According to Statistics Canada, the Unemployment Rate held steady at 6.4% in July, while the Employment Change decreased by 2.8K jobs during last month.

In addition, the Participation Rate eased a tad to 65%, while the Full Employment Change and the Part-time Employment Change increased by 61.6K jobs and shrank by 64.4K jobs, respectively.

Furthermore, Average Hourly Wages, a proxy for inflation via wages, rose by 5.2% from a year earlier (from 5.6%).

Market Reaction

The Canadian Dollar trades with modest losses and prompts USD/CAD to gyrate around 1.3740, up for the first time after five consecutive daily pullbacks.

Canadian Dollar PRICE Today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.08% | 0.15% | -0.53% | 0.11% | 0.38% | 0.11% | -0.34% | |

| EUR | -0.08% | 0.09% | -0.54% | 0.03% | 0.31% | 0.03% | -0.42% | |

| GBP | -0.15% | -0.09% | -0.63% | -0.07% | 0.22% | -0.06% | -0.48% | |

| JPY | 0.53% | 0.54% | 0.63% | 0.58% | 0.88% | 0.58% | 0.17% | |

| CAD | -0.11% | -0.03% | 0.07% | -0.58% | 0.27% | 0.00% | -0.42% | |

| AUD | -0.38% | -0.31% | -0.22% | -0.88% | -0.27% | -0.28% | -0.71% | |

| NZD | -0.11% | -0.03% | 0.06% | -0.58% | -0.00% | 0.28% | -0.43% | |

| CHF | 0.34% | 0.42% | 0.48% | -0.17% | 0.42% | 0.71% | 0.43% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Canadian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CAD (base)/USD (quote).

This section below was published as a preview of the Canadian labour market report at 5:00 GMT on August 9.

- The Unemployment Rate in Canada is expected to rise further in July.

- Further cooling of the labour market could favour extra rate cuts.

- The Canadian Dollar remains firm so far in August vs. its US peer.

Statistics Canada is set to release the Canadian Labour Force Survey report on August 9. Market participants so far anticipate that the report will present mixed results, which could further support the Bank of Canada's (BoC) ongoing easing cycle.

In July, the Bank of Canada trimmed its policy rate by an extra 25 bps to 4.50%, following a quarter-point interest rate reduction at its meeting in June. Back to the last gathering, the central bank left the door open to further rate cuts if inflation continues to progress towards the bank’s target, while it projects consumer prices to hover around the 2.0% goal in the latter part of 2025.

Regarding the domestic labour market, the BoC signalled in June that while it has cooled significantly, wage growth is still elevated when compared to productivity growth.

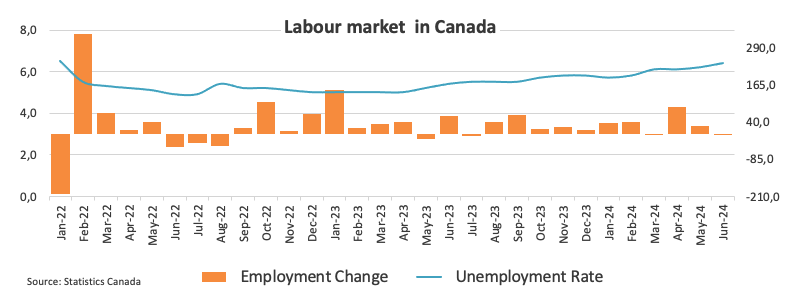

Statistics Canada reported that the Employment Change shrank by 1.4K jobs in June, halting two consecutive months of increases, while the Unemployment Rate ticked higher for the third consecutive month to 6.4%.

On another key economic indicator, the central bank now sees the Canadian Gross Domestic Product (GDP) expanding by 1.2% in 2024 (from 1.5%), while it expects annualized GDP to expand by 1.7% in Q1, by 1.5% in Q2, and by 2.8% in Q3.

What can we expect from the next Canadian Unemployment Rate print?

Attention remains on the upcoming Canadian labour market report, particularly the wage inflation data, which could influence the bank’s decision on whether to continue reducing its interest rates.

Consensus among market participants projects a slight rise in Canada’s Unemployment Rate to 6.5% in July, up from 6.4% in June. Additionally, investors forecast the economy will add nearly 27K jobs in the same month, reversing June’s 1.4K decrease. It is worth recalling that Average Hourly Wages, a proxy for wage inflation, rose for the second time in a row in June, up by 5.2% vs. June’s 4.8% gain.

BoC’s Minutes from the July meeting, released on August 7, revealed that prior to their decision to cut rates last month, officials expressed concerns that consumer spending in 2025 and 2026 might be considerably weaker than anticipated.

According to analysts at TD Securities: “We look for employment to rise by 30K in July on a rebound in service sector hiring, although this will not be enough to keep the UE rate from climbing 0.1pp to 6.5%. More labour market slack should add to the BoC's confidence that inflation/wage pressures will continue to ease, but wage growth will remain too high for the BoC's comfort even with a 0.5pp deceleration to 5.1%”.

When is July’s Canada Unemployment Rate released, and how could it affect USD/CAD?

The Canadian Unemployment Rate for July, accompanied by the Labour Force Survey, will be released on Friday at 12:30 GMT.

Further cooling of the labour market should leave the door wide open for the BoC to trim its interest rate at its next meeting, exerting at the same time some selling pressure on the Canadian currency. This favours some reversal in the strong monthly pullback in USD/CAD so far.

The rally in USD/CAD sparked around mid-July, sending the pair to as high as the 1.3950 region for the first time since October 2022. However, the Canadian Dollar managed to give away part of those losses since then and has started regaining upside momentum, prompting USD/CAD to retreat markedly to the low-1.3700s earlier this week, a region also neighbouring the interim 55-day SMA.

According to Pablo Piovano, senior analyst at FXStreet, further retracements should not be ruled out on the short-term horizon, with spot expected to meet provisional support at the 55-day and 100-day SMAs at 1.3714 and 1.3689, respectively, prior to the more relevant 200-day SMA at 1.3601. The latter reinforces the July low of 1.3584 (July 11) and should act as decent contention for the time being.

In case bulls regain the upper hand, Pablo adds that the immediate target for USD/CAD emerges at the 2024 top of 1.3946 (August 6), prior to the 1.4000 milestone.

(This story was corrected on August 9 to say that Canada's labor market report data was for July, not August.)

Economic Indicator

Unemployment Rate

The Unemployment Rate, released by Statistics Canada, is the number of unemployed workers divided by the total civilian labor force as a percentage. It is a leading indicator for the Canadian Economy. If the rate is up, it indicates a lack of expansion within the Canadian labor market and a weakening of the Canadian economy. Generally, a decrease of the figure is seen as bullish for the Canadian Dollar (CAD), while an increase is seen as bearish.

Read more.Last release: Fri Aug 09, 2024 12:30

Frequency: Monthly

Actual: 6.4%

Consensus: 6.5%

Previous: 6.4%

Source: Statistics Canada

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Gold hovers around all-time highs near $3,250

Gold is holding steady near the $3,250 mark, fuelled by robust safe-haven demand, trade war concerns, and a softer-than-expected US inflation gauge. The US Dollar keeps trading with heavy losses around three-year lows.

EUR/USD retreats towards 1.1300 as Wall Street shrugs off trade war headlines

The EUR/USD pair retreated further from its recent multi-month peak at 1.1473 and trades around the 1.1300 mark. Wall Street manages to advance ahead of the weekly close, despite escalating tensions between Washington and Beijing and mounting fears of a US recession. Profit-taking ahead of the close also weighs on the pair.

GBP/USD trims gains, recedes to the 1.3050 zone

GBP/USD now gives away part of the earlier advance to fresh highs near 1.3150. Meanwhile, the US Dollar remains offered amid escalating China-US trade tensions, recession fears in the US, and softer-than-expected US Producer Price data.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.