Canadian Dollar squeezed out a third straight gain after mixed US data, follow-up Fed comments

Most recent article: Canadian Dollar pares back slightly with Tuesday's Canadian CPI print in the barrel

- The Canadian Dollar has slowed recent gains but tests into the high side.

- Bank of Canada Governor Macklem due to make an appearance to round out the week.

- Crude Oil bids have deflated in the American trading session as Fed comments cool market rate cut hopes.

The Canadian Dollar (CAD) has paused near the top end of the week’s chart action as market participants digest updated comments from Federal Reserve (Fed) officials strongly suggesting that market expectations may have run far ahead of the Fed’s expectations of rate cuts in 2024.

Bank of Canada (BoC) Governor Tiff Macklem spoke at the Canadian Club of Toronto, where the BoC head delivered prepared notes, stating that it's still far too early to begin considering or discussing rate cuts. BoC Governor Macklem's appearance marks the most (if not only) noteworthy item on the CAD’s entire economic calendar for this week.

New York Fed President John Williams splashed some cold water on hot markets Friday morning, noting that market expectations of rate cuts as soon as March are “premature” The NY Fed President revealed that discussions of rate cuts haven’t even been tabled at the Fed yet.

Daily Digest Market Movers: Canadian Dollar on the high side but gains slow

- The Canadian Dollar was one of the best performers on Friday, gaining ground against all of its major currency peers.

- The CAD is up a full percent plus another fifth against the Euro (EUR), a full percent against the Pound Sterling (GBP), and a quarter of a percent against the US Dollar (USD).

- BoC Macklem: It’s still too early to consider cutting our policy rate

- NY Fed President Williams: rate cuts aren’t being discussed yet at the Fed, market expectations of rate cuts, specifically when and how much, are “premature”; Fed is “at or near” the right place in terms of policy.

- Fed Williams’ comments caused markets to stumble after this week’s bidding frenzy following adjustments to the Fed’s dot plot of interest rate expectations, with Fed policymakers now expecting around three rate cuts for 75 basis points in 2024.

- US economic calendar figures skewed to the downside on Friday, with the NY Empire State Manufacturing Index declining unexpectedly from 9.1 to -14.5 in December, falling far past market forecasts of 2.0.

- US Industrial Production for November likewise missed the mark, rebounding to 0,2% versus the forecast 0.3%, and October’s print was also revised downwards from -0.6% to -0.8%.

- The US S&P Global Purchasing Managers’ Index (PMI) prints came in mixed, with the Manufacturing component declining from 49.4 to 48.2 MoM (forecast: 49.3), steepening a decline into contraction territory.

- The US Services PMI for December surprised to the upside, coming in at 51.3 versus November’s 50.8; markets were forecast a slight move down to 50.6.

- Crude Oil markets, always looking for a reason to dump, were knocked back after Fed Williams’ appearance on CNBC, pulled WTI down towards $70.50 before stabilizing beneath $72 per barrel, limiting CAD support on Friday.

- The Canadian Dollar rounded out the Friday market session on the top side against the US Dollar for the week, in the green 1.6% against the Greenback from Monday’s opening bids.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the Euro.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.91% | 0.78% | -0.27% | 0.00% | 0.01% | 0.03% | 0.43% | |

| EUR | -0.94% | -0.16% | -1.19% | -0.94% | -0.90% | -0.94% | -0.49% | |

| GBP | -0.78% | 0.15% | -1.03% | -0.78% | -0.75% | -0.78% | -0.34% | |

| CAD | 0.26% | 1.18% | 1.02% | 0.25% | 0.30% | 0.25% | 0.69% | |

| AUD | 0.00% | 0.94% | 0.77% | -0.25% | 0.03% | 0.01% | 0.45% | |

| JPY | 0.00% | 0.89% | 0.74% | -0.30% | -0.01% | -0.06% | 0.39% | |

| NZD | 0.01% | 0.89% | 0.73% | -0.29% | -0.03% | -0.02% | 0.44% | |

| CHF | -0.45% | 0.49% | 0.34% | -0.71% | -0.44% | -0.40% | -0.44% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical Analysis: Canadian Dollar on a cautious note but drifting higher against the Greenback

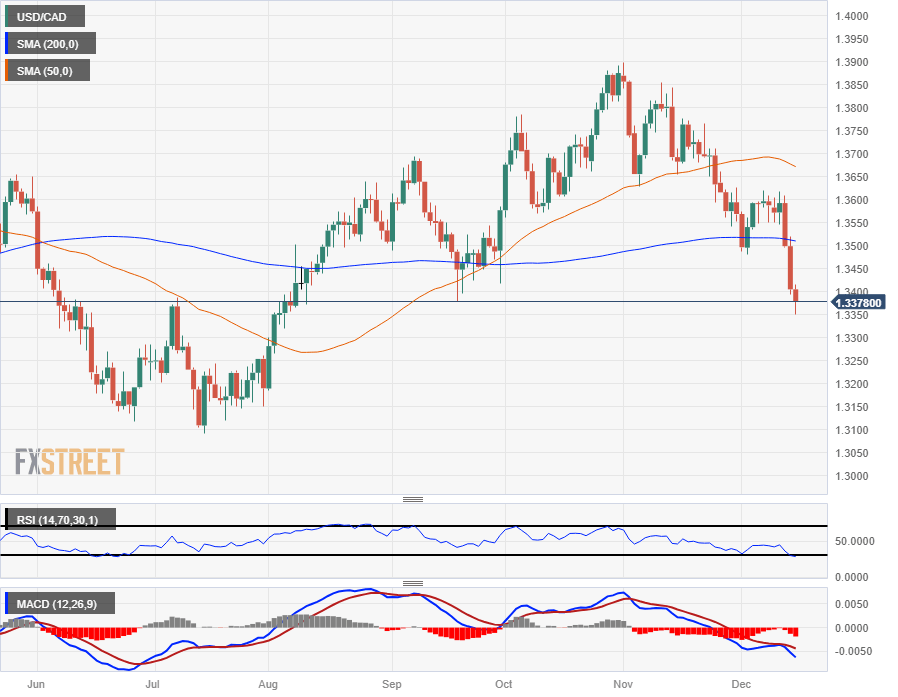

The Canadian Dollar is drifting into the high side against the US Dollar on Friday, squeezing out some last-minute gains before the markets wrap up the trading week.

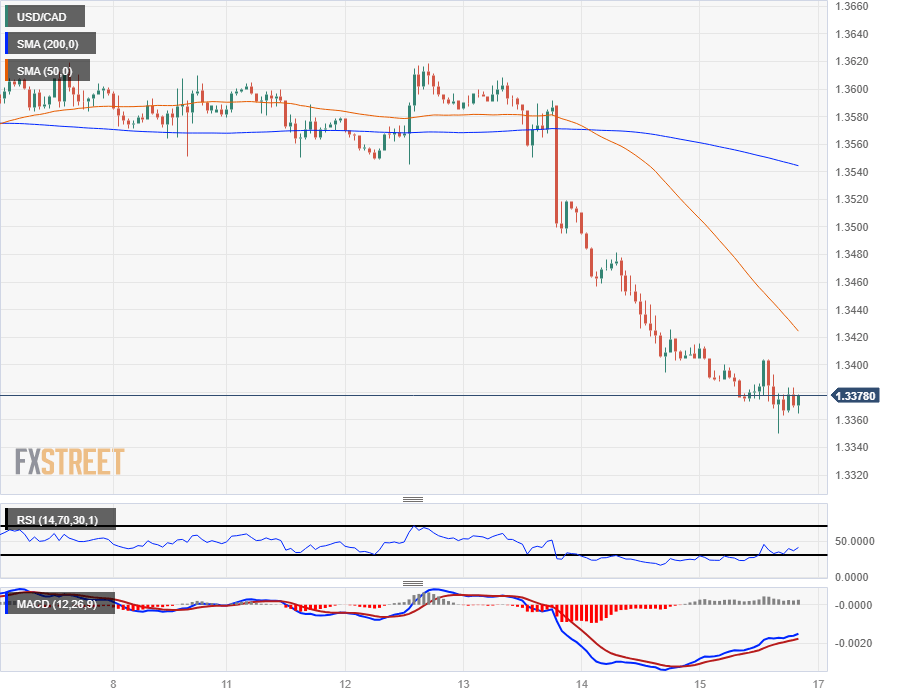

USD/CAD spent most of Friday drifting between 1.3400 and 1.3380 before settling down towards 1.3350, and the pair is down nearly two percent peak-to-trough from the week’s high bids near 1.3620.

Friday’s continued breakdown from the 1.3400 handle has the USD/CAD setting 17-week lows, setting the pair up for a challenge of July’s lows near 1.3100 as long as selling pressure holds.

A third straight day of hard declines has the USD/CAD facing its worst three-day performance since early 2020 when the pair shed nearly 500 pips in a single half-week.

USD/CAD Hourly Chart

USD/CAD Daily Chart

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.