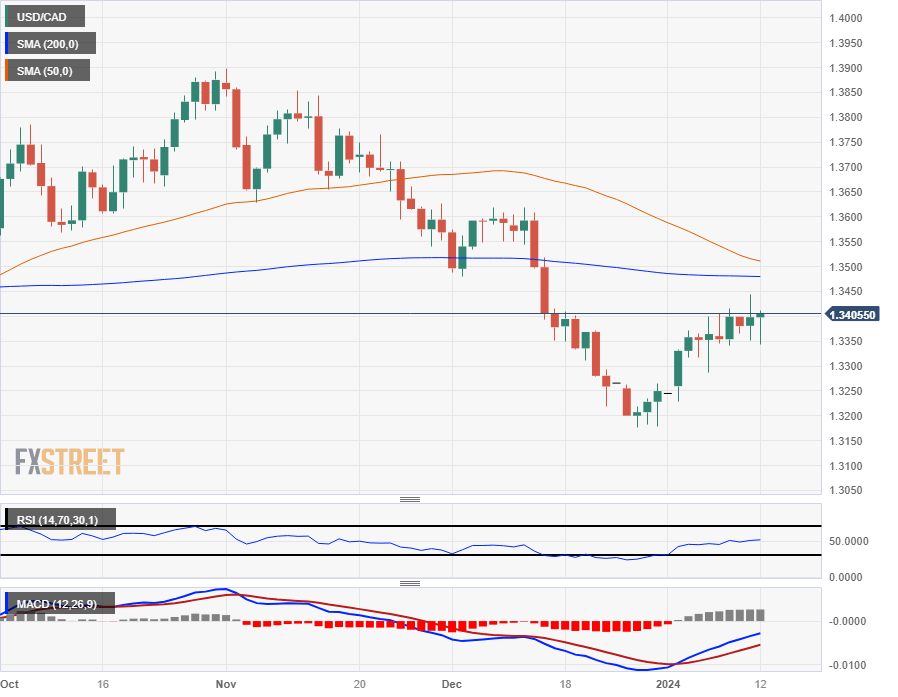

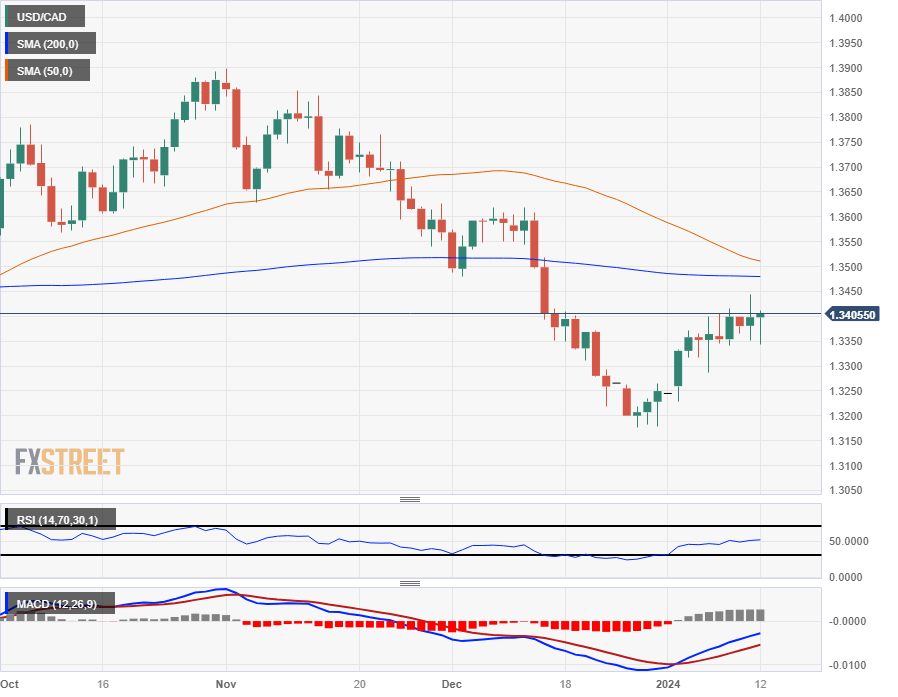

Daily candlesticks have the USD/CAD continuing to trade on the low side of the 200-day SMA near 1.3500, and a descending 50-day SMA is set for a bearish crossover of the longer moving average, which could form a technical ceiling for the pair moving forward. The pair is currently up 0.73% from 2024’s opening bids and has climbed 1.26% from December’s late low of 1.3775.

USD/CAD Hourly Chart

USD/CAD Daily Chart

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.