Canadian Dollar ends win streak before it can fully begin

- The Canadian Dollar lost ground on Wednesday, snapping a bullish recovery attempt.

- Canada will be off the data docket until Friday’s Retail Sales print.

- After two days of gains, the CAD fell back 0.1% against the Greenback.

The Canadian Dollar (CAD) is back to its losing ways, backsliding 0.1% against the Greenback on Wednesday. The Loonie has ended it’s near-term bullish recovery against the safe haven US Dollar during the midweek market session as the economic calendar remains low-impact on both sides of the USD/CAD pair.

Canada saw an uptick in Consumer Price Index (CPI) inflation figures this week, but the wind died down quickly and the Canadian Dollar is stuck near multi-year lows after USD/CAD pinged a 54-month high above 1.4100 last week. Thursday will remain a muted affair with very little of note on the data docket except for weekly US jobless claims figures, with USD/CAD traders trapped in a waiting period before Friday’s Purchasing Managers Index (PMI) prints for the US, as well as Canadian Retail Sales figures for September.

Daily digest market movers: Canadian Dollar returns to tepid ways amid light Wednesday calendar

- The Canadian Dollar fell back a tenth of a percent against the Greenback at the trading week’s midpoint, keeping USD/CAD bolstered near multi-year highs.

- Canadian Consumer Price Index (CPI) inflation figures earlier this week helped to extend a near-term Loonie rally, but bullish momentum quickly fizzled.

- Data remains thin on Wednesday, with little on the radar for Thursday outside of US weekly Initial Jobless Claims. New benefits claimants are expected to rise slightly to 220K week-on-week for the week ended November 15 compared to the previous week’s 217K.

- Loonie markets will pivot into Canadian Retail Sales figures from September on Friday, with the headline figure expected to hold steady at 0.4% MoM while core Retail Sales excluding automotive purchases are expected to rebound to 0.5% MoM from the previous month’s -0.7% contraction.

- US PMIs will be the key figures of note on Friday, with both Manufacturing and Services components expected to climb slightly. Manufacturing PMI activity survey results are expected to rise to 48.8 in November from the previous month’s 48.5, while November’s Services component figures are forecast to rise to 55.3 from October’s flat 55.0.

Canadian Dollar price forecast

Despite holding onto bullish hope, the Canadian Dollar (CAD) still shed some ground against the Greenback on Wednesday, trimming a scant tenth of a percent and snapping a two-day win streak that saw the Loonie recover around nine-tenths of a percent from multi-year lows. USD/CAD cycled just below the 1.4000 handle during the midweek market session, testing the key psychological level but keeping price action hampered on the low side of the key price level.

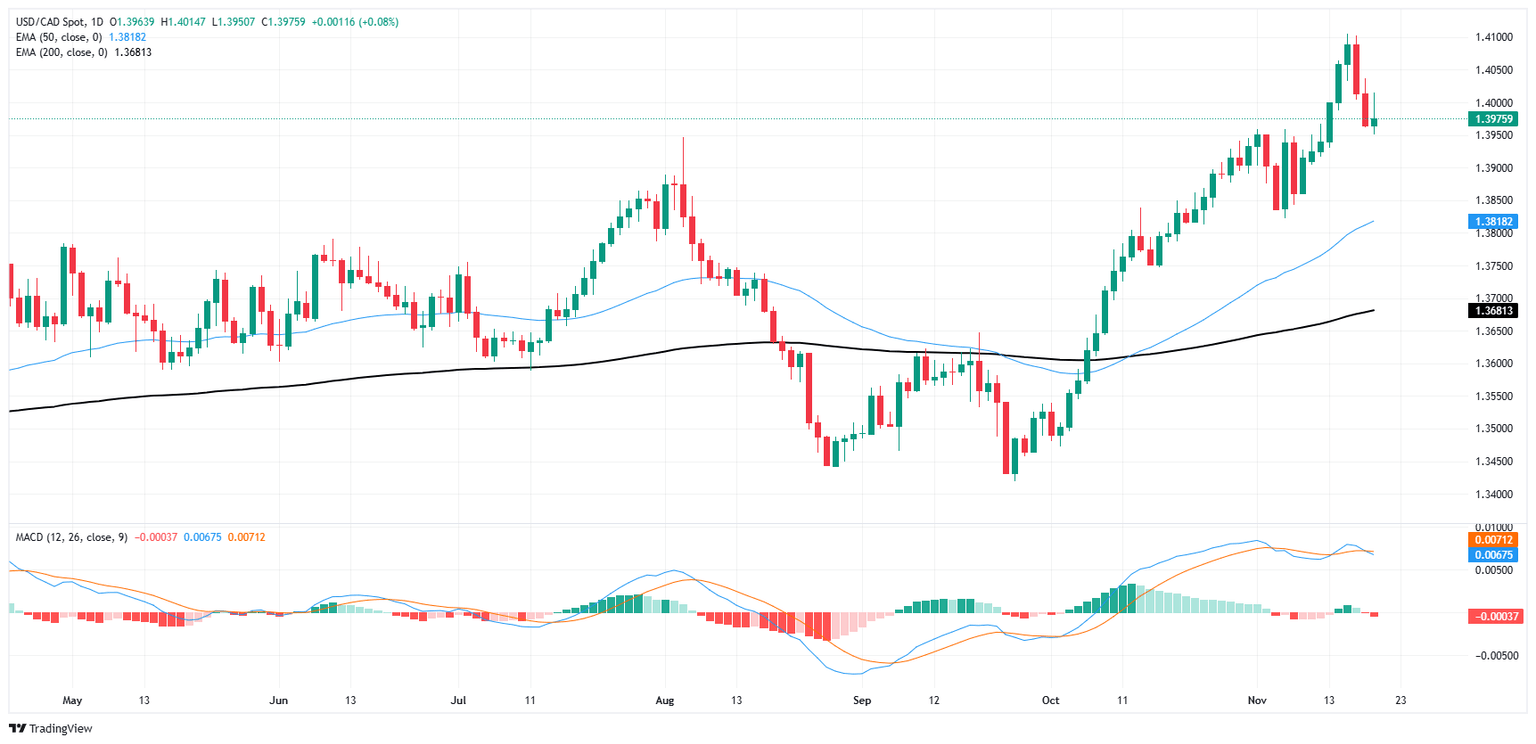

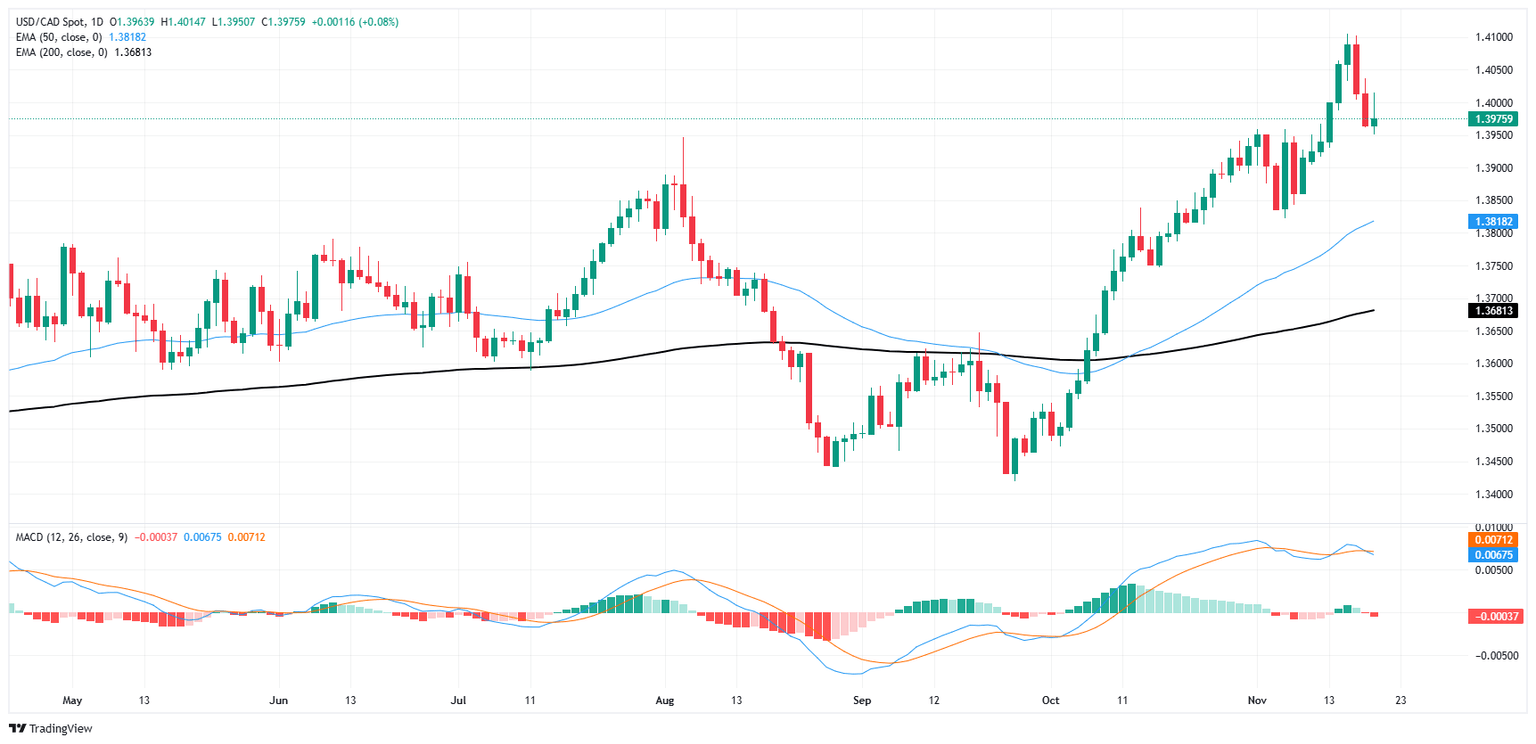

With USD/CAD holding close to a 54-month high near 1.4100, bearish momentum in the chart has limited potential to drag bids back into the 50-day Exponential Moving Average (EMA) near 1.3800.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.