Canadian Dollar battered by dovish outlook

- The Canadian Dollar fell a scant tenth of a percent, but tested multi-year lows.

- Canada expects a dip in economic growth in 2025 and 2026.

- Despite soothing talk from BoC Macklem, markets continue to pummel the Loonie.

The Canadian Dollar (CAD) hit another soft spot on Monday, testing into a 56-month low near 1.4250 against the US Dollar. With the Loonie falling to its lowest prices in almost five years against the Greenback, soft language from Bank of Canada (BoC) Governor Tiff Macklem and a tumultuous release of Canada’s latest Federal Economic Statement did little to assuage investor concerns.

Canada is now expected to see slightly-lower growth in 2025 and 2026, and a rosier-than-before outlook on Canadian Gross Domestic Product (GDP) growth in 2024 is being met with some scepticism from CAD traders. Canadian Finance Minister Chrystia Freeland resigned from her post early Monday, throwing the government’s FES release into a tailspin as investors scrambled to figure out who would deliver the report.

Daily digest market movers: CAD continues to suffer near five-year lows

- The Canadian Dollar fell back to kick off the new trading week, pushing the Greenback north of 1.4250 against the Loonie for the first time since April of 2020.

- The CAD is approaching a 2% decline against the USD in December alone.

- BoC Governor Macklem notes that lagging Canadian growth could save the BoC from an extended inflation fight.

- According to the Canadian government’s latest FES, Canadian GDP is expected to hit 1.3% in 2024, compared to the previous forecast of 0.7% set in April.

- 2025 GDP growth forecast has been revised down to 1.7% from the previous 1.9%, and 2026 growth is expected to tick down to 2.1% versus the previous 2.2%.

- Canada’s federal deficit is now expected to widen to $42.2 billion CAD, compared to April’s initial forecast of $38.9 billion CAD.

Canadian Dollar price forecast

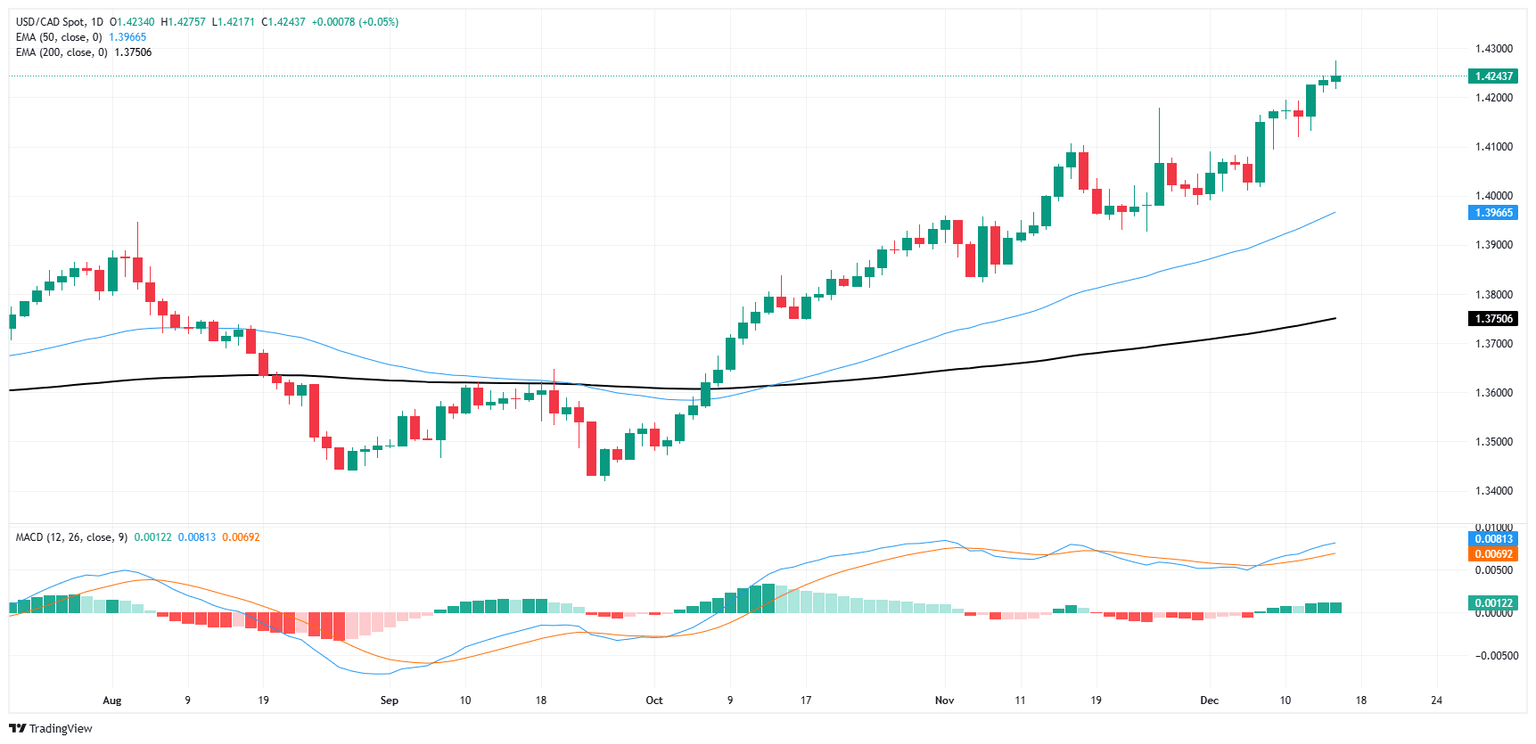

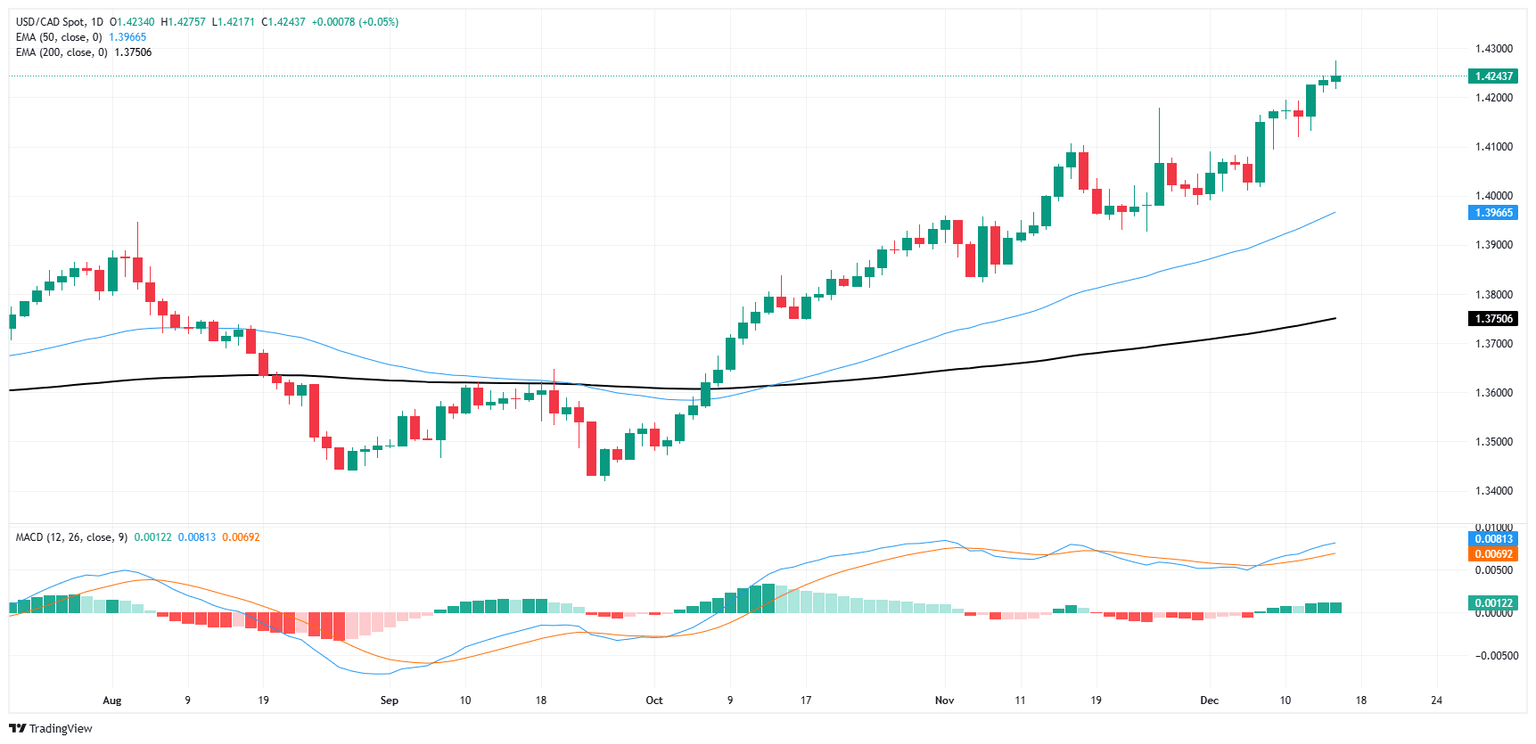

Fresh downside for the Canadian Dollar has bolstered USD/CAD to fresh multi-year highs, with the pair testing 1.4275 on Monday. USD/CAD has closed higher on a weekly basis for all but two of the last ten consecutive weeks.

CAD technical chart bulls will be looking for a downside turnaround in the USD/CAD chart, as near-term price action runs well ahead of the 50-day Exponential Moving Average (EMA) rising into 1.4000. A long-term sideways grind reveals itself on monthly candles, but a bull run in Greenback flows renders USD/CAD short position accumulation a hazardous affair.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.