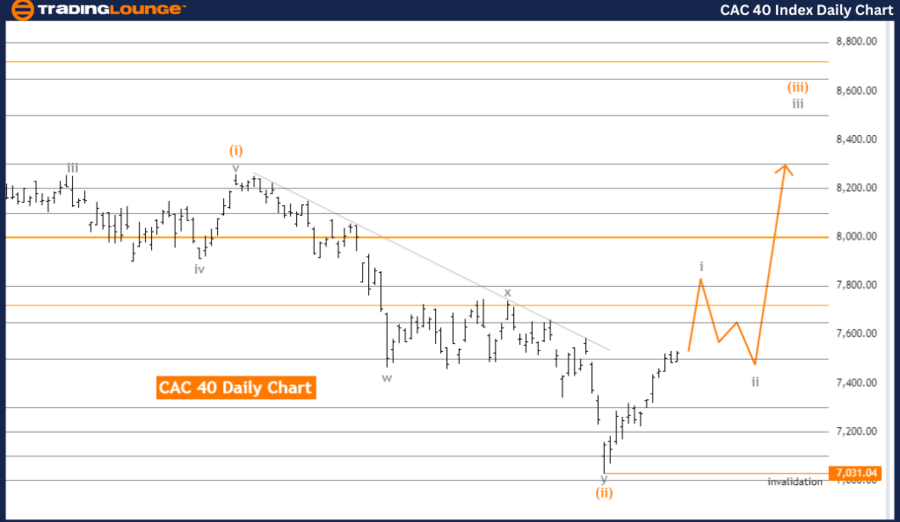

CAC 40 (France) Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Gray Wave 1.

Position: Orange Wave 3.

Direction next lower degree: Gray Wave 2.

Details: The completion of Orange Wave 2 is indicated. Currently, Gray Wave 1 of Orange Wave 3 is unfolding.

Wave cancel invalid level: 7,031.04.

The CAC 40 index in France is currently trending, based on Elliott Wave analysis. The analysis shows that the market is in an impulsive mode, indicating a strong directional movement in alignment with the dominant trend. The key structure under observation is Gray Wave 1, marking the initial phase of a new impulsive wave sequence.

At present, the market is situated within Orange Wave 3, following the completion of Orange Wave 2. This suggests the market is likely experiencing a significant upward movement, as Wave 3 typically represents the most powerful and extended wave in an impulsive sequence. The unfolding of Gray Wave 1 within Orange Wave 3 further reinforces the ongoing upward trend.

The analysis also identifies the next lower degree wave, Gray Wave 2, which is expected to follow the completion of the current wave. This wave is anticipated to be corrective, offering a temporary retracement within the broader upward trend. However, before this correction occurs, the focus remains on completing the current impulsive phase.

A critical level to watch in this wave structure is 7,031.04, defined as the wave cancel invalid level. If the market price exceeds this level, it would invalidate the current Elliott Wave count, suggesting that the anticipated wave structure may not develop as predicted. This level acts as a safeguard to maintain the validity of the current wave analysis.

In summary, the CAC 40 is in an impulsive trend phase, with Gray Wave 1 of Orange Wave 3 currently unfolding. The completion of Orange Wave 2 indicates that the market is set for continued upward movement, with Gray Wave 2 anticipated to follow. The 7,031.04 level is essential for confirming the current Elliott Wave structure.

CAC 40 (France) Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Orange Wave 3.

Position: Navy Blue Wave 3.

Direction next higher degrees: Orange Wave 3 (Started).

Details: The completion of Orange Wave 2 is noted. Now, Orange Wave 3 is in progress.

Wave cancel invalid level: 7,031.04.

The CAC 40 index in France is currently exhibiting a strong trend, as identified through Elliott Wave analysis on the weekly chart. The analysis suggests that the market is in an impulsive mode, indicating a decisive and powerful movement in the direction of the prevailing trend. The primary wave structure under observation is Orange Wave 3, a key phase in an impulsive sequence often marked by significant market advances.

At present, the market is positioned within Navy Blue Wave 3, which is part of the larger Orange Wave 3 structure. This positioning indicates that the market is undergoing a robust upward movement, as Wave 3 typically represents the most dynamic and extended wave in the Elliott Wave sequence. The completion of Orange Wave 2 suggests that the corrective phase has ended, and the market has transitioned into the next impulsive phase, which is Orange Wave 3.

The direction of the next higher degrees continues to align with the already initiated Orange Wave 3, reinforcing the likelihood of continued upward momentum in the market. The analysis highlights that Orange Wave 3 is currently active and suggests that the market will likely experience further gains as this wave progresses.

A critical level to monitor is 7,031.04, identified as the wave cancel invalid level. If the market price were to fall below this level, it would invalidate the current wave structure, indicating that the anticipated wave count is no longer applicable. This level serves as a key indicator for the validity of the ongoing Elliott Wave analysis.

In conclusion, the CAC 40 is in a strong upward trend, with Orange Wave 3 currently unfolding within Navy Blue Wave 3. The completion of Orange Wave 2 signals that the market is set for further advances, with 7,031.04 as a crucial level to confirm the current wave structure's validity.

CAC 40 (France) Index Elliott Wave technical analysis [Video]

As with any investment opportunity there is a risk of making losses on investments that Trading Lounge expresses opinions on.

Historical results are no guarantee of future returns. Some investments are inherently riskier than others. At worst, you could lose your entire investment. TradingLounge™ uses a range of technical analysis tools, software and basic fundamental analysis as well as economic forecasts aimed at minimizing the potential for loss.

The advice we provide through our TradingLounge™ websites and our TradingLounge™ Membership has been prepared without considering your objectives, financial situation or needs. Reliance on such advice, information or data is at your own risk. The decision to trade and the method of trading is for you alone to decide. This information is of a general nature only, so you should, before acting upon any of the information or advice provided by us, consider the appropriateness of the advice considering your own objectives, financial situation or needs. Therefore, you should consult your financial advisor or accountant to determine whether trading in securities and derivatives products is appropriate for you considering your financial circumstances.

Recommended content

Editors’ Picks

EUR/USD challenges YTD tops near 1.1170 on Powell

EUR/USD now picks up extra pace and revisits the 1.1170 region after Chief Powell somewhat “confirmed” a rate cut next month at his speech at Jackson Hole.

GBP/USD reaches new 2024 highs around 1.3200, Dollar plummets

The Greenback is now accelerating its decline and flirts with the area of 2024 low as Chair Powell signals that it is time to adjust monetary policy. GBP/USD picks up extra pace and challenges the 1.3200 region, clinching new 2024 peaks at the same time.

Gold keeps the bid bias unchanged above $2,500

The precious metal maintains its bullish stance in place on Friday, climbing above the $2,500 mark per ounce troy as Fed’s Powell signals an imminent rate cut.

Decentraland price is set for a rally after breaking above the descending trendline

Decentraland (MANA) price broke above the descending trendline and trades up 1.5% as of Friday at $0.291. Additionally, on-chain data support further price gains, as MANA's Exchange Flow Balance shows a negative spike, and the long-to-short ratio stays above one.

Jerome Powell expected to hint at upcoming interest-rate cut in September

Market participants will closely scrutinize Powell’s speech for any fresh hints on the trajectory of monetary policy, particularly about the magnitude of the Fed’s first interest-rate cut in years.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.