Canadian Dollar chalks in a third consecutive down day as Crude Oil support evaporates

- Canadian Dollar sees further downside as Loonie loses oil support.

- Canada Building Permits also slid to a five-month low.

- Loonie down a full percent for the week.

The Canadian Dollar (CAD) is extending the week’s decline, getting pushed down as broader markets favor the US Dollar (USD) and Crude Oil bids decline into four-month lows.

Last week’s rally into the close fueled by investors heralding the end of the Federal Reserve’s (Fed) rate hike cycle is hitting a wall this week, and elation is being replaced with trepidation as fears of a global economic slowdown and ongoing geopolitical concerns weigh on risk appetite.

Daily Digest Market Movers: Canadian Dollar heading back for the bottom as investors extend Greenback bets

- CAD set for a third consecutive down day, backsliding 1.25% from Monday’s high bids.

- Broad-market USD pickup is seeing the Loonie get pushed back down after a brief recovery from 13-month lows.

- Canadian Building Permits declined 6.5% MoM in September, erasing August’s print of 4.3% (revised upward from 3.4%).

- Canada Housing Starts next week will round out the housing development picture.

- Bank of Canada Senior Deputy Governor Carolyn Rogers to speak about financial stability at an Advocis event in Vancouver on Thursday.

- The CAD is losing fundamental support as risk aversion flows pick up the US Dollar and West Texas Intermediate (WTI) Crude Oil fumbles barrel bids.

- WTI Crude Oil down over 9% from November’s high.

Technical Analysis: Canadian Dollar heading back into the floorboards, sees 1.38 against US Dollar

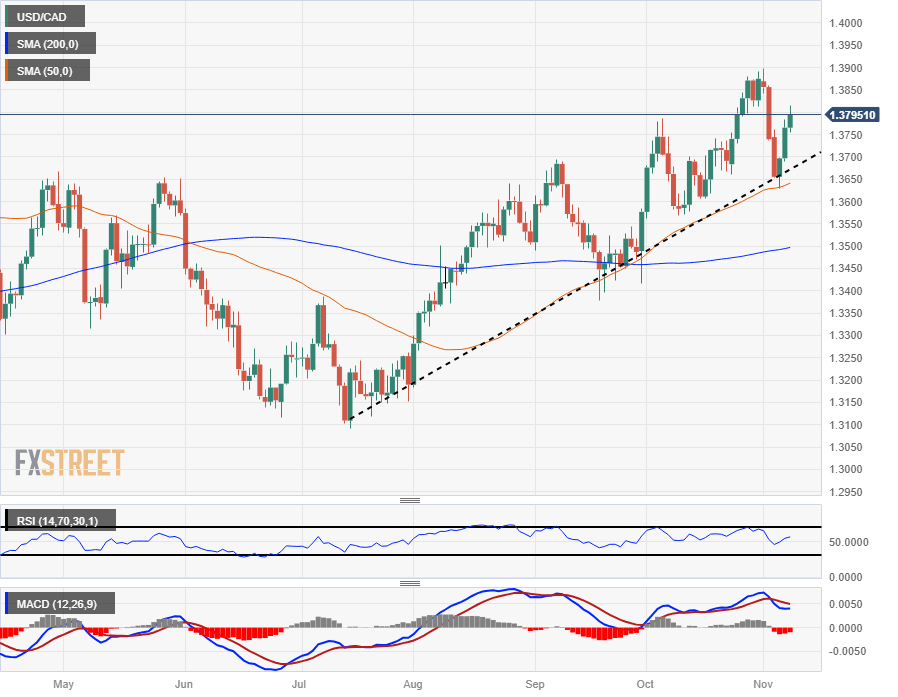

The USD/CAD has returned to the 1.3800 handle in Wednesday trading as the pair eases back, extending Greenback gains into a third straight day.

After seeing a technical bounce from the 50-day Simple Moving Average (SMA) near 1.3630 in confluence with a soft touch of the rising trendline from July’s low bids near 1.3100, the USD/CAD is set for a fresh challenge of 13-month highs at the 1.3900 handle. Multi-year highs remain locked behind 2022’s October peak of 1.3978.

Long-term trend technical support sits at the 200-day SMA currently rising into 1.2500, far below price action, and indicator traders will note that the Moving Average Convergence-Divergence (MACD) oscillator is still flashing short-side warnings after confirming a signal moving average crossover last week.

USD/CAD Daily Chart

Canadian Dollar price this week

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies this week. Canadian Dollar was the weakest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.21% | 0.72% | 0.96% | 1.72% | 1.01% | 1.39% | 0.01% | |

| EUR | -0.21% | 0.52% | 0.75% | 1.50% | 0.80% | 1.17% | -0.20% | |

| GBP | -0.73% | -0.52% | 0.24% | 0.99% | 0.28% | 0.66% | -0.72% | |

| CAD | -0.97% | -0.76% | -0.24% | 0.76% | 0.05% | 0.42% | -0.96% | |

| AUD | -1.76% | -1.53% | -1.01% | -0.79% | -0.71% | -0.34% | -1.73% | |

| JPY | -1.03% | -0.81% | -0.52% | -0.03% | 0.72% | 0.39% | -1.00% | |

| NZD | -1.41% | -1.18% | -0.66% | -0.42% | 0.34% | -0.38% | -1.41% | |

| CHF | -0.02% | 0.20% | 0.71% | 0.95% | 1.70% | 1.00% | 1.37% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.