Canadian Dollar churns after BoC rate cut

- The Canadian Dollar pared losses on Wednesday to rebound 0.2%.

- The Bank of Canada trimmed interest rates by another 50 bps.

- Weakening economic figures and labor data sparked another uptick in rate cuts.

The Canadian Dollar (CAD) bounced on Wednesday, regaining one-fifth of one percent against the Greenback and meagerly recovering from recent lows. US Consumer Price Index (CPI) inflation figures came in broadly as-expected, keeping wider market sentiment on-balance and giving Loonie traders an opportunity to claw back chart paper.

The Bank of Canada (BoC) delivered another outsized interest rate cut, slashing reference rates by 50 basis points. With Canada’s Unemployment Rate hitting multi-year highs, the BoC has been given all of the ammunition it needs to shrug off recent upticks in inflation figures and start delivering further relief to its darling industry, the Canadian mortgage sector. Real estate accounted for roughly 20% of Canada’s overall economy in 2023, and the BoC is hard-pressed to keep housing activity afloat after shock rises in interest rates following the COVID pandemic sent housing costs through the roof.

Daily digest market movers: CAD bounces on BoC rate cut

- The BoC cut Canada’s main interest rate to 3.25% on Wednesday, delivering a 50 bps rate trim.

- The Canadian Dollar bounced on the news, giving Loonie traders hope for a technical recovery.

- Broader market sentiment remains on-balance after US CPI inflation figures matched market expectations across the board.

- Despite CPI figures nailing forecasts, investors will have little to celebrate with headline US CPI inflation accelerating to 2.7% YoY in November, up from the previous period’s 2.6%.

- Meaningful Canadian economic data is done on the release calendar for this week, leaving the Loonie at the mercy of wider market flows for the back half of the trading week.

Canadian Dollar price forecast

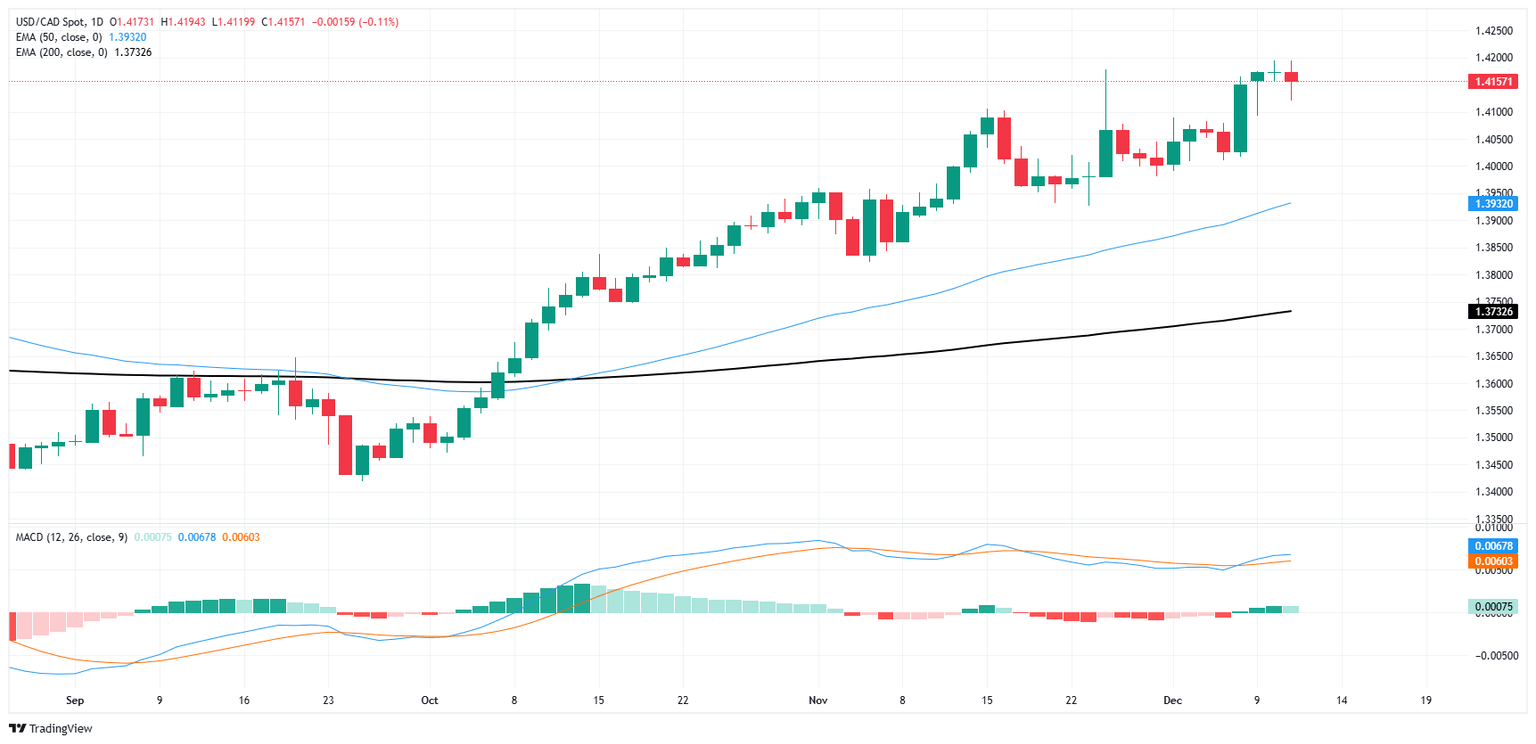

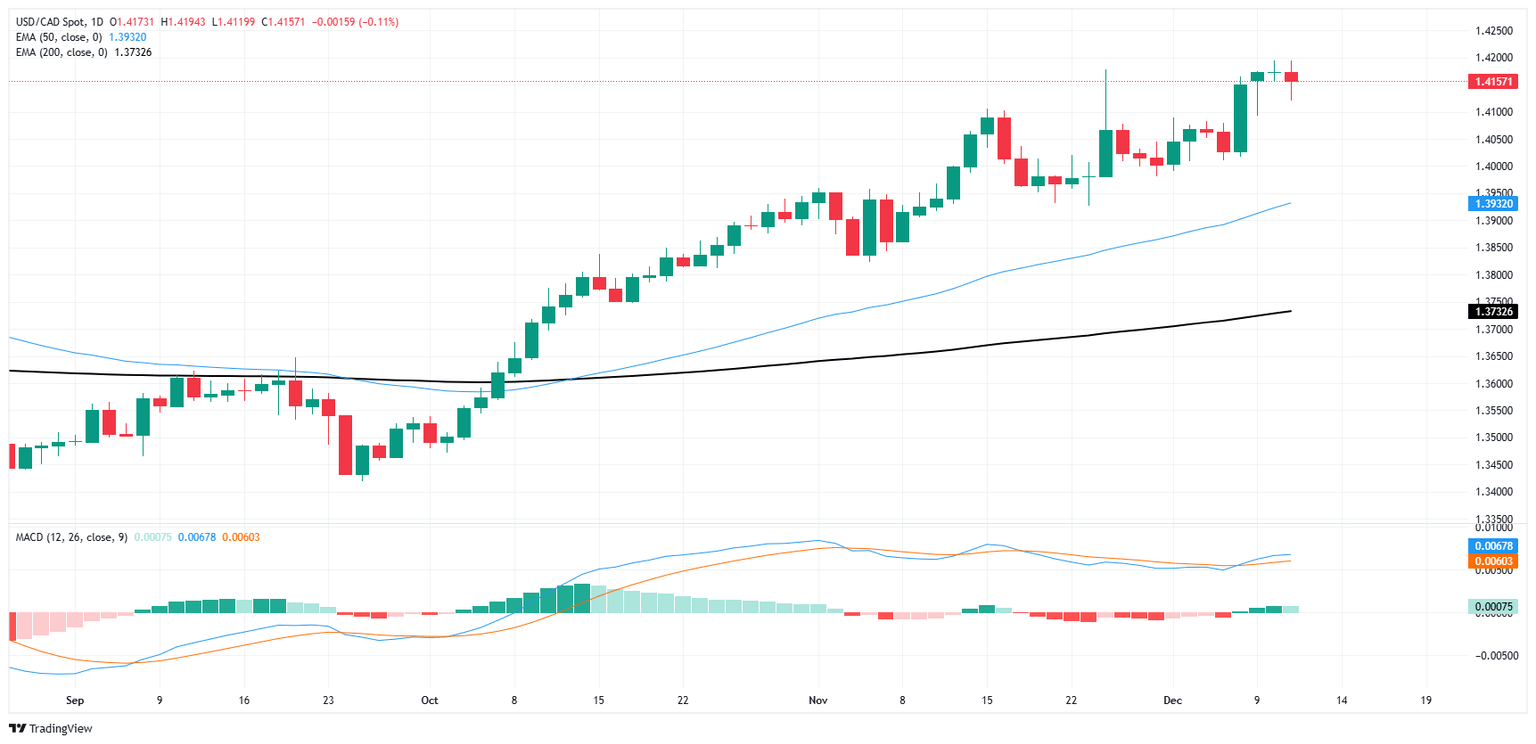

Despite a firm bid in the Canadian Dollar post-BoC, bullish flows into the CAD remain limited, and markets pared away much of Wednesday’s intraday gains. Momentum is firmly tilted into the Greenback side on the USD/CAD chart, with the pair barely easing from multi-year highs near the 1.4200 handle.

Loonie bulls will be looking to drag the pair down to 1.4100 before making a break lower toward the 50-day Exponential Moving Average (EMA) near 1.3930.

USD/CAD daily chart

Economic Indicator

BoC Interest Rate Decision

The Bank of Canada (BoC) announces its interest rate decision at the end of its eight scheduled meetings per year. If the BoC believes inflation will be above target (hawkish), it will raise interest rates in order to bring it down. This is bullish for the CAD since higher interest rates attract greater inflows of foreign capital. Likewise, if the BoC sees inflation falling below target (dovish) it will lower interest rates in order to give the Canadian economy a boost in the hope inflation will rise back up. This is bearish for CAD since it detracts from foreign capital flowing into the country.

Read more.Last release: Wed Dec 11, 2024 14:45

Frequency: Irregular

Actual: 3.25%

Consensus: 3.25%

Previous: 3.75%

Source: Bank of Canada

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.