Canadian Dollar pares back slightly with Tuesday's Canadian CPI print in the barrel

- Canadian Dollar pares back some of last Friday’s gains ahead of Canadian CPI on Tuesday.

- Monday’s economic calendar has a thin docket, but key data to wrap up 2023 due this week.

- CAD and crude Oil diverge as WTI recovers some ground on Monday.

The Canadian Dollar (CAD) is pulling back in the bids to kick off the last two weeks of trading in 2023, with a final print of StatsCAN’s Canadian Consumer Price Index (CPI) inflation on the docket for Tuesday.

On top of muddying the waters by reporting its own version of Canadian CPI on Tuesday, the Bank of Canada (BoC) will publish its latest Summary of Deliberations on Wednesday. Thursday’s Canadian Retail Sales and Friday’s Canadian Gross Domestic Product (GDP) will be overshadowed by counterpart US data punching in a higher weight class.

Daily Digest Market Movers: Canadian Dollar markets coil ahead of 2023’s final inflation print

- Monday opens quietly heading into the final turn of the trading year.

- The CAD is paring back slightly on Monday, falling or flattening against nearly all other major currencies.

- The Loonie slipped one tenth of one percent against the US Dollar (USD) but climbed a fifth of a percent against the Japanese Yen (JPY) with both the Yen and the Pound Sterling (GBP) outpacing the Canadian Dollar to be the weakest currencies in Monday trading.

- Canadian Consumer Price Index inflation on Tuesday is expected to show further cooling in consumer-facing prices, with the YoY figure forecast to tick down from 3.1% to 2.9%. November’s MoM CPI is also expected to see a return to cooling territory, slated to fall to -0.2% from October’s 0.1%.

- The BoC’s Summary of Deliberations is due on Wednesday but is unlikely to reveal much new information that wasn’t already discussed at length by BoC Governor Tiff Macklem at last Friday’s speaking event.

- BoC Macklem: It’s still too early to consider cutting our policy rate

- Thursday’s Canadian Retail Sales for October are forecast to improve to 0.8% from September’s 0.6%, and Friday’s Canadian Gross Domestic Product print is forecast to round out the trading year with an upbeat expectation of 0.2% in October versus September’s 0.1%.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.23% | 0.20% | 0.14% | -0.13% | 0.35% | -0.05% | -0.36% | |

| EUR | 0.22% | 0.45% | 0.36% | 0.10% | 0.58% | 0.16% | -0.12% | |

| GBP | -0.20% | -0.43% | -0.06% | -0.30% | 0.14% | -0.25% | -0.57% | |

| CAD | -0.13% | -0.37% | 0.06% | -0.25% | 0.21% | -0.20% | -0.50% | |

| AUD | 0.13% | -0.10% | 0.31% | 0.25% | 0.46% | 0.06% | -0.25% | |

| JPY | -0.35% | -0.58% | -0.14% | -0.19% | -0.47% | -0.43% | -0.72% | |

| NZD | 0.06% | -0.16% | 0.26% | 0.20% | -0.06% | 0.41% | -0.30% | |

| CHF | 0.36% | 0.14% | 0.57% | 0.51% | 0.27% | 0.73% | 0.30% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical Analysis: The Canadian Dollar’s Monday pause could give way to full-blown pullback if Greenback bidders catch Loonie bulls with their pants down

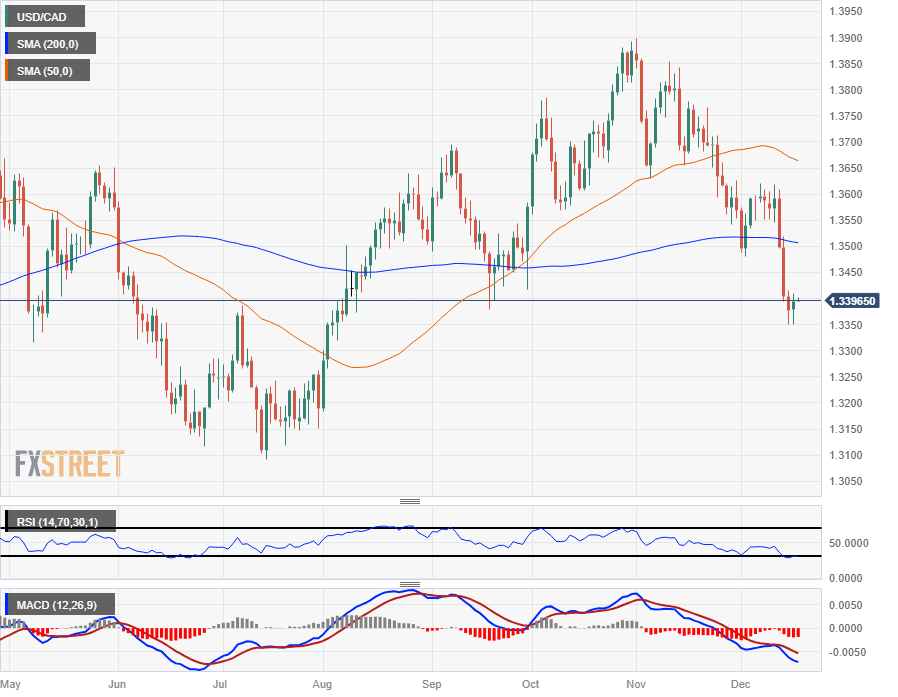

Monday sees the Canadian Dollar pulling back into 1.3400 against the US Dollar in a slight paring back from recent bullish momentum. The Canadian Dollar’s three-day bull run last week saw the USD/CAD tip into multi-month lows near 1.3350 after falling from last week’s highs near the 1.3600 handle.

The pair is down over three and a half percent from November’s early high just below 1.3900, but last week’s clean break of the 200-day Simple Moving Average (SMA) near 1.3500 could see the USD/CAD primed for a pullback.

If Loonie bidding doesn’t return meaningfully to push the pair back down to 2023’s bottom bids near 1.3100, the ceiling on a bullish rebound for the Greenback might not firm up until bids return to the 50-day SMA descending into 1.3650.

USD/CAD Hourly Chart

USD/CAD Daily Chart

(this article was corrected on December 18 at 18:30 GMT to say, in the first paragraph of the Technical Analysis section, that the USD/CAD hit multi-month lows near 1.3350, not multi-month highs.)

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.