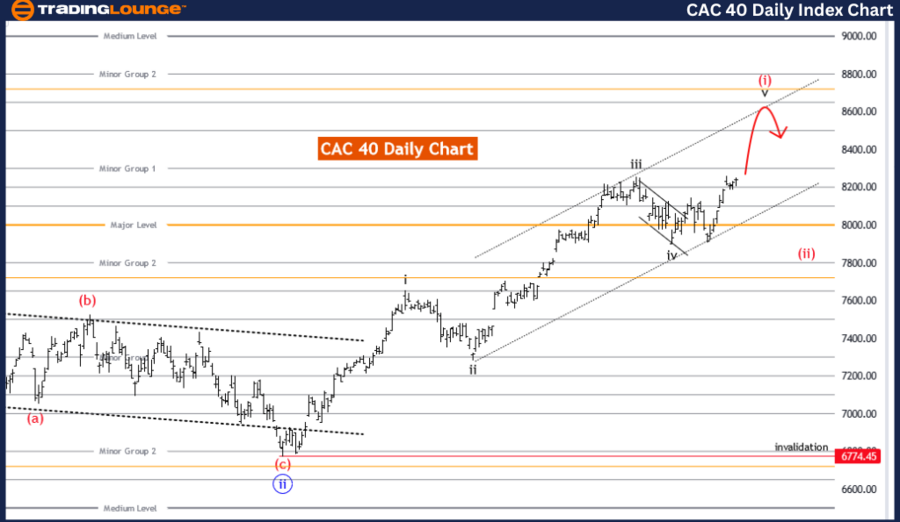

CAC 40 (France) Elliott Wave Analysis Trading Lounge Day Chart,

CAC 40 (France) Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Black Wave 5.

Position: Red Wave 1.

Direction next lower degrees: Red wave 2.

Details: Black wave 4 looking completed at 7905.49. Now black wave 5 of 1 is in play. Wave Cancel invalid level: 6774.45.

CAC 40 (France) Elliott Wave Analysis Trading Lounge Day Chart.

Function

The analysis identifies the current movement of the CAC 40 on the daily chart as part of a "Trend." This suggests that the waves being analyzed are in line with the prevailing market direction.

Mode

The mode of the current market activity is "impulsive." In Elliott Wave theory, impulsive waves move in the direction of the trend and typically consist of five sub-waves (1, 2, 3, 4, and 5). These waves indicate strong market momentum in the trend's direction.

Structure

The structure under examination is "black wave 5." This wave is part of the larger trend and is typically the final wave in the five-wave impulsive sequence, indicating the culmination of the trend's current phase.

Position

The market is currently in "red wave 1," which is the first sub-wave of the larger black wave 5. This wave marks the beginning of a new impulsive sequence within the broader trend.

Direction for next lower degrees

The next anticipated movement is "red wave 2." In Elliott Wave terms, red wave 2 is expected to be a corrective wave that temporarily moves against the direction of red wave 1 before the trend resumes with red wave 3.

Details

Wave Completion: The analysis notes that "black wave 4" appears to be completed at the level of 7905.49. The completion of black wave 4 sets the stage for the final black wave 5.

Current Wave in Play: The market is currently experiencing "black wave 5 of 1." This indicates that the first sub-wave (red wave 1) of the final black wave 5 is now active.

Invalidation Level: The wave cancellation or invalidation level is set at 6774.45. If the market drops below this level, the current wave count will be invalidated, suggesting a possible reevaluation of the wave structure.

Summary

The CAC 40 Elliott Wave analysis on the daily chart indicates the index is in the final stages of a significant trend phase, specifically within black wave 5. The market has completed black wave 4 at 7905.49 and is now in the initial stages of black wave 5, marked by the formation of red wave 1. Following red wave 1, a corrective red wave 2 is expected to play out. The analysis sets an invalidation level at 6774.45, where falling below this level would negate the current wave count and imply a potential shift in the market dynamics. This detailed wave structure provides traders with insights into the trend's continuation and critical reversal points to monitor.

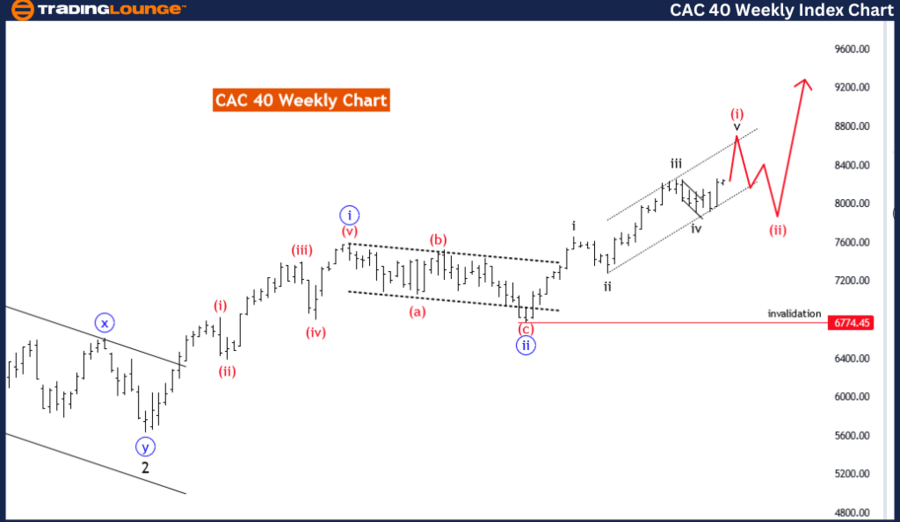

CAC 40 (France) Elliott Wave Analysis Trading Lounge Weekly Chart,

CAC 40 (France) Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Red Wave.

Position: Blue Wave 3.

Direction next lower degrees: Red wave 2.

Details: Red Wave 1 is in play and looking near to end. Wave Cancel invalid level: 6774.45.

CAC 40 (France) Elliott Wave Analysis Trading Lounge Weekly Chart

Function

The analysis identifies the current movement of the CAC 40 on the weekly chart as part of a "Trend." This indicates that the waves being analyzed are moving in the direction of the prevailing market trend.

Mode

The mode of the current market activity is "impulsive." In Elliott Wave theory, impulsive waves are strong movements in the direction of the trend and typically consist of five sub-waves (1, 2, 3, 4, and 5). These waves signal robust market momentum aligned with the trend's direction.

Structure

The structure under examination is "red wave 1." This wave is the initial wave in the impulsive sequence, setting the foundation for the larger trend movement.

Position

The market is currently in "blue wave 3." This implies that within the broader impulsive structure, the market is experiencing the third wave of the blue degree, which is typically the strongest and most extended wave in the Elliott Wave sequence.

Direction for next lower degrees

The next anticipated movement is "red wave 2." In Elliott Wave terms, red wave 2 is expected to be a corrective wave that temporarily moves against the direction of red wave 1 before the trend resumes with red wave 3.

Details

Wave Completion:The analysis notes that "red wave 1" is currently in play and appears to be nearing its end. This completion is crucial as it signals the transition to red wave 2, a corrective phase.

nvalidation Level: The wave cancellation or invalidation level is set at 6774.45. If the market falls below this level, the current wave count will be invalidated, suggesting a need to reassess the wave structure and potentially indicating a shift in market dynamics.

Summary

The CAC 40 Elliott Wave analysis on the weekly chart indicates that the index is currently experiencing an impulsive trend, specifically within red wave 1. This wave is part of a larger impulsive structure, positioned within blue wave 3, which typically represents strong market momentum. As red wave 1 nears its completion, the market is expected to transition into red wave 2, a corrective phase that temporarily moves against the trend. The analysis sets an invalidation level at 6774.45, where a drop below this level would negate the current wave count and imply a potential reevaluation of the market dynamics. This detailed wave structure provides traders with valuable insights into the trend's continuation and critical points for potential reversals.

Technical analyst: Malik Awais.

CAC 40 (France) Elliott Wave technical analysis [Video]

As with any investment opportunity there is a risk of making losses on investments that Trading Lounge expresses opinions on.

Historical results are no guarantee of future returns. Some investments are inherently riskier than others. At worst, you could lose your entire investment. TradingLounge™ uses a range of technical analysis tools, software and basic fundamental analysis as well as economic forecasts aimed at minimizing the potential for loss.

The advice we provide through our TradingLounge™ websites and our TradingLounge™ Membership has been prepared without considering your objectives, financial situation or needs. Reliance on such advice, information or data is at your own risk. The decision to trade and the method of trading is for you alone to decide. This information is of a general nature only, so you should, before acting upon any of the information or advice provided by us, consider the appropriateness of the advice considering your own objectives, financial situation or needs. Therefore, you should consult your financial advisor or accountant to determine whether trading in securities and derivatives products is appropriate for you considering your financial circumstances.

Recommended content

Editors’ Picks

EUR/USD stabilizes near 1.0400, volumes remain light on New Year's Eve

EUR/USD stabilizes at around 1.0400 on Tuesday following Monday's choppy action. The cautious market stance helps the US Dollar stay resilient against its rivals and doesn't allow the pair to gain traction as trading conditions remain thin heading into the end of the year.

GBP/USD retreats below 1.2550 after short-lasting recovery attempt

GBP/USD loses its traction and retreats below 1.2550 after climbing above 1.2600 on Monday. Although falling US Treasury bond yields weighed on the USD at the beginning of the week, the risk-averse market atmosphere supported the currency, capping the pair's upside.

Gold rebounds after finding support near $2,600

After posting losses for two consecutive days, Gold found support near $2,600 and staged a rebound early Tuesday. As investors refrain from taking large positions ahead of the New Year Day holiday, XAU/USD clings to daily gains at around $2,620.

These three narratives could fuel crypto in 2025, experts say

Crypto market experienced higher adoption and inflow of institutional capital in 2024. Experts predict the trends to look forward to in 2025, as the market matures and the Bitcoin bull run continues.

Three Fundamentals: Year-end flows, Jobless Claims and ISM Manufacturing PMI stand out Premium

Money managers may adjust their portfolios ahead of the year-end. Weekly US Jobless Claims serve as the first meaningful release in 2025. The ISM Manufacturing PMI provides an initial indication ahead of Nonfarm Payrolls.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.