Canadian Dollar adrift on uneasy post-NFP markets

- Canadian Dollar markets swamped out by NFP release.

- Canada has limited data releases on the scope.

- US data broadly softened, fanning the flames of recession fears.

The Canadian Dollar (CAD) was tossed around on Friday as global markets roiled following a broad downside miss in US labor and wages figures released early in the US trading session. US Nonfarm Payrolls (NFP), wages, and unemployment figures all missed forecasts, raising investor concerns that the US may be headed for a “hard landing” scenario in the coming months.

Canada has little of note slated for immediate release on the economic calendar, leaving CAD traders adrift until next Friday’s Canadian labor data. As markets roil under deflating US economic figures, market flows should be expected to continue tossing the CAD around as traders scramble to adjust their exposure.

Daily digest market movers: US NFP misfire all but guarantees Fed rate cut in September

- US NFP jobs data showed the US added 114K net new employment positions in July, well below the forecast 175K and easing back from the previous month’s 179K, which was also revised lower from 206K.

- The US Unemployment Rate ticked higher to 4.3% in July, the highest rate of measured unemployment since November of 2021.

- Average Hourly Earnings also grew by less than expected in July, notching in 0.2% MoM against the forecast hold at 0.3%.

- Annualized wages rose 3.6%, below the forecast 3.7% and easing further back from the previous 3.8% (revised from 3.9%).

- US Factory Orders contracted in June, printing -3.3% MoM versus the forecast for -2.9% and accelerating down from the previous month’s print of -0.5%.

- Rate markets are now pricing in 75% odds of a double cut from the Federal Reserve (Fed) in September, with a rate cut now a forgone conclusion when the Fed delivers its rate call on September 18.

Canadian Dollar PRICE Today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -1.10% | -0.43% | -1.57% | -0.16% | -0.26% | -0.27% | -1.39% | |

| EUR | 1.10% | 0.67% | -0.48% | 0.93% | 0.85% | 0.82% | -0.30% | |

| GBP | 0.43% | -0.67% | -1.17% | 0.27% | 0.16% | 0.16% | -0.96% | |

| JPY | 1.57% | 0.48% | 1.17% | 1.45% | 1.33% | 1.32% | 0.18% | |

| CAD | 0.16% | -0.93% | -0.27% | -1.45% | -0.10% | -0.09% | -1.23% | |

| AUD | 0.26% | -0.85% | -0.16% | -1.33% | 0.10% | 0.00% | -1.13% | |

| NZD | 0.27% | -0.82% | -0.16% | -1.32% | 0.09% | 0.00% | -1.11% | |

| CHF | 1.39% | 0.30% | 0.96% | -0.18% | 1.23% | 1.13% | 1.11% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Canadian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CAD (base)/USD (quote).

Technical analysis: Canadian Dollar finds some upside against deflating Greenback, but overall lower

The Canadian Dollar (CAD) is broadly lower on Friday as traders pivot away from the CAD into more interesting assets. The CAD tumbled a full percent against the Euro, the Japanese Yen, and the Swiss Franc on Friday, but was able to eke out a slim quarter-percent gain against the floundering US Dollar.

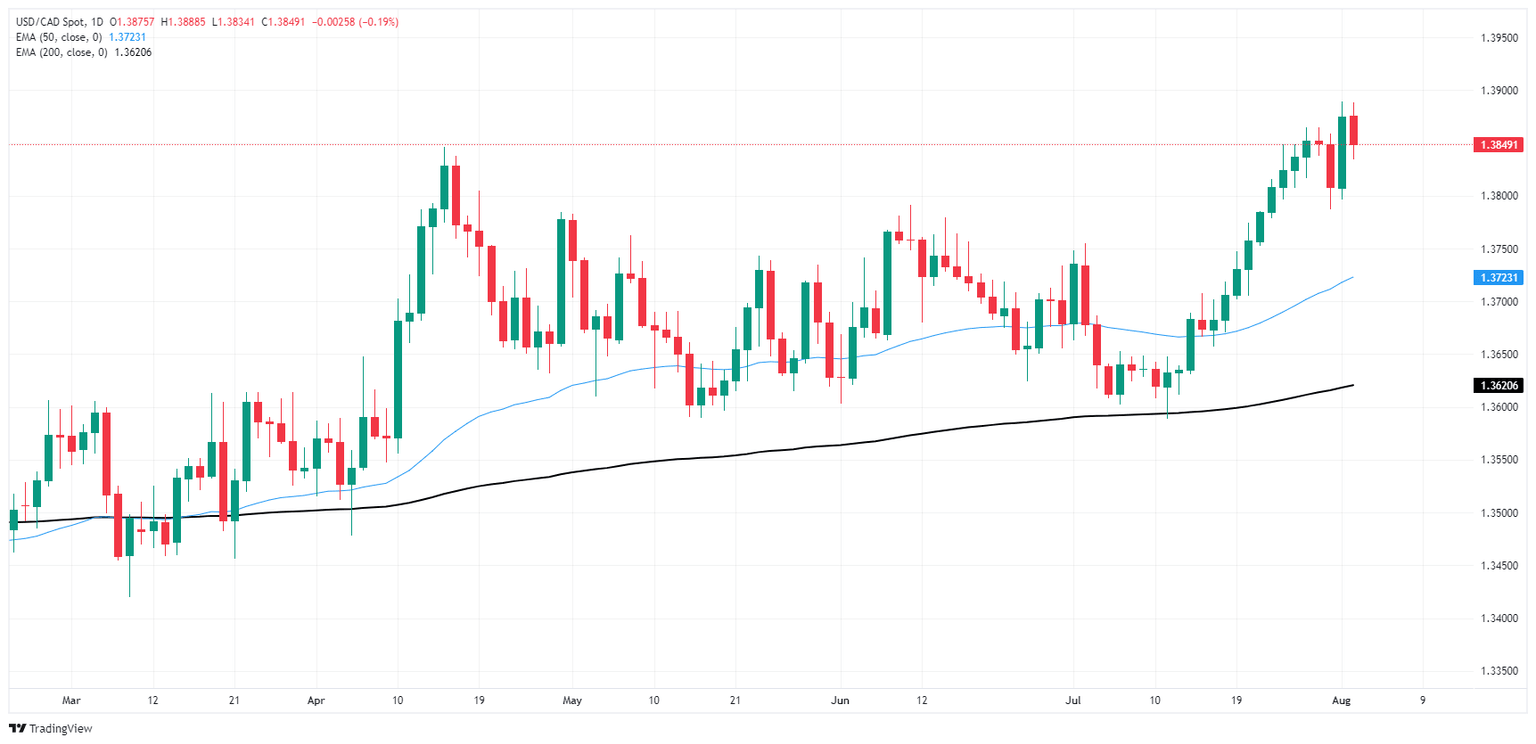

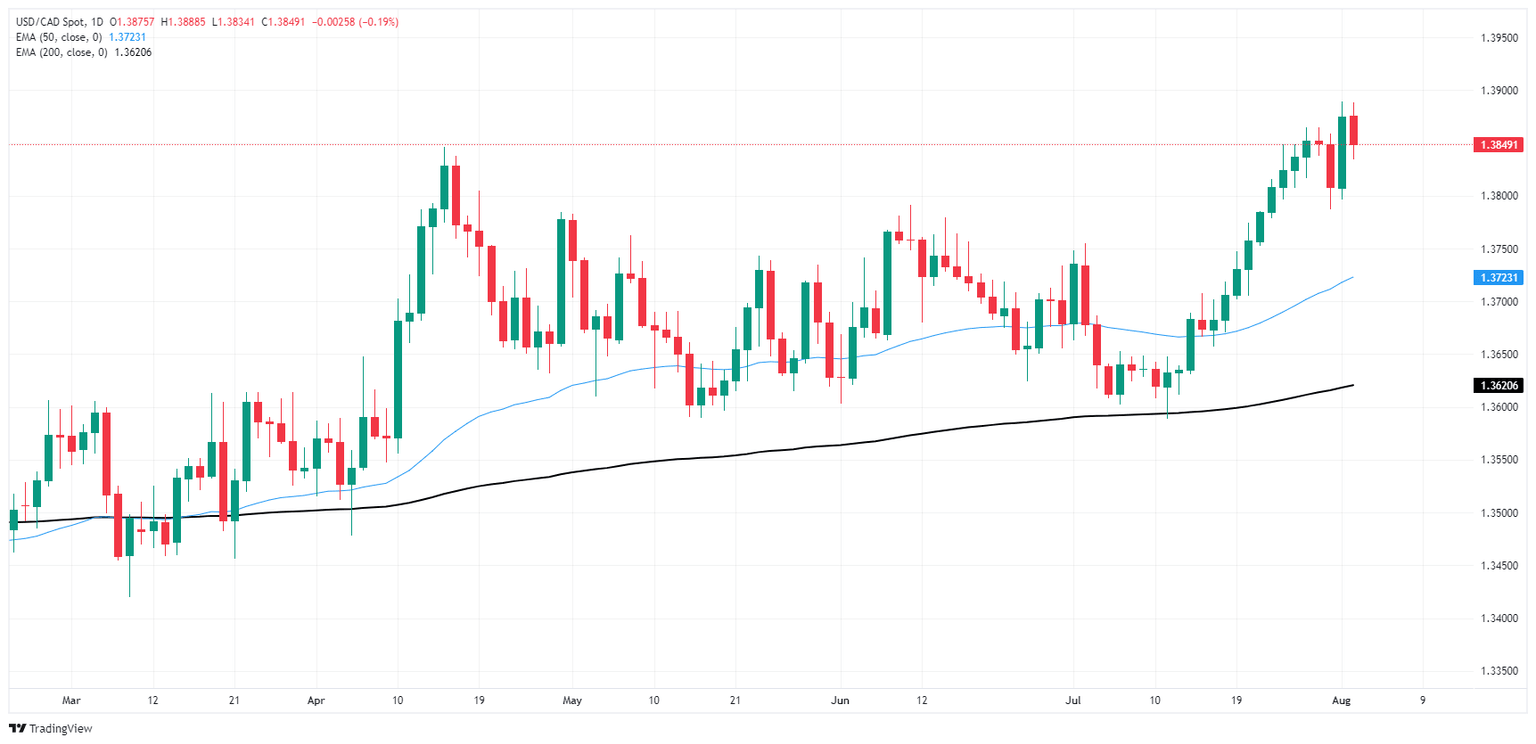

USD/CAD continues to splash around the 1.3850 level, churning close to the top end of 2024’s peak bids. The pair is up a little over 2% after the last swing low into the 1.2600 handle rolled over into a technical bounce off of the 200-day Exponential Moving Average (EMA). Bullish momentum appears set to wither as USD/CAD bids fail to capture the 1.3900 region, but short pressure still needs more percolation before knocking bidders off of a three-week winning streak.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.