Canadian Dollar snaps two-day win streak, dragged down by Crude Oil declines

- The Canadian Dollar is getting dragged down by declining Crude Oil bids.

- Housing Starts in Canada tick upward, overshadowed by US unemployment figures.

- WTI Crude Oil slumps below $74 per barrel.

The Canadian Dollar (CAD) is getting pushed back into recent lows against the US Dollar (USD) as declining Crude Oil and softening risk appetites weighed on the Loonie.

Canada saw a welcome bump in annualized Housing Starts in October, but the figure was entirely overshadowed by a miss for US Initial Jobless Claims, which is dragging down market sentiment.

Daily Digest Market Movers: Canadian Dollar on the back foot with no support from Crude Oil

- US Initial Jobless Claims rise to their highest level in nearly two years, market narrative tilts back toward fears of a harder-than-soft landing.

- 231K new unemployment benefit claims are reported in the US for the week of November 10 versus forecast 213K; previous week revised from 217K to 218K.

- US Industrial Production also declined past forecast, printing at -0.6% for October against the forecast decline to -0.3%. September’s Industrial Production printed at just 0.1% after being revised down from 0.3%.

- Canadian Housing Starts for the year into October ticked upward, 274.7K new homes started construction, well over the expected 252.9K, climbing over September’s reading of 270.7K.

- Despite production cap quotas, OPEC member countries continue to export more oil than expected, sending Crude Oil lower on Thursday.

- West Texas Intermediate (WTI) Crude Oil is trading back down below $74.00/barrel, pulling the plug on CAD support in the markets.

- CAD: Limited scope for near-term gains – Scotiabank

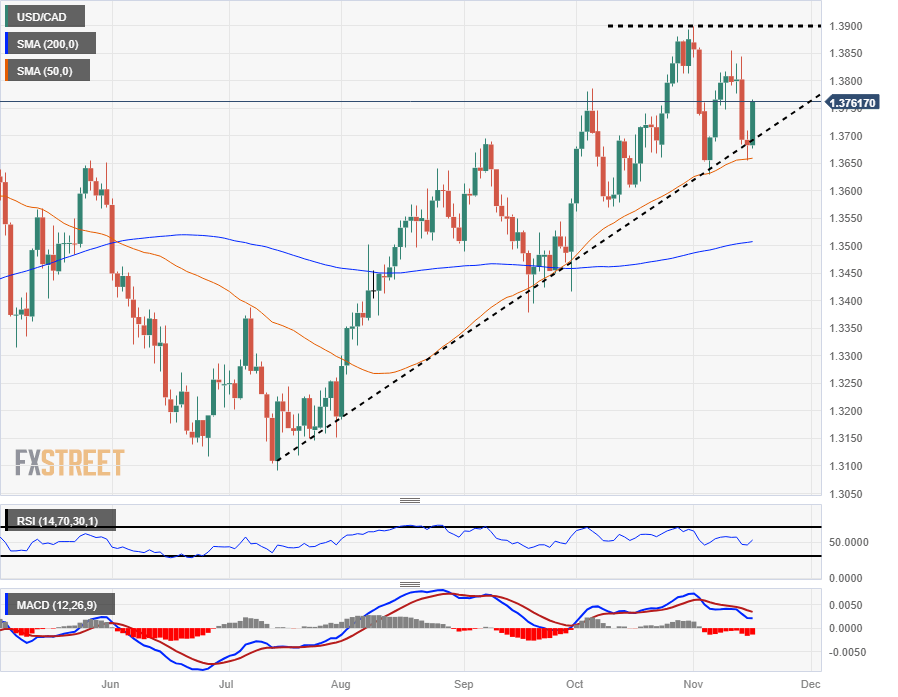

Technical Analysis: Canadian Dollar bounces off 50-day SMA, USD/CAD sees rejection from rising trendline

The USD/CAD reclaimed the 1.3700 handle during Thursday trading, setting the pair up for a fresh run at 1.3800.

The early week’s declines saw the USD/CAD ease into a near-term low of 1.3654 before getting a clean bounce off of the 50-day Simple Moving Average (SMA) and a rising trendline drawn from July’s lows near 1.3100.

Long-term technical support comes from the 200-day SMA sitting near the 1.3500 handle. A bullish extension for the USD/CAD will see bidders looking to take another run at cracking the 1.3900 handle at November’s high bids.

USD/CAD Daily Chart

Canadian Dollar price this week

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies this week. Canadian Dollar was the strongest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -1.50% | -1.50% | -0.30% | -1.62% | -0.47% | -1.29% | -1.47% | |

| EUR | 1.48% | 0.00% | 1.18% | -0.12% | 1.02% | 0.21% | 0.03% | |

| GBP | 1.48% | 0.00% | 1.18% | -0.12% | 1.02% | 0.21% | 0.03% | |

| CAD | 0.30% | -1.19% | -1.19% | -1.31% | -0.16% | -0.97% | -1.16% | |

| AUD | 1.59% | 0.13% | 0.12% | 1.29% | 1.13% | 0.33% | 0.14% | |

| JPY | 0.47% | -1.03% | -1.03% | 0.16% | -1.14% | -0.81% | -0.99% | |

| NZD | 1.28% | -0.21% | -0.21% | 0.97% | -0.33% | 0.81% | -0.18% | |

| CHF | 1.45% | -0.02% | -0.03% | 1.15% | -0.14% | 0.99% | 0.19% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Interest rates FAQs

What are interest rates?

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%.

If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

How do interest rates impact currencies?

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

How do interest rates influence the price of Gold?

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank.

If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

What is the Fed Funds rate?

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure.

Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.