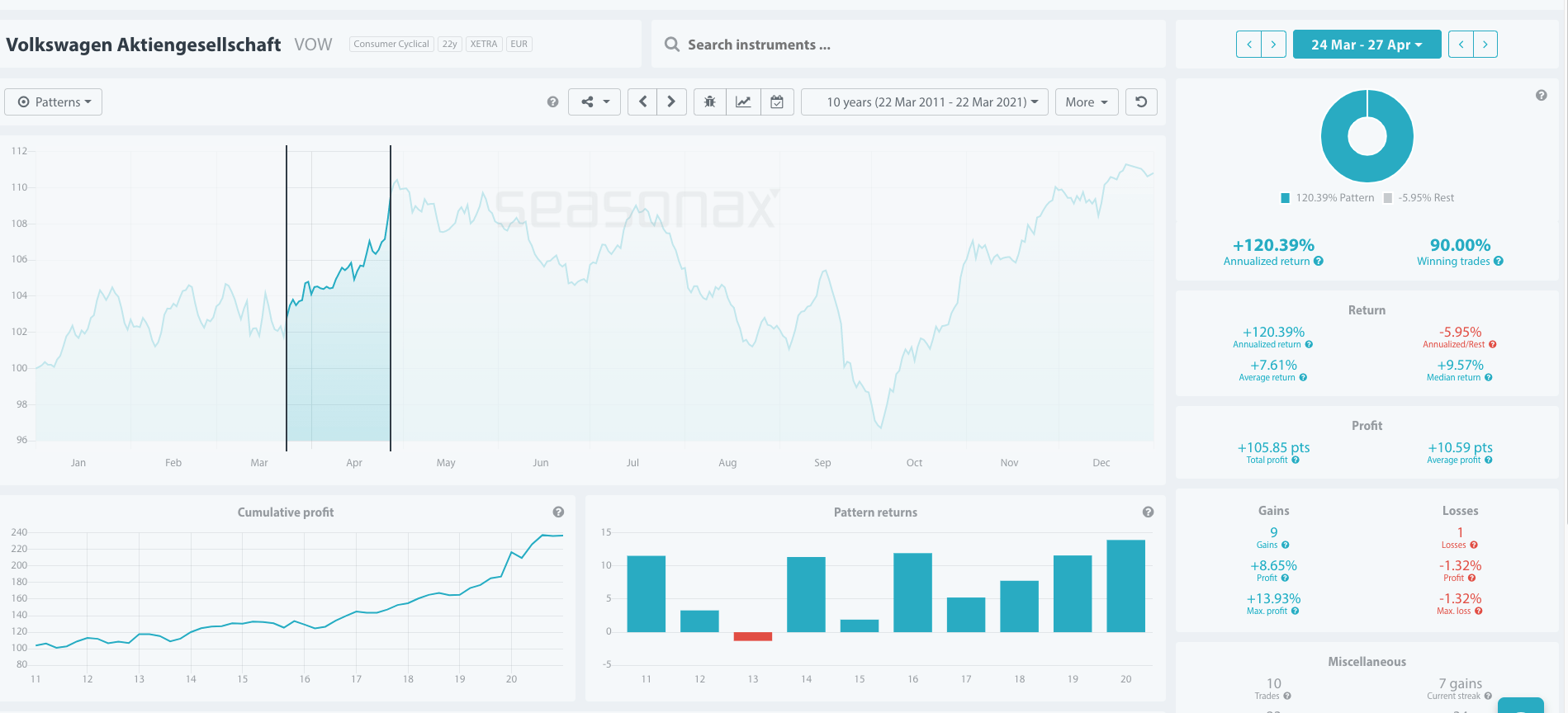

The German motor company Volkswagen is entering into a strong time of year where it tends to see seasonal gains. Over the last 10 years, Volkswagen has risen 9 times between March 24 and April 27. The average return over the last 10 years has been +7.61%. The maximum profit was +13.93% in 2020. There has been 1 loss in the last 10 years in 2013 with a drop of -1.32%.

Earlier in March Volkswagen are projecting 450K electric cars delivered to customers, which is double that of 2020. Will strong electrical vehicle sales allow Volkswagen to take on Tesla and boost shares again?

Trade risks

-

There is a risk that investors consider equity markets overbought and that could see a correction. It is hard to know when that correction will come, but investors need to be aware of the potential risk.

-

There is a risk that further slowdowns in the EU vaccine roll out drag on German stocks and pressure them lower.

Our products and commentary provides general advice that do not take into account your personal objectives, financial situation or needs. The content of this website must not be construed as personal advice.

Recommended content

Editors’ Picks

EUR/USD extends slide below 1.0300, touches new two-year low

EUR/USD stays under bearish pressure and trades at its lowest level since November 2022, below 1.0300 on Thursday. The US Dollar benefits from the risk-averse market atmosphere and the upbeat Jobless Claims data, causing the pair to stretch lower.

GBP/USD slumps to multi-month lows below 1.2400 on broad USD strength

Following an earlier recovery attempt, GBP/USD reversed its direction and declined to its weakest level in nearly eight months below 1.2400. The renewed US Dollar (USD) strength on worsening risk mood weighs on the pair as trading conditions normalize after the New Year break.

Gold benefits from risk aversion, climbs above $2,650

Gold gathers recovery momentum and trades at a two-week-high above $2,650 in the American session on Thursday. The precious metal benefits from the sour market mood and the pullback seen in the US Treasury bond yields.

These 5 altcoins are rallying ahead of $16 billion FTX creditor payout

FTX begins creditor payouts on January 3, in agreement with BitGo and Kraken, per an official announcement. Bonk, Fantom, Jupiter, Raydium and Solana are rallying on Thursday, before FTX repayment begins.

Three Fundamentals: Year-end flows, Jobless Claims and ISM Manufacturing PMI stand out Premium

Money managers may adjust their portfolios ahead of the year-end. Weekly US Jobless Claims serve as the first meaningful release in 2025. The ISM Manufacturing PMI provides an initial indication ahead of Nonfarm Payrolls.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.