Canadian Dollar keeps the constructive tone against the US Dollar

- Canadian Dollar is broadly higher in calm markets.

- Canada Unemployment, Average Hourly Wages due on Friday.

- Canadian Dollar in tight race with recovering US Dollar.

The Canadian Dollar (CAD) has stepped broadly higher against the majority of its major currency peers on Thursday, though the CAD is battling a recovering US Dollar (USD) as the two currencies are on pace to settle the day as the top performers. US Initial Jobless Claims came in lower than expected, driving investors back into the Greenback as the US economy continues to outperform.

Canada sees a clear economic docket on Thursday as investors gear up for Friday’s Canadian labor and wages figures. Markets are forecasting a slight uptick in the Canadian January Unemployment Rate, as well as a smaller-than-usual Net Change in Employment for January, though the number is still projected to be positive.

Daily digest market movers: Canadian Dollar appreciates further on oil gains, steady Greenback

- US Initial Jobless claims beat expectations, coming in at 218K for the week ended February 2 compared to the forecast of 220K.

- The previous week’s Initial Jobless Claims saw an upside revision from 224K to 227K.

- The 4-week average for US Initial Jobless Claims climbed to 212.25K from 208.5K (revised up from 207.75K).

- President of the Federal Reserve (Fed) Bank of Richmond, Thomas Barkin, noted on Thursday that Fed Chairman Jerome Powell speaks for the Federal Open Market Committee (FOMC).

- Fed’s Barkin won’t prejudice the outcome of the March FOMC meeting, deferring to Fed head Powell’s statements.

- More Barkin:

- The Fed is focused on inflation and unemployment, not US government debt.

- If the US economy takes a turn for the worse, that would be a rate cut scenario.

- The Fed has time to be patient on rate cuts.

- Economic data remains remarkable, but Barkin is cautious regarding accuracy.

- It’s entirely possible that the neutral rate has risen.

- Need to see good inflation numbers being sustained and broadening.

- Canada’s Friday Unemployment Rate for January is forecast to tick upward to 5.9% from December’s 5.8%.

- Net Change in Employment forecast to add 15K net job gains through January, a thin number but still positive.

- Canadian annualized Average Hourly Wages in January will also print on Friday, last annualized wage growth figure showed YoY hourly wage gains of 5.7%.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.12% | 0.15% | 0.00% | 0.55% | 0.91% | 0.38% | 0.05% | |

| EUR | -0.12% | 0.03% | -0.11% | 0.43% | 0.78% | 0.26% | -0.09% | |

| GBP | -0.15% | -0.03% | -0.14% | 0.40% | 0.76% | 0.23% | -0.12% | |

| CAD | -0.01% | 0.10% | 0.14% | 0.54% | 0.89% | 0.37% | -0.02% | |

| AUD | -0.56% | -0.44% | -0.41% | -0.54% | 0.36% | -0.17% | -0.53% | |

| JPY | -0.90% | -0.81% | -0.76% | -0.91% | -0.38% | -0.52% | -0.87% | |

| NZD | -0.37% | -0.27% | -0.24% | -0.37% | 0.18% | 0.53% | -0.36% | |

| CHF | -0.03% | 0.09% | 0.10% | -0.02% | 0.53% | 0.87% | 0.35% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

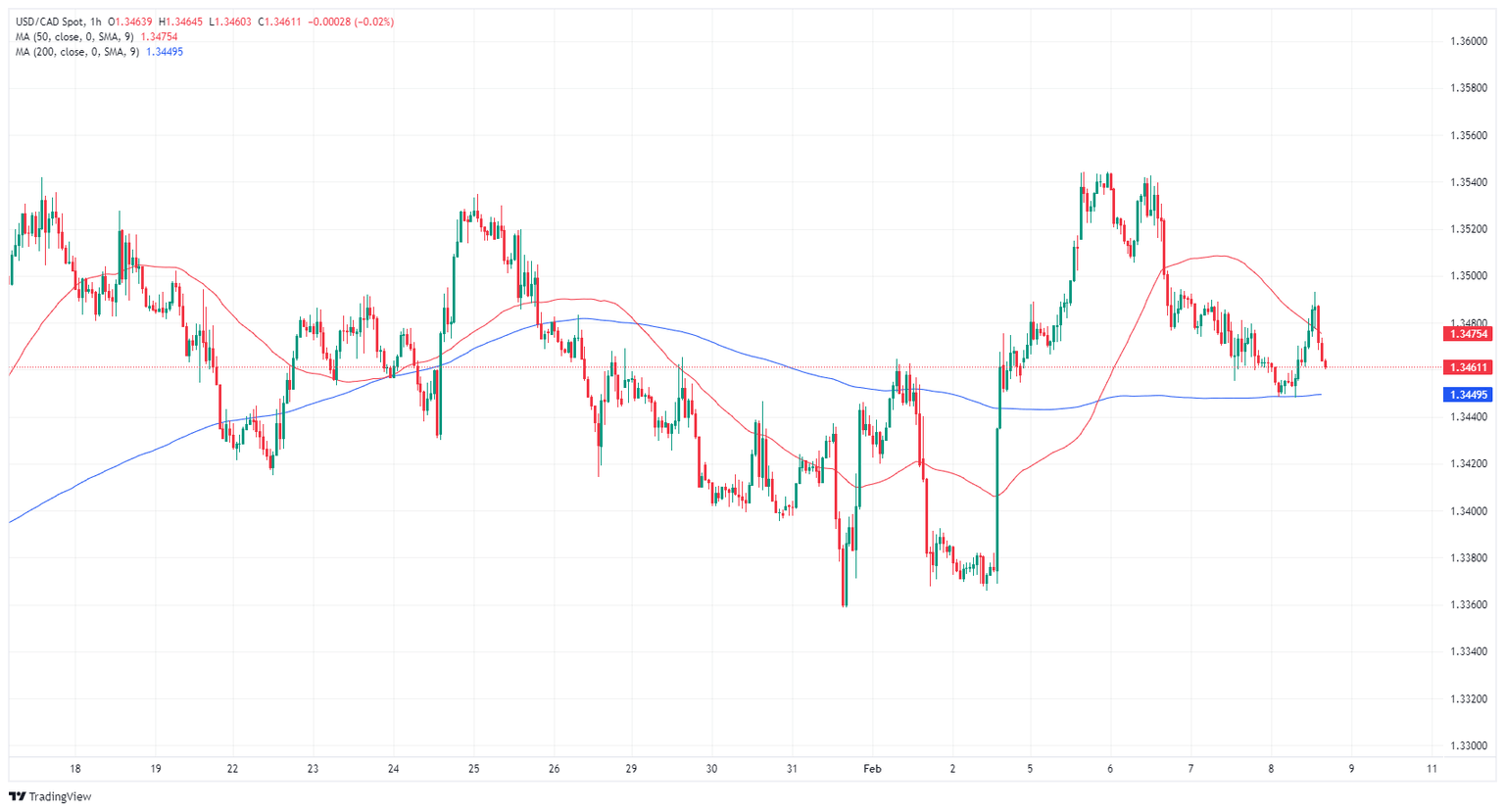

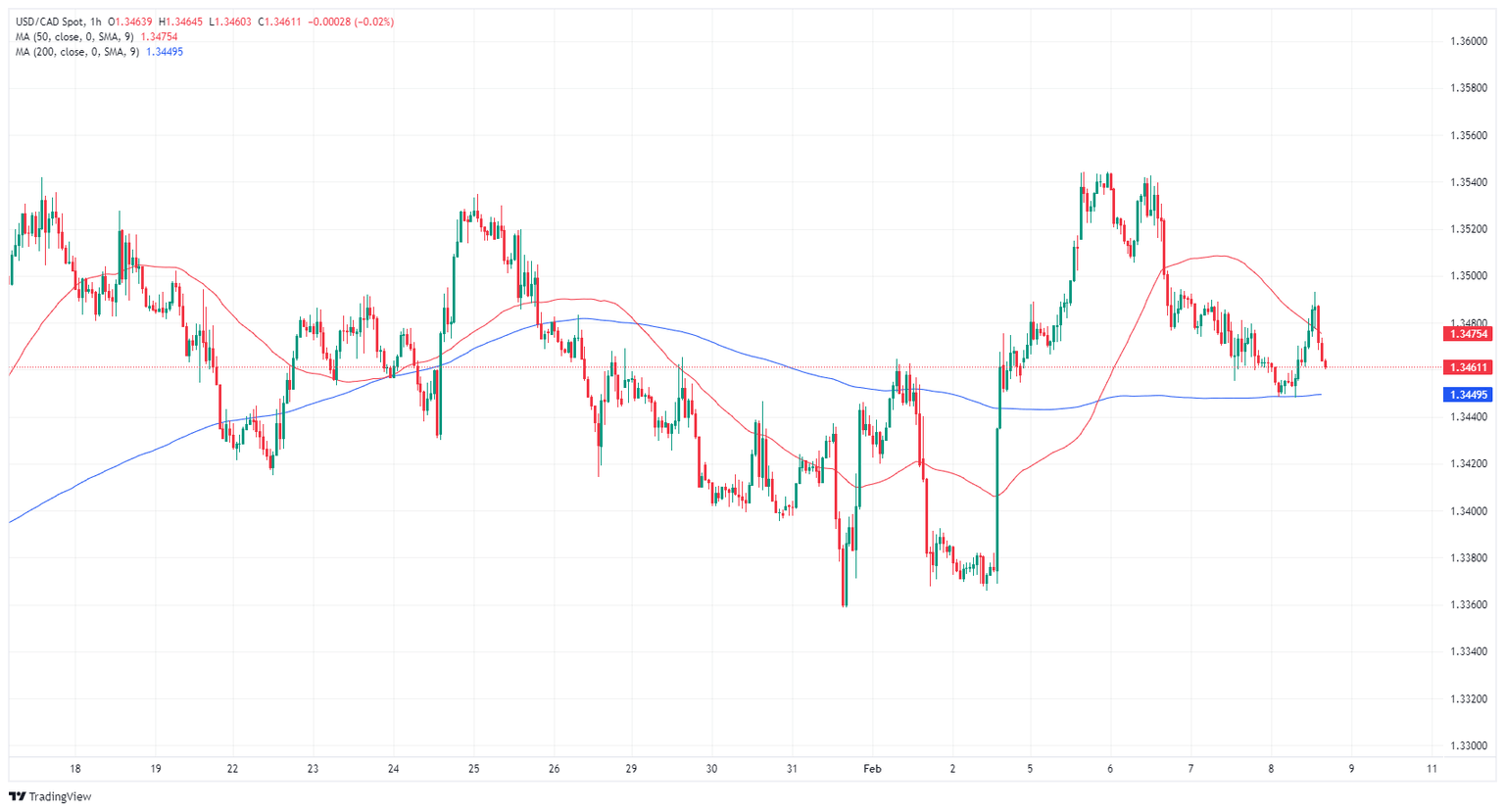

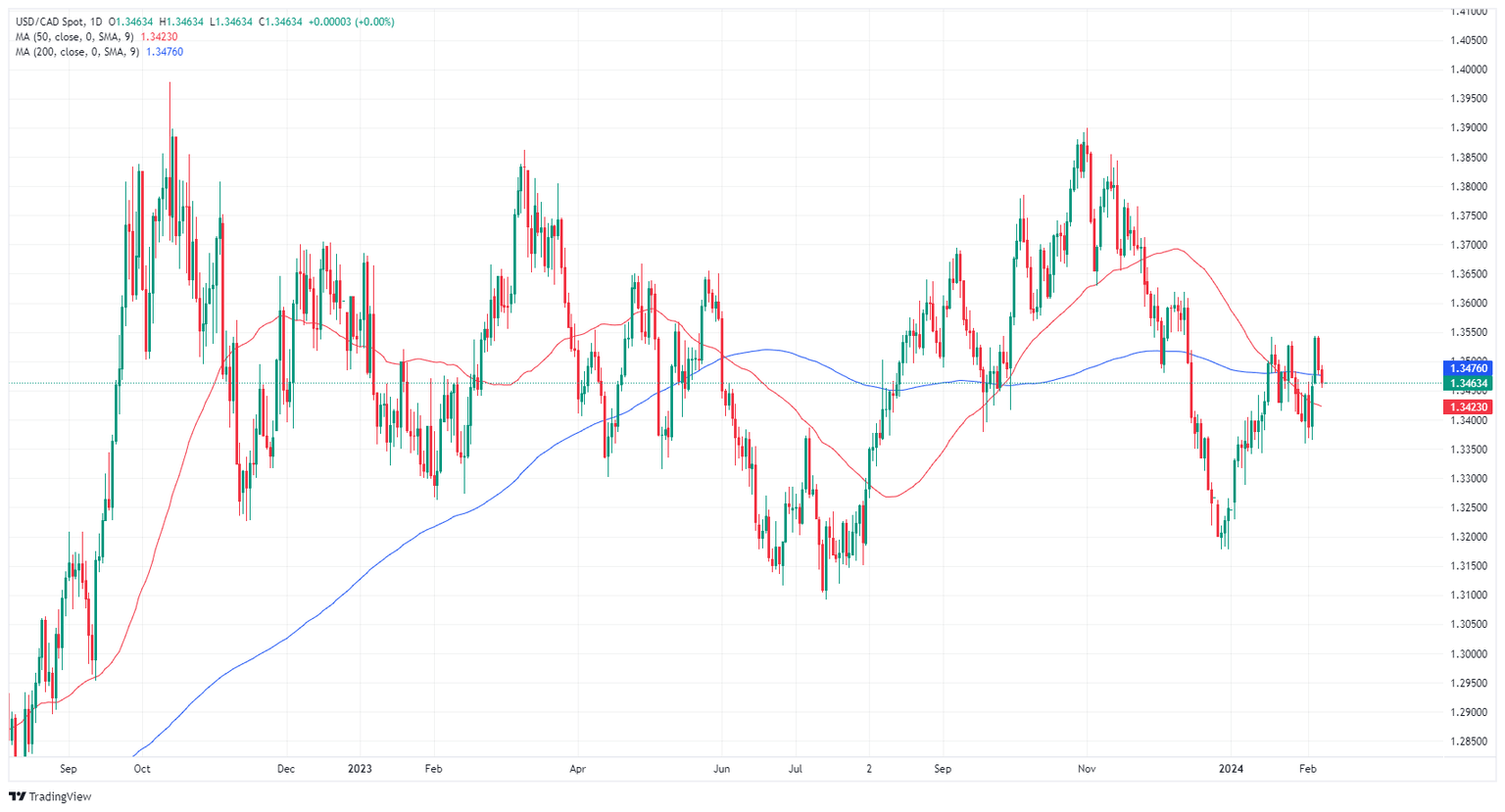

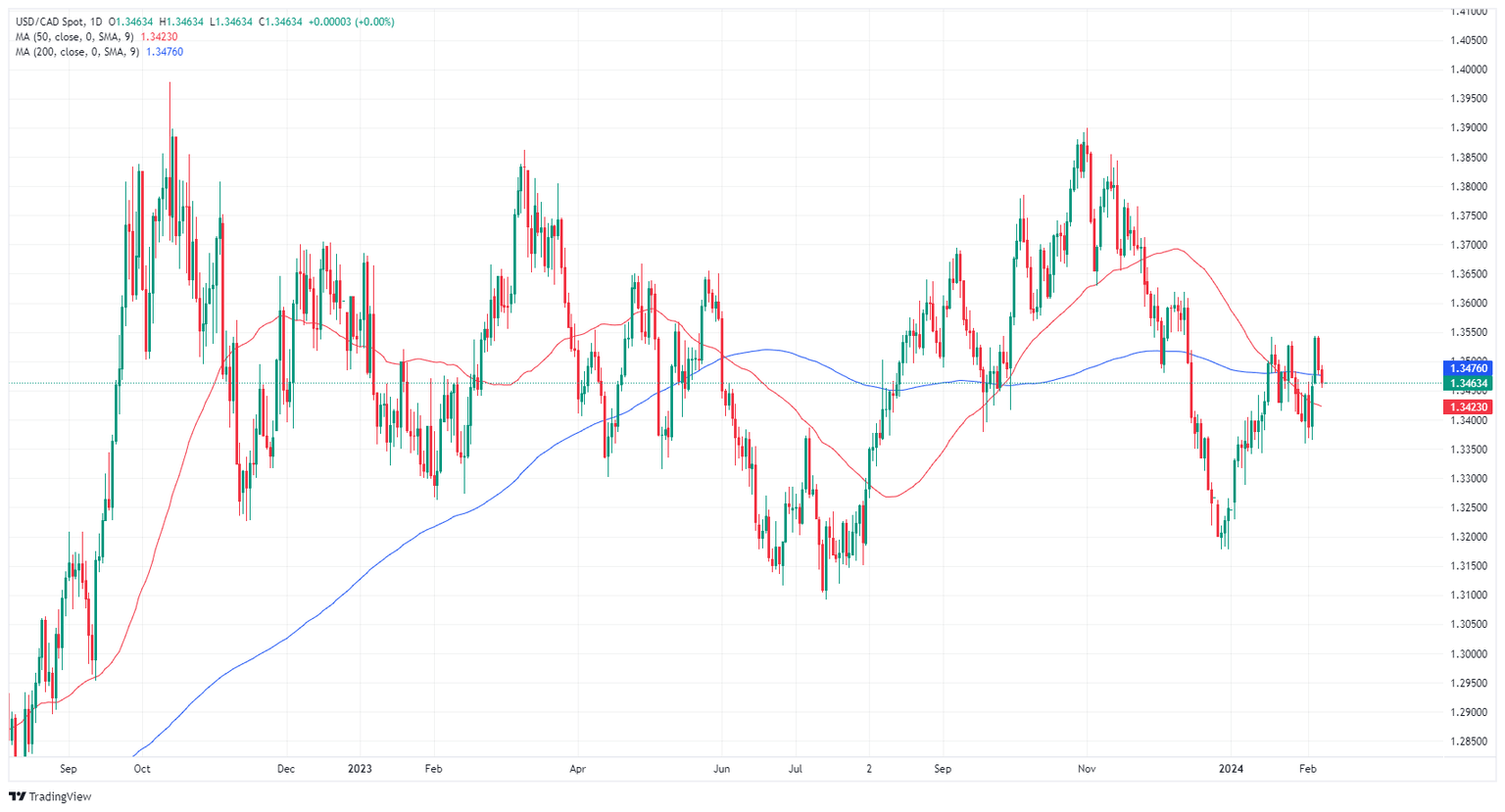

Technical analysis: Canadian Dollar revisits the 55-day SMA near 1.3450

The Canadian Dollar is broadly higher on Thursday, gaining nine-tenths of a percent against the Japanese Yen (JPY) and over half a percent against the Australian Dollar (AUD). On the low end, the CAD is mostly flat against the US Dollar after recovering from an early dip, and it is up a scant tenth of a percent against the Euro (EUR).

The USD/CAD saw a sharp turnaround just below 1.3500 on Thursday as investors aren’t ready to push the pair back over the key price handle. The pair is currently finding technical support from the 200-hour Simple Moving Average (SMA) near 1.3450, and an extended breakdown puts the USD/CAD on the road to re-challenging early February’s swing lows into 1.3370.

Daily candles remain caught in the midrange of a consolidation zone between the 50-day and 200-day SMAs at 1.3423 and 1.3476, respectively, but the USD/CAD is still up over 2% from December’s bottom bids of 1.3177.

USD/CAD hourly chart

USD/CAD daily chart

Economic Indicator

Canada Unemployment Rate

The Unemployment Rate, released by Statistics Canada, is the number of unemployed workers divided by the total civilian labor force as a percentage. It is a leading indicator for the Canadian Economy. If the rate is up, it indicates a lack of expansion within the Canadian labor market and a weakening of the Canadian economy. Generally, a decrease of the figure is seen as bullish for the Canadian Dollar (CAD), while an increase is seen as bearish.

Read more.Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.