- The Canadian Consumer Price Index is seen losing further traction in July.

- The BoC could extend its easing cycle in the latter part of the year.

- The Canadian Dollar appears firm against its US counterpart so far in August.

Canada is poised to release the latest inflation figures on Tuesday, with Statistics Canada publishing the Consumer Price Index (CPI) data for July. Forecasts suggest the continuation of disinflationary trends in the headline CPI, while another uptick in the core reading, as it happened in June, could add some volatility to the release.

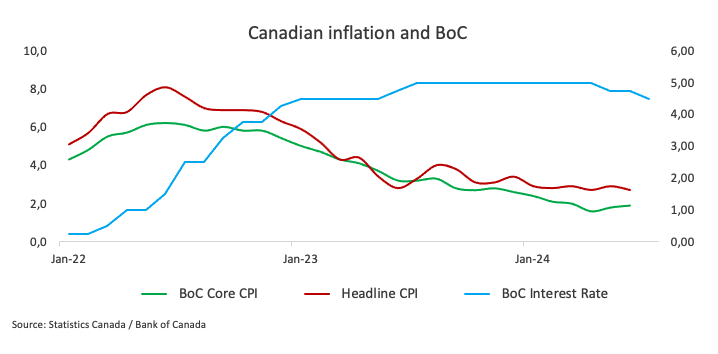

Alongside the CPI data, the Bank of Canada (BoC) will also unveil its core Consumer Price Index, which excludes volatile components like food and energy. In June, the BoC core CPI recorded a 0.1% drop against May’s reading and a 1.9% gain over the last twelve months, while the headline CPI climbed by 2.7% over the past year and contracted by 0.1% from the previous month.

These numbers are under close scrutiny, as they could impact the Canadian Dollar (CAD) in the short term and shape expectations for the Bank of Canada's monetary policy, particularly after the central bank cut its policy rate by an extra 25 basis points (bps) to 4.50% in July.

In the FX world, the Canadian Dollar gathered strong traction following year-to-date lows near 1.3950 against the Greenback on August 5. So far, the downside in USD/CAD remains well guarded by the key 200-day SMA near 1.3600 the figure.

What can we expect from Canada’s inflation rate?

Analysts anticipate that price pressures in Canada will maintain their downward bias in July, though they are likely to still remain above the central bank’s target. Consumer prices are expected to follow the recent trend observed in the US, where lower-than-expected CPI data have fuelled speculation about a 50 bps interest rate cut by the Federal Reserve (Fed) in September. Despite those expectations fizzling out afterwards, along with strong results on the US macro data, the Fed is largely predicted to trim its interest rates by 25 bps next month.

Should the upcoming data meet these expectations, investors may speculate that the Bank of Canada (BoC) could further ease its monetary policy with another quarter-point interest rate cut, potentially bringing the policy rate down to 4.25% at its September 4 meeting.

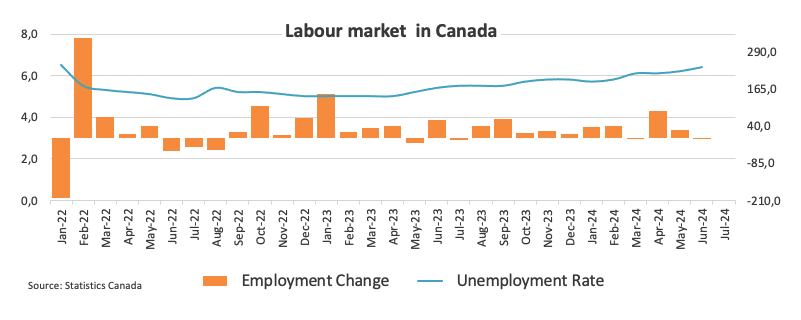

According to the Minutes of its July event, BoC governors expressed concerns about weaker consumer spending in 2025 and 2026 compared to expectations. Lower borrowing costs could boost spending, but households would still face debt-servicing burdens, hindering any recovery. Economic growth lags behind population growth, causing excess supply and labour market slack. This could weaken the labour market and dampen consumption, affecting growth and inflation.

Back to inflation, and following the interest rate cut last month, BoC’s Governor Tiff Macklem argued that the economy is experiencing excess supply, with slack in the labour market contributing to downward pressure on inflation. He noted that their assessment indicates sufficient excess supply already exists in the economy and emphasized that, rather than increasing excess supply, the focus should be on boosting growth and job creation to absorb this surplus and achieve a sustainable return to the 2% inflation target.”

Analysts at TD Securities commented that: “Markets will look to the July CPI for a final update on underlying price pressures ahead of the September BoC decision, with TD projecting a 0.2pp drop to 2.5% y/y, although stronger core inflation momentum should give a mixed tone to the report.”

When is the Canada CPI data due, and how could it affect USD/CAD?

On Tuesday at 12:30 GMT, Canada will release the Consumer Price Index (CPI) for July. The Canadian Dollar's response will largely hinge on any shifts in expectations regarding the Bank of Canada's (BoC) monetary policy. However, unless there are significant surprises in the data, the BoC is expected to maintain its current easing approach, somewhat mirroring the stance of other central banks like the Fed.

USD/CAD began the month trading with a strong bias and climbing to yearly highs around 1.3950. However, the Canadian currency managed to regain firm pace and dragged spot nearly three cents lower at the time of writing, pari passu with a strong corrective decline in the US Dollar (USD).

Pablo Piovano, Senior Analyst at FXStreet, suggests that USD/CAD appears well supported by the critical 200-day SMA around 1.3600. A breach of that level could spark further weakness to the next support of note at the March bottom of 1.3419 (March 8), prior to the weekly low of 1.3358 from January 31.

On the upside, Pablo adds, immediate resistance is found at the 2024 high of 1.3946 (August 5), ahead of the key milestone of 1.4000 (June 11).

Pablo also noted that significant increases in CAD volatility would likely depend on unexpected inflation data. If the CPI comes in below expectations, it could bolster the argument for another BoC interest rate cut at the upcoming meeting, leading to a rise in USD/CAD. On the other hand, if inflation exceeds expectations, the Canadian Dollar might see only modest support.

Economic Indicator

Consumer Price Index (MoM)

The Consumer Price Index (CPI), released by Statistics Canada on a monthly basis, represents changes in prices for Canadian consumers by comparing the cost of a fixed basket of goods and services. The MoM figure compares the prices of goods in the reference month to the previous month. Generally, a high reading is seen as bullish for the Canadian Dollar (CAD), while a low reading is seen as bearish.

Read more.Last release: Tue Jul 16, 2024 12:30

Frequency: Monthly

Actual: -0.1%

Consensus: 0.1%

Previous: 0.6%

Source: Statistics Canada

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stays below 1.1100 ahead of Fedspeak

EUR/USD is treading water below 1.1100 in the European session on Tuesday, sitting at an eight-month high of 1.1089. The pair struggles amid a steady US Dollar, as markets trade with caution ahead of Fedspeak.

GBP/USD hovers around 1.3000 amid softer risk tone

GBP/USD is holding gains to trade near 1.3000 in European trading on Tuesday, following a three-day winning streak. The US Dollar pauses its downside momentum amid a tepid risk tone, checking the pair's upside. Fedspeak awaited.

Gold price refreshes record highs near $2,520 on dovish Fed bets

Gold price has resumed its uptrend, refreshing record highs above $2,520 in the European session on Tuesday. Gold price continues to benefit from the underlying US Dollar weakness, courtesy of increased Fed rate cut expectations. The focus now remains on Fedspeak.

Tether to launch USDT on Aptos blockchain

Aptos announced on Tuesday that Tether is launching its USDT stablecoin on the Aptos blockchain. This move is positive for Aptos as stablecoins such as USDT act as a bridge between the crypto assets and fiat currencies.

Canada CPI set to show easing price pressures, bolstering BoC to further ease policy

Canada is poised to release the latest inflation figures on Tuesday, with Statistics Canada publishing the Consumer Price Index data for July.